How to Easily Earn Passive Income With Crypto – 20 Best Ways Updated 2025

Can Cryptocurrency Make Money?

YES! Cryptocurrency can make you money Due to the inherent volatility of crypto assets, some demand domain knowledge or experience while others do not. One way to make money using cryptocurrency is to trade cryptocurrencies. Although the daily average volume of cryptocurrency trading is only 1% of the forex market, the crypto market is highly volatile. That allows for short-term trading. Although the crypto sector is still small, it has huge development potential. AMP, Dogecoin, ElonGate, Iota, Moonshot, Polygon, Safemoon, Stellar, Tether, VTHO, and Shiba Anu are just a few of the emerging cryptocurrencies.

There are also several crypto buying platforms like Binance, Coinbase, and Robinhood, thus there are many ways to make money with crypto. Essentially, there are several ways to generate actual money with cryptocurrencies besides trading. Let’s look at 6 ways to make money with cryptocurrencies.

Having multiple passive income streams is a good strategy to attain your financial goals. As a result, many investors and people have found ways to grow their income streams passively. This might be anything from writing an online course to running a dropshipping business. However, advances in the crypto realm have ushered in a new digital economy that allows individuals to earn passively with cryptocurrencies. Aside from requiring additional knowledge and expertise, trading and investing in digital currency can allow individuals to earn passive income.

A source of income may not be assured due to price changes and market instability. Even the smartest investors will certainly lose money during market downturns. As a result, it may be prudent to seek out alternate techniques to enhance your crypto assets’ productivity and earn consistently, even when the market is gloomy. Here are several easy ways to create passive income with cryptocurrencies.

Is It Possible to Earn Passive Income in Crypto?

Many bitcoin owners have overcome their fears and found ways to invest in and trade their digital money for lucrative rewards. The value of cryptocurrencies fluctuates often, for example, and is only one of several significant problems that cryptocurrency investors must deal with. You also need to concentrate on managing your positions while keeping track of your cryptocurrency investments and investing portfolio.

You can see right away that investing in cryptocurrencies is everything but simple! The risk of losing your cryptocurrency investments is the first thing to consider. To ensure the highest results, you must also cope with the complexity of investing in cryptocurrencies. Passive income would be the only way to avoid direct engagement in cryptocurrency investing.

By using a certain investment plan or placing your crypto assets on a particular platform, you may generate passive income in cryptocurrency. You may find some amazing ways to make your crypto assets work for you with the appropriate techniques and approaches. Holding on to your cryptocurrency, or “HODLing,” is one of the most popular strategies for generating passive income on digital assets without any effort.

20 Best Ways How to Easily Earn Passive Income With Crypto

Deposit Your Assets in an Interest-earning Account

While investing in bitcoin can help you gain as prices rise, putting your funds into interest-bearing accounts can help you earn more. Currently, numerous platforms offer this service to investors, and most of them include extra tools to assist you to maximise your crypto returns. One such platform is Hodlnaut, which provides daily interest rates of up to 12.73 percent.

With features like Preferred Interest Payout and Token Swap, users can earn and receive in any currency they want. These platforms may also offer compounding interest. This means you will earn interest on a higher quantity than your initial deposit. This is a great way to make steady profits even when the market fluctuates. The best? You don’t even have to handle it. Simply deposit cash to get started.

Cloud Mining

Cloud mining is another technique to earn cryptocurrencies passively. Cloud mining does not require technical expertise or physical mining hardware. Here’s a basic rundown for those unfamiliar. Cloud mining is the process of creating cryptocurrency utilizing a third party’s computational power. To do so, you just deposit funds with a cloud mining service provider, who then invests them in a real mining operation.

You will receive a piece of the cryptocurrency when it starts paying rewards. Cloud miners like BeMine and Shamining are also available. Some even have mining farms powered by wind and solar energy. Compared to the traditional mining method, this is a simpler and less time-consuming approach.

Strategies for Making Money with Crypto

Buying and holding dividend-paying tokens is a hassle-free way to earn passive income using cryptocurrencies. However, not all digital currencies provide dividends, so do your homework before investing. Exchanges currently supply most dividend-paying digital tokens. Cryptocurrencies that pay dividends include NEO and Cosmos. Some tokens are known to give users savings on trading fees and even a piece of the platform’s profits.

Some tokens, including KuCoin Token (KCS) and Bibox Token (BIX), pay up to 50% of the platform’s trading fees as dividends. The good thing about dividends is that they are quite consistent and reliable, so you know you’ll be earning more money without doing anything. To increase your dividends, simply buy more tokens and hold them.

Investing

Investing is a long-term strategy that involves purchasing and holding crypto assets for an extended period of time. In general, crypto assets are well-suited to a buy-and-hold strategy. They are highly volatile in the short term but offer enormous long-term growth potential. The investing approach necessitates the identification of more stable assets that will last for a long time. Bitcoin and Ethereum, for example, have a history of long-term price increases and can be regarded secure investments in this regard.

While investing is a long-term strategy centred on buy-and-hold, trading is designed to take advantage of short-term opportunities. The cryptocurrency market is quite volatile. This means that asset prices can fluctuate considerably in the short term. You must possess the necessary analytical and technical skills to be a successful trader. To create correct forecasts about price increases and declines, you’ll need to evaluate market charts on the performance of the listed assets.

Depending on whether you expect the price of an asset to climb or fall, you can take a long or short position while trading. This means you can earn whether the cryptocurrency market is bullish or bearish. Check out our day trading crypto guide to learn more about the cryptocurrency market.

Staking and lending

Staking is a method of verifying cryptocurrency transactions. You own coins when you stake, but you don’t use them. You store the coins in a cryptocurrency wallet instead. The coins are then used to validate transactions on a Proof of Stake network. As a result, you’ll be rewarded. You’re basically lending coins to the network. As a result, the network’s security and transaction verification may be maintained.

You’ll get a reward that’s similar to the interest you’d get from a bank on a credit balance. The Proof of Stake algorithm selects transaction validators based on the number of coins you have staked. This saves a lot of energy and eliminates the need for pricey gear. You may also lend coins to other investors and earn interest. Crypto financing is possible on many platforms. Check out our guide on lending crypto to learn more about it.

Why Stake Cryptocurrencies?

Crypto staking is the practise of depositing money into a virtual wallet and maintaining it there in order to support PoS blockchains’ transaction validation. Participants gain more bitcoin by taking part in transaction validation.

The following are the primary advantages of staking cryptocurrency:

- Unlike crypto mining, which needs additional equipment, crypto staking doesn’t.

- On your cryptocurrency investments, you may make a set amount of interest.

- Staking has less of an impact on the environment than mining.

- The effectiveness and security of PoS blockchains are directly improved by staking.

Mining and staking vary from each other in a few significant ways. In general, staking platforms let you to earn money on both PoW and PoS currencies whereas mining solely uses proof of work (PoW) methods.

Blockchain transactions may be verified by PoW and PoS without the assistance of a third party like a bank or other financial institution. The two methods’ energy requirements are the primary distinction.

You must first acquire PoS coins if you want to begin the staking procedure. You will choose how much of your top staking coins to stake after choosing the coins you wish to utilise. You may carry out this procedure on any significant bitcoin exchange.

Remember that yield farming is another way to get more revenue. Yield farming is the practise of generating money by lending your present crypto assets to other DeFi sites, albeit it is a little more difficult than staking. You can donate cryptocurrency assets for a few days to several months via yield farming. Rewards always increase as loan quantities do.

What Coins Are the Best for Staking?

The best stake coins you may buy to begin earning stake rewards are thoroughly examined in the list below. After each crypto platform, a list of the tokens’ symbols is provided.

BitDAO

Investors can have faith that BIT will be one of the upcoming major exchange tokens thanks to prominent sponsors like Peter Thiel and Pantera Capital. One of the biggest DAOs in the world, BitDAO aims to support the DeFi community in realising its goals of open finance and a decentralised, tokenized economy. By casting their votes on governance proposals, such as changes to the core protocols and token swaps, BIT token holders may influence the direction of BitDAO.

Sign up for the Bybit Launchpool to start staking. Simply transfer BIT into your Bybit Earn account after registering up on Bybit and completing Level 1 KYC to start staking. You’ll have a difficult time finding similar staking coins with comparable development potential and staking incentives when they have a prize pool of 1,500,000 BIT tokens and an average yearly return of 14.77 percent.

Tether

Try staking a stablecoin as an alternative if you’re concerned about the value of your staked tokens and coins declining. Although selecting the finest stablecoin for staking is a matter of personal opinion, we suggest Tether (USDT) because of its enormous trading volume. The huge daily USDT volume makes it simple to exchange USDT for more attractive tokens, which may do wonders for liquidity.

Would you want to try USDT staking? Use Bybit Earn flexible staking to your advantage and take advantage of average yearly returns up to 3.5 percent. We undoubtedly think of USDT as one of the finest staking coins for newcomers learning about staking who wish to utilise a platform that provides rapid withdrawals and minimum bother because of the stability of its overall value.

You’ll be rewarded for creating and curating content on many blockchain-based social media networks. Frequently, you will be awarded with the platform’s native coin.

Mining

Cryptocurrencies mining is a way to profit from cryptocurrency in the same way that the early adopters did. The Proof of Work technique still requires mining. It’s from here that a cryptocurrency’s value is derived. You will be paid with new coins if you mine a cryptocurrency. Technical skill and an upfront investment in specialised machinery are required to mine. As a subset of mining, running a master node. It necessitates a high level of skill as well as a substantial initial and continuous investment.

Airdrops and Forks

To raise awareness, airdrops and free tokens are being provided. To build a big user base for a project, an exchange may do an airdrop. You can acquire a free coin by participating in an airdrop, which you may use to buy items, invest in, or trade with.

Changes or updates to a protocol lead a blockchain to fork, resulting in the creation of new coins. If you have money on the old chain, you will almost always receive free tokens on the new network. Because you were in the right position at the right time, you get a free penny.

Yield Farming

Another decentralised, or DeFi, way to generate passive cryptocurrency income is yield farming. The idea of staking your cryptocurrency is elevated by yield farming. It’s referred to as “DeFi’s Wild West” since it’s riskier and more difficult than staking.

Similar to staking pools, yield farming entails adding bitcoin to a liquidity pool where it may be exchanged for more currency. This is significant since decentralised cryptocurrency exchanges and crypto-based lending/borrowing services are now two of the most used applications of DeFi.

In both situations, yield farmers offer the required cryptocurrency cash for these platforms to operate, or “liquidity.” Decentralized exchanges, which are essentially trading platforms where users depend on a mix of smart contracts (programmable, self-executing computer contracts) and investors for the liquidity necessary to complete deals, enable this through their dynamic operations.

Users do not compete with brokers or other traders here. Instead, they exchange against money put into unique smart contracts known as liquidity pools by investors, also known as liquidity providers. In exchange, liquidity suppliers get a share of the pool’s trading commissions. To begin using this approach to generate passive revenue, you must first sign up as a liquidity provider (LP) on a DeFi exchange like Uniswap, Aave, or PancakeSwap. You must deposit a specific ratio of two or more digital assets into a liquidity pool in order to start earning these fees.

Purchase cryptocurrency to earn cryptocurrency.

The most straightforward approach to earning crypto coins is to acquire them, as is the case with most things in life. Purchasing cryptocurrency has never been easier. The need for the sector has expanded as it has grown in popularity over the last few years. Many businesses began to offer services that allow anyone to access the market quickly and safely. But where do you go to buy cryptocurrency? For example, purchasing Bitcoin with cash or credit can be as simple as heading to a Bitcoin ATM. Other crypto coins, on the other hand, aren’t as widely available, and may only be purchased through crypto exchanges. Check out Topflight to check crypto exchange.

However, there is one factor to consider: transaction fees. The transaction fees on most online exchanges are changed in real-time based on market fluctuations. In addition, the costs are rather inexpensive. Transaction costs at ATMs, on the other hand, are usually quite high. As a result, buying Bitcoin (or other cryptocurrencies) through exchanges like Coinbase, Binance, or Kraken is usually recommended. And, for the most part, the procedure is simple. You only need to create an account, validate it, and you’re ready to go. Some exchanges, however, require verification from your bank, which can take several weeks. If you’re in a rush, you can skip the sign-up and verification steps and buy with cash instead.

Begin mining cryptocurrency

Mining is a fantastic technique to obtain cryptocurrency. However, it is not applicable to all currencies. The majority of people feel that mining is just about getting as much bitcoin as possible. However, the entire procedure is a little more difficult. A person uses his computer to solve complex mathematical equations that validate blocks of transactions, which is known as mining. Every cryptocurrency has already been created within a protocol. They simply need to be authenticated before they can be sold.

The first person to validate it will receive a piece of the virtual token he validated as a reward. But, first and foremost, what do you require to begin mining? To begin with, it is dependent on what you want to mine. While Bitcoin mining necessitates high-end hardware such as an ASIC (Application-Specific Integrated Circuit), other coins can be mined with a standard PC. If you want to try your hand at Bitcoin mining, though, you won’t have to spend hundreds of dollars to get started. It is always possible to join a mining network. All you have to do now is pay the membership fee, and you’ll be able to mine with other members. The only drawback is that the prizes will have to be shared.

DeFi Yield Farming is a great way to make money using cryptocurrency.

Decentralized Finance initiatives, also known as Yield Farming or Liquidity Mining, include a reward system that mirrors the bonds market in several ways. Yield Farming, in its most basic form, is a means of creating rewards by locking up cryptocurrency. You will receive incentives and interest when you lock up your funds and offer liquidity to a Defi token. You may receive more tokens in addition to the payout, depending on the project.

Begin freelancing and earn Bitcoin.

You can, however, take microtasks a step further by opting to be paid in Bitcoin or another cryptocurrency for your efforts. Blockchain technology is used by a slew of platforms to make freelancing easier. Employees receive exactly what the company pays because most of them have no charges or transaction fees. Freelancing is a great method to get your professional career started. While accepting Bitcoin payments may be risky owing to its volatility, you may always choose a more stable cryptocurrency. Here are a few areas to start if you want to get into the freelancing business:

Accept cryptocurrency payments.

Are you the owner of an e-commerce site? Then now is your chance to shine. Merchants can accept cryptocurrency payments on their websites using platforms like Shopify or WooCommerce. And I’m not just referring to Bitcoin. WooCommerce allows customers to accept more than 50 different crypto coins, whereas Shopify offers more than 300. And the procedure isn’t particularly difficult. All you have to do with Shopify is enable an alternative payment option from your account. You’ll need to install one (or more) additional plugins for WooCommerce, such as BitPay or CoinGate. Simply activate it after installation, configure it, and you’re ready to go.

Become a member of a publisher’s network.

Do you own a website that isn’t intended for e-commerce? You can still earn some coins in this case. The advertising industry had to react after Google banned or restricted crypto-related businesses from advertising on its network. Numerous crypto ad networks (such as Coinzilla) appeared to be able to meet the market’s advertising requirements. Advertisers may display their advertising on their platforms, which established large networks of crypto publishers.

The publication is compensated for displaying advertisements. While the majority of networks will only pay out in one currency (such as EUR or USD), several will also pay out in cryptocurrency. SIDENOTE. This is a condensed version of the entire procedure. In a previous post, we discussed the differences between ad networks, ad exchanges, and demand-side platforms (DSPs), which you can find here.

Use bitcoin and payment channels to your advantage.

How do you keep track of your payments? Digital banking is progressing, and it is increasingly meeting the needs of cryptocurrency consumers. As a result, cryptocurrency and payment systems such as Crypto.com now include financial management tools that can help you earn more cryptos with the money you already have. You can profit from cashback features in addition to earning bitcoins by depositing and earning interest. We all spend money on a daily, weekly, or monthly basis. So, if you still need to pay for everything, utilize a fintech company’s card to get some of your money back. With the Metal Visa Card from Crypto.com, you may earn up to 5% back on all purchases.

Take a chance on cryptocurrency bonuses

Gambling is a high-risk activity that can result in you losing more money than you win. However, you can use 1xBit or WOLF.BET, which are both trustworthy platforms in the crypto gambling business. Some even provide a welcome bonus for logging in. You can earn Bitcoins by multiplying your in-game funds up to the time of withdrawal with that bonus. Keep in mind that even if you meet the minimum withdrawal limit, crypto gambling platforms that give a login bonus will normally require you to deposit a minimum amount in order to withdraw your cryptocurrency. As a result, you must exercise extreme caution while selecting a crypto gambling platform.

Earn Bitcoins by using cryptocurrency faucets

Faucets are one technique to generate cryptocurrencies without having to invest any money. It will take some time and effort, but in the long run, it will pay off handsomely. You can join a variety of cryptocurrency faucets, the majority of which pay in Bitcoin or Ethereum. Those who pay in Bitcoin will give their users Satoshis for each micro-task completed, while those who pay in Ethereum will give Wei.

A faucet’s system is relatively simple to comprehend. To earn a little fraction of a cryptocurrency, you must view adverts, do surveys, and play games. Once you’ve reached the minimum withdrawal limit, you can cash out your cryptocurrency. If you have the time and determination, a crypto faucet can help you earn your first Bitcoins, despite how slow it may seem.

For savvy shoppers, free money is nothing new: There are sign-up incentives for credit cards, interest on bank accounts, and even programs to get cashback when buying online. Many of the same benefits are now available in cryptocurrencies rather than credit card points or US cash. If you’ve already included cryptocurrencies in your investment portfolio, these alternatives can help you get more money for your money – but you should understand how it works first.

You should also be aware of the additional duties that free cryptocurrency may entail, particularly as tax season approaches. While some forms of free crypto, such as crypto credit card rewards, are only taxed on capital gains when you cash out (just like any other crypto you buy with your own money), others may be considered taxable income when you receive it, and you must declare it to the IRS.

Shopping Bonuses

When you shop with its retail partners, Lolli, a Google Chrome or Firefox browser extension, gives you “Bitcoin Back.” It works in a similar way to browser extensions like Rakuten or Honey, which provide discounts and cashback when you shop online through the portal or extension. Lolli, like those schemes, rewards you for spending conventional money when shopping online – not for buying crypto. Nike, Sephora, and Malaysia Airlines are among the retailers on Lolli. Depending on the shop and product, rewards range from 1 percent to 30 percent Bitcoin back. Your incentives will be deposited in your Lolli account, which you can subsequently transfer to a cryptocurrency wallet or exchange account.

Cards

A bitcoin credit card operates like any other rewards credit card, only you get cryptocurrency instead of cashback or points. With cashback benefits (which may be used to acquire crypto), these cards can help you diversify your crypto holdings. BlockFi and Upgrade, among others, have revealed plans for bitcoin rewards credit cards. These cards’ reward categories are similar to many cash-back credit cards.

For example, the BlockFi Credit Card earns 1.5 percent back in Bitcoin on every purchase after earning 3.5 percent for the first 90 days. These cards have variable rewards rates and redemption values. You may pick whatever cryptocurrency to redeem rewards in, while BlockFi receives Bitcoin rewards and others only allow particular altcoins. As with any credit card, the incentives are only worthwhile if you avoid paying excessive interest rates. If you use a credit card to earn crypto rewards, be sure you only charge what you can afford to pay off each month.

Sign-Up and Referral Bonuses

Some bitcoin exchanges reward new users or referrers. For example, a former Coinbase sign-up bonus paid $5 to new crypto investors, and the exchange now provides $10 to you and your referrer when they open an account and trade $100 or more. Pay heed to the bonus terms. To claim these benefits, you may need to give more personal information or take other steps. Even if you already have an account, keep an eye out for new exchangers that may provide a sign-up bonus or referral programme for friends who may be interested.

Earnings on Coinbase

a popular crypto exchange Coinbase rewards users who use the Learn hub. Take Coinbase’s videos and quizzes to obtain the free change. Coinbase will then put a tiny quantity of crypto into your wallet. Because the classes usually focus on a certain cryptocurrency (like GRT or BOND), these are the coins you’ll win after completing them. Because altcoins aren’t suggested for long-term investment, you can exchange them for Bitcoin or Ethereum.

Remember to maintain track of your crypto-to-crypto trades, as they are taxable. You should also track your earnings on Coinbase Earn and submit them as income on your federal tax return. While we’re on the subject, your federal tax return is entirely free to file in most circumstances. Beyond that, Coinbase will issue you a Form 1099-MISC if you earn over $600 through the program. To earn with Coinbase Earn, you must have a funded Coinbase account, reside in a qualifying country, and validate your personal information.

Earn Bitcoin Interest

Many exchanges offer interest on cryptocurrency holdings. For example, Gemini Earn lets you lend your crypto to institutional borrowers and earn up to 7.4% APY. This is identical to BlockFi’s Interest Account, which earns up to 7.5 percent. The risk of lending your crypto to these institutions is added to the inherent risk of bitcoin, so be sure to read the terms thoroughly before signing up.

You can also earn interest by staking on Binance.US. Sitting on cryptocurrency earns benefits or interest. So you aid the blockchain network. You may only stake particular coins within an exchange, so you may need to buy riskier altcoins to benefit. Interest on your crypto and staking revenues are both taxable and must be reported as income. If you choose to participate, you must keep note of your cost basis for tax purposes.

Airdrops

Airdrops are the riskiest way to gain free bitcoin, and we believe the reward is not worth the risk for most investors. Airdrops are used to promote a new coin. Simply put, they give away coins to gain adoption. You can find out about airdrop initiatives online; they’re generally advertised on the company’s website, social media platforms, and some crypto news sites. Amounts are sent directly to your digital wallet address if you qualify.

Be wary of new cryptocurrency initiatives. Hackers frequently utilize fake airdrops and ICOs (initial coin offerings). Even when they are authentic, many airdropped currencies are not good financial stores of value. Beginners should stick to the most popular cryptos, Bitcoin and Ethereum. If you follow that advice, avoid airdrops. Airdropped crypto is likewise taxed. Taxpayers must report it as such based on its fair market value on the date it was recorded on the distributed ledger (usually when it was airdropped into your digital wallet). You can check sale.finance for airdrops list also.

Stake Cryptos

Staking (or proof-of-stake) is another way to generate money from cryptocurrencies. Staking entails keeping money in a live wallet and earning more coins for safeguarding a crypto network. NAV Coin, PIVX, Neblio, Decred, and other coins can be staked.

Forks and Airdrops

To raise awareness, free tokens and airdrops are given out. To build a sizable user base for a project, an exchange could perform an airdrop. You can receive a free currency by participating in an airdrop, which you can then use to make purchases, investments, or trades.

A protocol upgrade or change that produces new currencies causes a blockchain to split. Usually, you will receive free tokens on the new network if you have currency on the original chain. This indicates that since you were in the correct position at the right moment, you received a free coin.

Do Crypto Microtasks

If you have spare time, you can work for individuals or bitcoin platforms and earn money. The activities might range from app testing to watching ads, surveys, and videos. Sites like Bitcoins Rewards, Coinbucks, and Bituro offer microtasks.

Work with Cryptocurrency Firms

Profiting from the sector is widespread. Anyone can work for a bitcoin company as a digital marketer, content creator, or web designer. All you have to do is identify their needs and demonstrate your expertise. The best part about working with crypto platforms is that you’ll likely work remotely, allowing you to work from home. Aside from that, most legitimate crypto organisations provide very competitive packages, so don’t miss out on the possibility to work with one. Way #8. Arbitrage

The cryptocurrency industry is generally unregulated, resulting in wide variances in asset valuation, product pricing, and so on. Most exchanges set their own prices for their assets, avoiding the differences in volatility and liquidity. These price discrepancies can be exploited by buying from low-cost suppliers and selling on high-cost exchanges. This pretty basically sums up an arbitrage. Depending on the exchange, price margins might range from 5% to 30%. Engage in price comparisons across platforms to see if there are any relevant differences to profit from.

Faucets – Earn Free Cryptocurrency by Completing Simple Tasks

You may earn free digital tokens by doing tasks on cryptocurrency faucet websites. The particular activities that you are expected to do will differ from one platform to the next in this market. For instance, you must solve captchas on several cryptocurrency faucet systems.

No prior expertise is necessary because anyone may accomplish this. Then there are cryptocurrency faucets that are available as smartphone apps. These frequently demand you to play recently released games, and after reaching specific milestones, you will receive free cryptocurrency.

It’s crucial to remember that the benefits offered by bitcoin faucet services are meagre. In reality, the majority of the time, each assignment you accomplish will only pay just a few pennies in cryptocurrency. Crypto faucets, on the other hand, let you earn rewards without taking any financial risks because you are not obliged to deposit any money.

Decentralized autonomous organisations (DAOs), together with the metaverse and NFTs, are anticipated to have a substantial impact on the development of cryptocurrencies and blockchain technology in the future. Projects that the community and investors collectively own are referred to as DAOs. Additionally, all you need to do to participate in a DAO is possess the relevant token.

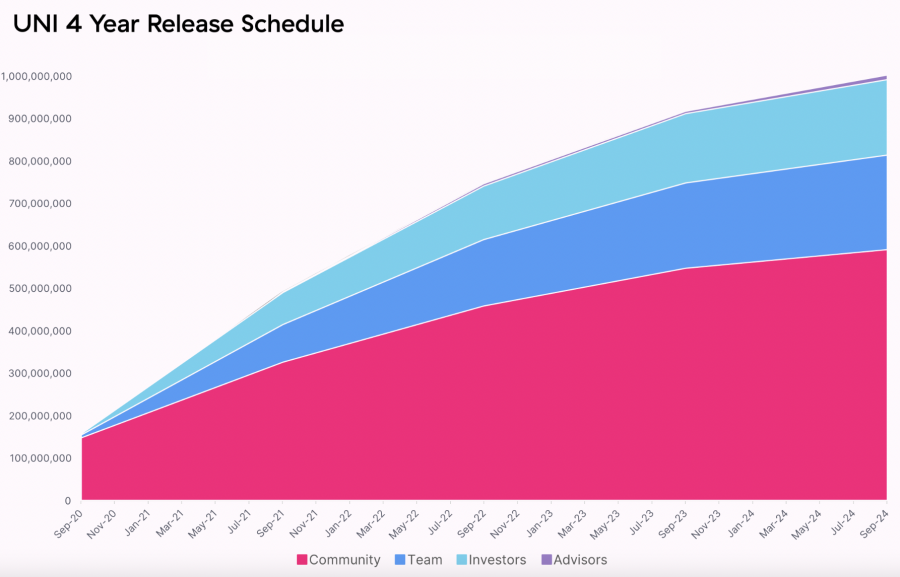

There are several active crypto DAOs, and each initiative is distinct from the others. Uniswap is a prime illustration. It is possible to purchase, sell, and trade digital currencies using this project’s decentralised exchange without the involvement of a centralised third party. Since Uniswap established its DAO cryptocurrency, token holders are now the owners of the project.

And as a result, the holders of the Uniswap exchange’s DAO token will receive a proportionate share of any revenues earned by the exchange. Additionally, DAO token owners have a voice in how each project is managed. This implies that before a DAO project can decide how to proceed with its development, a vote must be held.

Bitcoin Faucets

Crypto faucets are a relatively new source of revenue. The most popular Bitcoin faucets are websites or applications that reward qualifying users with Satoshis. A Satoshi is a hundredth of a millionth BTC; a reward for completing an application or website task.

How to Safely Invest in Cryptocurrency – How to Easily Earn Passive Income With Crypto

Investing is never without danger. One of the riskier investment options on the market, according to experts, is cryptocurrencies. However, the trendiest asset right now is digital money.

The market capitalization of all cryptocurrencies is currently $2.66T, and it is predicted to climb remarkably. The following advice can aid in your decision-making if you decide to invest in digital currencies.

Research Exchanges

Before you put any money into a bitcoin exchange, educate yourself. These online marketplaces offer a way to purchase and trade bitcoins. There are more than 500 exchanges to select from, according to Bitcoin.com. Before moving further, do your homework, study reviews, and consult a seasoned investor. Numerous Telegram groups are there offering advice and discussing their own experiences. Bulls in Crypto Gaming is one of them.

Know-How to Store Your Virtual Currency

You must store your cryptocurrency purchases once you’ve made them. To store your cryptocurrency on an exchange or in a virtual “wallet,” you can select a crypto wallet (one of the cryptocurrency wallets described in the blog). Wallets come in a variety of forms, and each has advantages and technological and security needs. Before making an investment in trading, you should consider your hosting alternatives.

Diversify Your Investments

When it comes to investing in cryptocurrencies, diversification is the cornerstone of any sound investment plan. For instance, just because you are familiar with the name of the network, you shouldn’t put all of your money into it. There are countless possibilities, thus it is preferable to diversify your investment over several digital currencies.

Prepare for Volatility

Be ready for some ups and downs because the cryptocurrency market is always erratic. The cost will change drastically. Cryptocurrencies might not be your best option if your financial situation or mental health are beyond of your control.

Although it is now popular, cryptocurrency is still in its early stages. Be ready since investing in anything new might be challenging. If you’re thinking about joining, start by conducting research and developing a cautious investment plan.

F.A.Q – How to Easily Earn Passive Income With Crypto

How do I make money with cryptocurrency?

There are several strategies to take into account if you’re wondering how to generate money using cryptocurrencies. You may make money in addition to buying and selling digital currencies like Bitcoin via staking, using interest-bearing accounts, yield farming, faucets, airdrops, play-to-earn games, and much more.

What is the best way to make money off crypto in 2025?

Investing in recently launched businesses is arguably the best method to profit from cryptocurrencies right now. A fantastic example of this is Lucky Block, which was first introduced in January 2022.

Can you make money from mining crypto?

Without substantial investments in specialised hardware and continuing power costs, it is no longer viable to profit from bitcoin mining specifically. However, you may either mine a less popular cryptocurrency or join a Bitcoin mining pool.

Summary – How to Easily Earn Passive Income With Crypto

If you’re seeking new ways to earn crypto passively, we’ve listed three simple strategies to try. Plus, they don’t take up much time and allow you to make more without doing anything. Depositing funds into an interest-bearing account is also beneficial for new investors in digital currencies. You will only need to investigate on the platform of your choosing and have no prior knowledge. Now you can start earning interest on your savings. So you want to go into crypto and convert Bitcoin to cash. You’ve heard the success tales — people making millions by buying early and selling late. Maybe you have acquaintances that earn living mining cryptocurrencies.

Everyone wants to make money with cryptocurrencies, but not everyone succeeds. Many people abandon up or lose money because they don’t grasp how to generate money with cryptocurrencies. The bitcoin sector is very young. As a crypto-assets gain value, more people enter the business. These newbies are continually looking for ways to profit from cryptocurrency. The good news is that cryptocurrency can be used to make money. Since 2011, the bitcoin business has seen increased developer engagement, social media activity, and startup activity. Here we examine how to profit from cryptocurrencies.

Thanks for sharing the wonderful information on making passive income by using cryptocurrency or bitcoin.

Thanks

I have been exploring for a little for any high quality articles or weblog posts in this sort

of space. Exploring in Yahoo I at last stumbled upon this website

Thanks for nice comments, keep reading and sharing

Thanks for the detailed post this is what I’m looking for

Thank you so much for your work.It’s very helping to me.give me some advice.I will wait for your reply……

Your blog posts are really interesting. I love your writing style, and you have so many great ideas!Thanks for sharing the wonderful information on making passive income by using cryptocurrency or bitcoin.

Thanks keep reading and sharing

Probably one of the most useful and informative blog posts Ive come across in a while!

A new wave of cross-chain solutions are taking the market by storm, and have their sights set on unleashing the full potential of decentralized finance.

Thanks keep reading and sharing

i found that your blog has enough information about blockchain that i wants to know. thanks for this post

Thanks keep reading and sharing

Awesome Post! This is a very informative & Helpful Post. I got too much information about the Top cryptocurrency news & updates from this post. Thanks for sharing such an amazing post. Keep Posting

Thanks keep reading and sharing

Definitely fantastic information about Cryptocurrency, Thanks for sharing this article with us

Thank You So Much to Share such a great List of Blog Commenting Sites to do sumptuous Backlinks, Which will help to grow organic ranking in the Search Engine.

Thanks for sharing your thoughts

Very helpful! thank you for the Blog Commenting Sites list, it is very helpful, I was searching for some valuable links. Good work, and keep sharing your research and knowledge. Thank you again. This post really too helpful for me to do blog commenting. Thank you for sharing. I am waiting for your next article.

I think that your blog is really useful and I will share it with my friends.

Great keep it up, very good post