Creating a Budget: Essential Steps for Financial Success

Budgeting is a fundamental financial tool that assists individuals and organizations in managing their finances more efficiently. By offering a structured approach to spending, a budget allows for a clearer understanding of income, expenses, and potential savings. This article delves into the key steps involved in creating a budget, devoid of any references to specific apps or companies.

Understand Your Financial Goals

Before diving into the numbers, one should identify and prioritize their financial goals. These might include short-term objectives like taking a vacation or longer-term ambitions like purchasing a home or securing retirement. Knowing what one aims to achieve will provide direction and motivation for the budgeting process.

Gather Relevant Financial Information

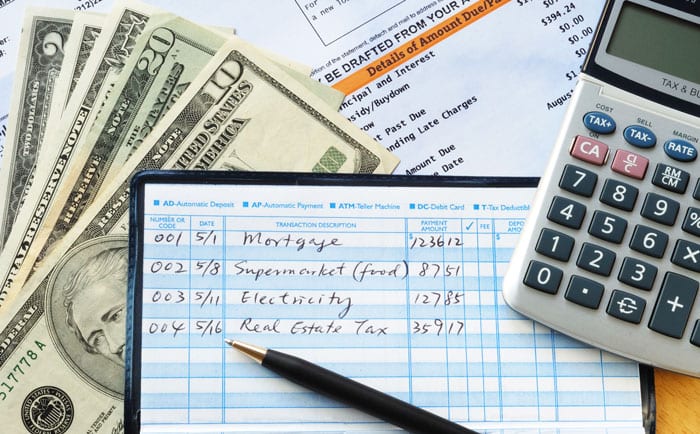

Before drafting a budget, compile all financial information. This includes:

- Sources of income: wages, rental income, dividends, etc.

- Fixed expenses: rent, mortgage, utilities, insurance, etc.

- Variable expenses: groceries, entertainment, eating out, etc.

Categorize & List Your Expenses

Divide expenses into fixed and variable categories. Fixed expenses remain consistent each month, while variable expenses may fluctuate. Itemizing these expenses makes it simpler to spot patterns and areas for potential savings.

Calculate Total Income & Total Expenses

To get a holistic view of one’s financial situation, subtract total expenses from total income. If the result is positive, there’s a surplus which can be allocated towards savings or other financial goals. If negative, it indicates that expenses are outpacing income, necessitating adjustments.

Adjust Spending Habits

With a clear understanding of where the money is going, one can identify areas to cut back. This may involve reducing discretionary spending, renegotiating bills, or seeking additional income sources. Regularly reviewing and adjusting the budget is essential for ensuring it remains effective over time.

Allocate for Savings & Investments

Financial experts often recommend the “pay yourself first” principle. This means before covering other expenses, a portion of the income should be directed towards savings or investments. Setting up automatic transfers to a savings account can simplify this process.

Review & Adjust Regularly

Economic conditions, personal circumstances, and financial goals evolve over time. Consequently, one’s budget should be dynamic, not static. Periodic reviews, preferably monthly or quarterly, can help ensure the budget remains aligned with current financial realities.

Plan for Unexpected Expenses

Life is full of surprises, and not all of them are pleasant. Setting aside a contingency or emergency fund can cushion against unexpected financial shocks, ensuring one doesn’t derail their budget.

Stay Committed

Like any new habit, sticking to a budget might be challenging initially. However, with perseverance and a clear focus on financial goals, the benefits of budgeting become evident. Over time, it becomes an invaluable tool for financial success.

Educate & Seek Guidance

Knowledge is power. Continuously educate oneself on financial management principles, and don’t hesitate to seek guidance when needed. Whether from books, seminars, or financial professionals, gaining insights can significantly enhance one’s budgeting skills.

Summary

In essence, budgeting is more than just numbers on paper. It’s a strategic roadmap guiding one towards financial stability and success. By understanding one’s financial situation, setting clear goals, and making informed choices, anyone can harness the power of budgeting to achieve their financial dreams.