What’s Passive Earnings? – Passive Income Ideas You Can Make Money

Passive income ideas offer opportunities to generate money with minimal daily effort or maintenance on the individual’s part. Let’s delve into it further:

Passive: This means requiring little or none of your most valuable resource, your time. Income: It represents a cash inflow that either serves as the earnings you use for daily expenses or that you reinvest. A good litmus test is being able to work a full-time job that occupies the majority of your working hours while still managing your passive income streams.

Passive income can be a great way to generate additional cash flow, especially during times of financial upheaval like the COVID-19 crisis. It proves valuable in bridging the gap when facing unemployment or taking voluntary time away from work. Passive income ensures that money continues to come in, whether you pursue your primary job or choose to relax a bit after building a stable stream of passive income. It provides an extra layer of financial security.

If you’re concerned about saving enough for retirement, building wealth through passive income can be an appealing strategy. It offers an opportunity to accumulate wealth and contribute towards meeting your long-term financial goals.

Passive income enables you to have financial stability, whether as a supplement to your primary job or as a means to achieve financial independence. It provides you with additional security and flexibility, making it a valuable aspect of personal finance planning.

The golden rule of passive earnings – shield your time.

Passive earnings is extra about time than the rest. You possibly can do a number of issues to make money, however not all earnings streams are passive. I’m all for you actively building a enterprise or a side hustle, however for the earnings stream to really be passive, it should require much less and fewer effort to supply earnings, ultimately requiring no effort (or little or no to keep up). For instance, if it takes you 2 hours to generate $100 at the moment, and it takes you an identical 2 hours to generate $100 subsequent week or a 12 months from now, that earnings stream just isn’t passive, as a result of it takes the identical effort (cash, time, and so on). Alternatively, if I open an investing account at the moment that takes some effort.

However as that account grows and I test it 4 instances a 12 months, my returns go up, and my effort goes down. Similar if I build a web based course. At first, I’m incomes no cash and my effort could be very high. However I expend a ton of effort at first. As soon as the course is full, I do some continued advertising and marketing and shopper help which quantities to only a few hours per week, whereas gross sales roll in month after month. You get the image? Now let’s discuss what passive earnings just isn’t.

What Passive Earnings just isn’t.

Your job.

Clearly. The entire concept of passive earnings is to complement, increase or get you out of your job so you’ll be able to retire, journey or spend extra time with family members.

Aspect hustles.

Aspect hustles are nice methods to earn money, however not all side hustles are passive. Aspect hustles are often lively, and perhaps with systemization, they’ll flip into passive earnings streams. If it’s essential regularly make investments the identical (or extra) period of time for a similar quantity of monetary output, the enterprise just isn’t passive. Watch out right here, as a result of bear in mind, to start with, a passive earnings stream may require extra time, cash or work than it produces. It’s a must to consider the passive earnings alternative on its long time period state for you.

Consulting.

Consulting is simply one other job – excellent for a side hustle, however not precisely passive. For consulting to be passive, you’ll have to build the follow with different individuals, and be capable to step away from the work ultimately.

Investing for hypothesis.

Right here’s the place I break up hairs. I don’t take into account inventory investments for capital appreciation only to be passive earnings. Why? As a result of inventory appreciation just isn’t earnings. Alternatively, investing in secure firms that throw off money within the type of dividends is unquestionably a passive earnings technique. The difference is, are you getting a money on money return, or will you only see return for those who promote the funding? Additionally, investments like cryptocurrencies and commodities are reserved for worth hypothesis. There are numerous instances the place these investments should get some allocation of your portfolio, however investing like this isn’t a secure passive earnings technique.

Examples: What’s and isn’t passive earnings

| Lively Aspect Hustle Earnings | Passive Earnings |

| Consulting by the hour | A course in your space of experience that you simply promote on-line |

| Freelance computer programming | Building a program you’ll be able to promote time and again |

| Freelance writing | Writing a e book |

| Working development | Investing in actual property |

| Driving for Uber | Renting out your car |

| Pictures classes | Building your photog Instagram account |

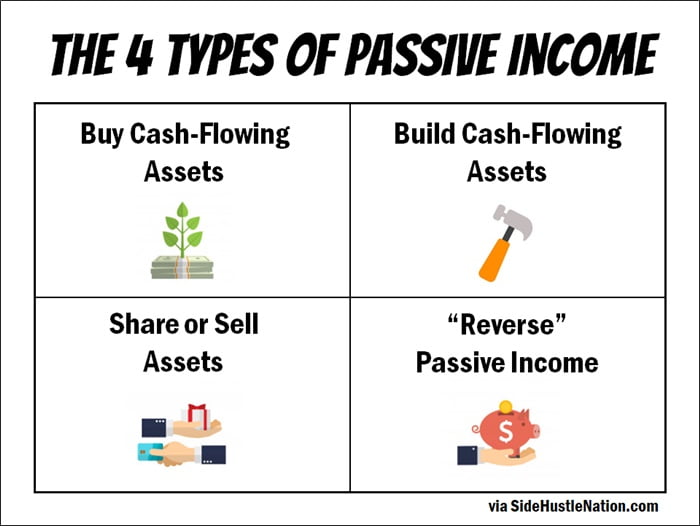

The 4 Types of Passive Earnings

The attract of passive earnings is thrilling. I imply, if the concept of getting cash in your sleep doesn’t get you excited, I’d test your pulse. On top of that, passive earnings is essential. I’ll let Warren Buffett clarify: “In the event you don’t discover a approach to earn money whilst you sleep, you’ll work till you die.” I believe we will all get on board with that. So how are you going to get some that candy, candy passive earnings–or “mailbox cash”–for your self?

Right here’s what it’s essential know. Usually, passive earnings is the cash you earn from belongings you control. (Property are merely issues that different individuals worth; money, actual property, bodily items, consideration, and so on.) The disadvantage is belongings often take both time to build or cash to amass. Listed below are the 4 sorts of passive earnings you can begin working towards at the moment:

1. Purchase cash-flowing belongings

That is the “earn money with cash” choice. Under this class you’ll discover choices like dividend investing, enterprise lending, actual property, and stuff like that. It’s nice–if you have already got cash to take a position!

2. Build belongings

Building one thing of worth–say, a digital product or web site that earns promoting income–is a viable path to passive earnings. This stuff take a while to create and market, however can run comparatively passively usually for years if arrange accurately. We’ll discover some examples of how I’ve performed this and the way different side hustlers have as well.

There are methods to make relatively-passive earnings renting or promoting belongings you control. This might embrace further house round your home, stuff you have got amassing mud, and even the information generated by your cellphone (see under!).

4. “Reverse” passive earnings

“Reverse” passive earnings comes from slicing your ongoing month-to-month bills. A penny saved is a penny earned, proper? Properly, due to taxes on earned earnings, it’s really higher than that! I’ll present you a few of my favourite methods to earn some reverse passive earnings. No extreme couponing, I promise.

Top Passive Earnings Streams

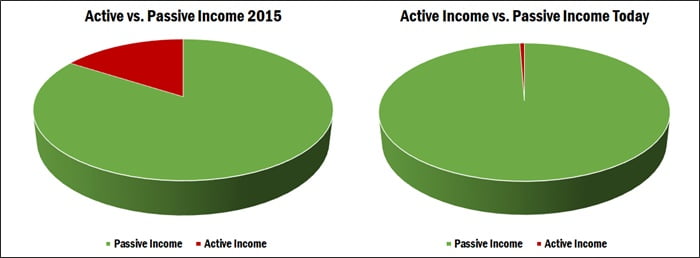

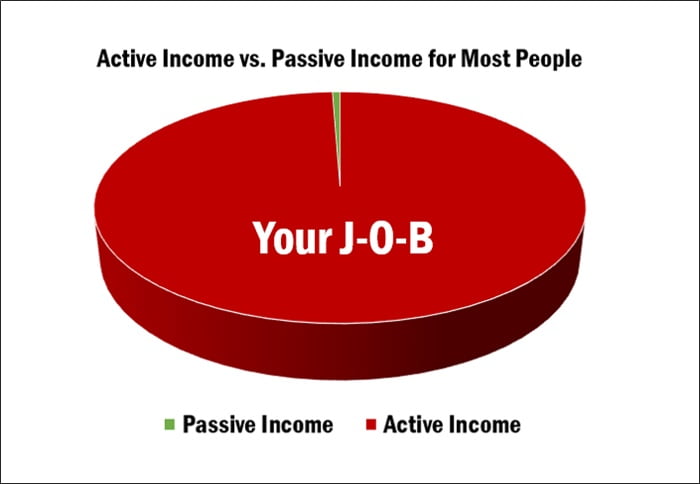

I’m actually no funding guru or monetary wizard, however the overwhelming majority of my earnings is “passive”– or no less than time-leveraged. By time-leveraged, I imply I don’t punch a clock or commerce my time for cash in any direct method. And it’s been that method for a number of years:  The tiny sliver of “lively earnings” on the chart comes from one-on-one consulting calls. Sadly, right here’s how the chart appears to be like for most individuals:

The tiny sliver of “lively earnings” on the chart comes from one-on-one consulting calls. Sadly, right here’s how the chart appears to be like for most individuals:  They’ve a giant chunk of lively earnings–from their job–and (in the event that they’re fortunate) somewhat slice of funding earnings. Let’s work towards shifting the stability to the inexperienced! Listed below are my present sources of passive earnings, roughly from largest to smallest. It’s essential to notice I’ve built these up slowly over time, beginning whereas I used to be nonetheless working a 9-5 job. I don’t need to paint the image that I’m raking in tens of millions sitting in a hammock on the seaside, both–as a result of I’m not. I nonetheless work a number of days per week on rising my enterprise. However I get to do it by myself phrases and have a ton of enjoyable doing it.

They’ve a giant chunk of lively earnings–from their job–and (in the event that they’re fortunate) somewhat slice of funding earnings. Let’s work towards shifting the stability to the inexperienced! Listed below are my present sources of passive earnings, roughly from largest to smallest. It’s essential to notice I’ve built these up slowly over time, beginning whereas I used to be nonetheless working a 9-5 job. I don’t need to paint the image that I’m raking in tens of millions sitting in a hammock on the seaside, both–as a result of I’m not. I nonetheless work a number of days per week on rising my enterprise. However I get to do it by myself phrases and have a ton of enjoyable doing it.

Affiliate Commissions

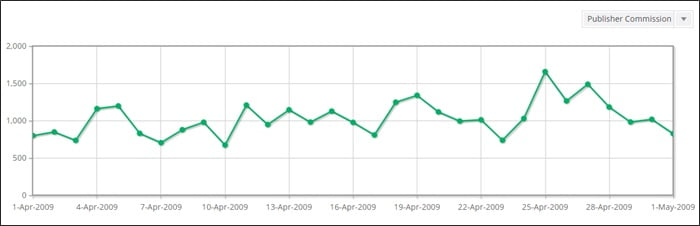

I obtained my begin in affiliate advertising and marketing again in 2004, and it’s been a big piece of my income pie ever since. How affiliate advertising and marketing works is I earn a fee for referring leads and clients to different products and companies.

Instructed Playlist: Affiliate Advertising

Earn cash on-line by sharing related products and companies along with your viewers. Here is a killer playlist full of actionable recommendation from the professionals. Add to Spotify My first affiliate enterprise was a comparability buying website for footwear. It helped individuals discover the best worth on their subsequent pair of footwear, and earned commissions from Zappos and different footwear retailers when these individuals made a purchase order. As soon as the positioning was built, I earned these commissions whether or not or not I used to be actively sitting on the computer. Right here’s a have a look at my every day affiliate fee pattern again within the day:  Even at the moment, affiliate advertising and marketing is a very essential income stream for me. This website (and sure, this post too) consists of a number of affiliate hyperlinks to products, apps, services, and software I think will be helpful to my audience. Right here’s an (over-the-top) instance of a post monetized with affiliate links. Nonetheless, over its lifespan, it’s generated over $30,000 in commissions.

Even at the moment, affiliate advertising and marketing is a very essential income stream for me. This website (and sure, this post too) consists of a number of affiliate hyperlinks to products, apps, services, and software I think will be helpful to my audience. Right here’s an (over-the-top) instance of a post monetized with affiliate links. Nonetheless, over its lifespan, it’s generated over $30,000 in commissions.

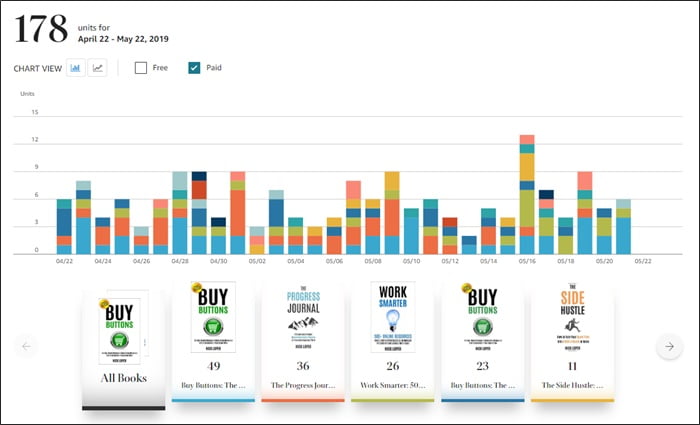

Kindle E book Gross sales

The subsequent few earnings streams are all self-publishing associated. It’s by no means been simpler to create a e book of your individual and put it up for sale on Amazon. I received my first writer royalties in 2012 and have added several more titles since then. It’s one in all my favourite side hustles and one in all my most passive earnings streams–write the e book as soon as and gather royalties for months and even years at any time when it sells. A few of these titles are nonetheless racking up passive earnings years later:  While you worth your e book between $2.99 and $9.99, you’ll earn a 70% royalty. Exterior of that range, it’s 35%.

While you worth your e book between $2.99 and $9.99, you’ll earn a 70% royalty. Exterior of that range, it’s 35%.

Paperback E book Gross sales

For each Kindle e book you write, it most likely is sensible so as to add a paperback version. Fortunately, Amazon makes this extremely easy with its KDP Print service. The service is print-on-demand, which means you don’t have to inventory a storage stuffed with books. After you add your files and set your costs, Amazon prints and ships out every copy as clients place their orders. I sometimes earn round $3 for each paperback copy bought.

Audiobooks

Since some readers will all the time choose audio, I’m all for giving them that choice. Considered one of my books earned over $2000 in audiobook gross sales in its first 12 months. You don’t even must document your work your self. In reality, until you have got a podcast or YouTube channel the place individuals are used to listening to your voice, I most likely wouldn’t! By means of ACX, the Audiobook Creation Exchange, Amazon helps join you with skilled narrators. A few of these voice over artists will even learn and produce your e book without cost, in change for a share of future royalties.

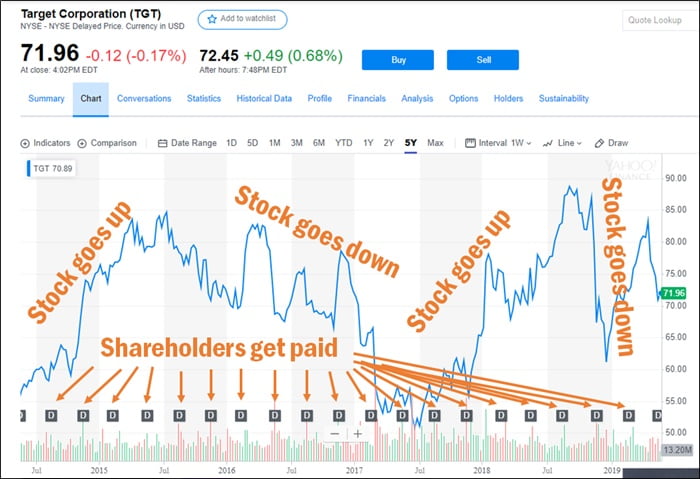

Dividend Investing

Investing for dividend cash flow has helped me get off the sidelines and into the market. (I’m the one that all the time thinks we’re due for a correction!) My fundamental technique–and once more, don’t take this as funding recommendation–has been to purchase shares in firms with a long historical past of paying, and growing, dividends. These embrace largely name-brand companies like Goal, Chevron, AT&T, and Proctor and Gamble. As a result of they’ve been round without end, they’re not more likely to have explosive share worth development, however they do spin off constant passive money circulate.

Over the previous few years, I’ve slowly built this as much as a number of hundred {dollars} a month. Take a look at a service like the fashionable brokerage M1 Finance to get began your self. You’ll be able to commerce shares without cost, or choose one in all their pre-built portfolios. (That’s an instance of an affiliate hyperlink; I’ll obtain compensation from M1 for those who create an account.)

Udemy Course Gross sales

In 2014 I created a web based video course about how to launch non-fiction Kindle books on Amazon. It earned $3500 in the first couple months, and has gone on to earn passive gross sales ever since. The entire is now over $20,000!  All I’ve to do is reply to the (fairly rare) pupil questions or feedback. Once more this falls under the model of “create one thing as soon as, and promote it again and again.”

All I’ve to do is reply to the (fairly rare) pupil questions or feedback. Once more this falls under the model of “create one thing as soon as, and promote it again and again.”

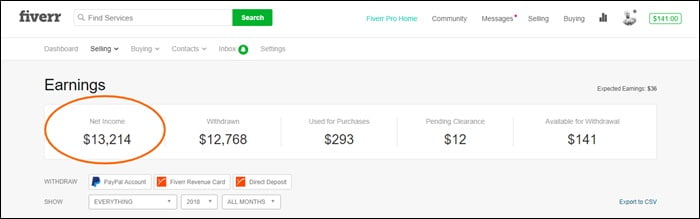

Digital Product Gross sales on Fiverr

A number of years in the past, I made a decision to check promoting a few my books on Fiverr. I figured it will be one other attention-grabbing “purchase button” platform to experiment with. Certain sufficient, people bought them. And in reality they proceed to purchase them. Fiverr positively has not been a spotlight these days, however in whole I’ve earned over $13,000 on the positioning since late 2013.  (Full disclosure: A good chunk of that income was NOT passive; I bought e book editing and video website reviews along with my digital products. Through the years, Fiverr has shifted to develop into primarily a contract platform, so the technique at the moment could be to create a compelling service offer.)

(Full disclosure: A good chunk of that income was NOT passive; I bought e book editing and video website reviews along with my digital products. Through the years, Fiverr has shifted to develop into primarily a contract platform, so the technique at the moment could be to create a compelling service offer.)

Merch by Amazon

It is a low-overhead, low-investment approach to build somewhat passive earnings. In our home, Merch is a enjoyable little side enterprise and generates round $60-200 a month for us. The way it works is you upload t-shirt (and now other product) designs to Amazon, and the e-commerce big does the remainder. When somebody orders it, they’ll print it within the dimension and colour chosen, and ship it to the shopper. You earn the unfold between no matter worth you set and the associated fee to print it.

Our best month was over $500 in revenue, which I believe we may hit constantly if we dedicated extra time to creating new designs. (That hasn’t occurred because the arrival of Little Hustler #2.) Right here’s an instance of one in all our designs:  Display Adverts

Display Adverts

In the event you run an internet site, display advertisements like Google Adsense could be your first approach to earn a number of passive {dollars} out of your site visitors. I don’t have display advertisements on Aspect Hustle Nation, however do on one other website I handle. I’ve really bought these sidebar banner advert placements myself as an alternative of utilizing a Third-party promoting host (like Adsense). This offers me extra control over what advertisements are proven to my guests, and I can earn extra as well. My advertisers are arrange on computerized month-to-month funds and have been with me for years. This earnings stream generates round $450 a month for me. Your potential to do the identical will in fact depend upon the quantity of site visitors your web site receives and the demographics of that site visitors.

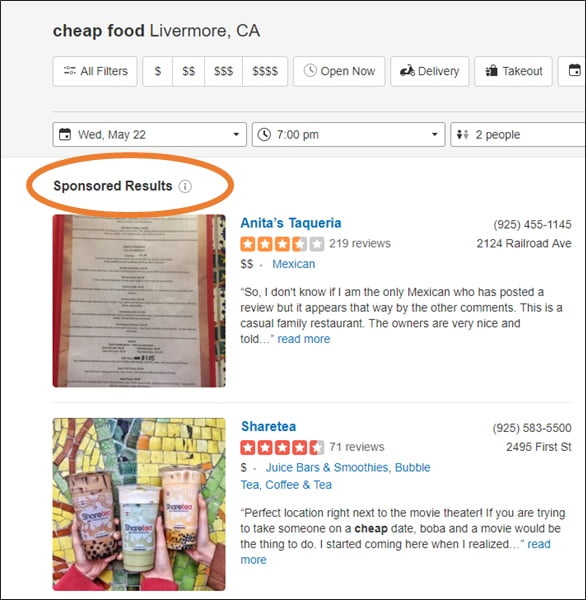

Promoting a Featured Itemizing in a Listing

The positioning I discussed above has a company listing part to it. It’s much like Yelp in that the highest-rated firms rise to the top of the rankings. And much like Yelp, firms have reached out about shopping for a “featured” placement on the top:  I stated I may try this for $500 a month, labeled the itemizing as “sponsored”, and put the company on an computerized month-to-month fee plan. Growth, a brand new passive earnings stream.

I stated I may try this for $500 a month, labeled the itemizing as “sponsored”, and put the company on an computerized month-to-month fee plan. Growth, a brand new passive earnings stream.

“Non-Display” Adverts

Many web site homeowners don’t need to litter their websites with advertisements, and I completely perceive that. (That’s one motive there aren’t any advertisements on this website!) However, one possible further income stream is to let advertisers place their retargeting scripts in your website. That is invisible to guests however permits these different firms to doubtlessly market to that viewers on Facebook or different channels. (Simply be sure you disclose this in your privateness coverage.) I’ve been enjoying round with this for the previous few years on the listing website I discussed above. Just a few advertisers have taken me up on it, to the tune of round $150 a month. I don’t charge a ton for these, however every is on computerized fee by means of PayPal. Right here’s a cool service that can help you sell these on your site.

YouTube Adverts

When you have over 1000 subscribers in your YouTube channel, you’ll be able to allow Google’s built-in monetization. Recently this passive earnings steam has been round $300 a month:  That is the earnings stream I’m most likely most enthusiastic about proper now, as a result of it feels fully new. And to make certain, creating video content material takes time, however as soon as your movies are up there, they’ll earn passive earnings for you for years — as a few of mine have.

That is the earnings stream I’m most likely most enthusiastic about proper now, as a result of it feels fully new. And to make certain, creating video content material takes time, however as soon as your movies are up there, they’ll earn passive earnings for you for years — as a few of mine have.

Instructed Playlist: Make Cash On-line

Listed below are some artistic and provoking methods you can also make cash on-line. Add to Spotify

14. Fundrise

Fundrise is a cool “various” approach to put money into actual property. Disclosure: I’m a Fundrise affiliate. This isn’t funding recommendation or solicitation for funding. They’ve a number of funds that function like mini REITs or actual property funding trusts, the place you’re shopping for a mix of debt and fairness in a range of economic properties they’ve bundled collectively. The platform is open to non-accredited traders with only a $500 minimal funding.  Traditionally the company has paid 6-10% dividend yields. I’m about 5 years into my investments there and so they’ve paid out every quarter so far. (After all there haven’t been any main actual property downturns that point both!)

Traditionally the company has paid 6-10% dividend yields. I’m about 5 years into my investments there and so they’ve paid out every quarter so far. (After all there haven’t been any main actual property downturns that point both!)

PeerStreet

With PeerStreet, you’re primarily serving to actual property flippers with their acquisition and rehab prices, and incomes 6-9% in your funding.  The large benefit over different peer-to-peer lending is the loans are backed by the true property so if the borrower stops paying, you have got some recourse — specifically foreclosures. The loans are shorter time period, usually 1 12 months or much less, as an alternative of 3-5 years. The large disadvantage is it’s $1000 minimal funding per deal, in comparison with $25 on Prosper (see under) — so if a type of defaults, it may doubtlessly be a giant blow. PeerStreet can also be at present only open to accredited investors.

The large benefit over different peer-to-peer lending is the loans are backed by the true property so if the borrower stops paying, you have got some recourse — specifically foreclosures. The loans are shorter time period, usually 1 12 months or much less, as an alternative of 3-5 years. The large disadvantage is it’s $1000 minimal funding per deal, in comparison with $25 on Prosper (see under) — so if a type of defaults, it may doubtlessly be a giant blow. PeerStreet can also be at present only open to accredited investors.

Worthy Bonds

So as to add diversification and money circulate to my portfolio, I’ve taken up a small place in Worthy Bonds. These small enterprise bonds pay 5% curiosity, and you should purchase them for only $10 apiece. The bonds are used to fund stock or asset-backed loans to small U.S. companies.  For the reason that loans use stock as collateral, they’re thought-about safer than different private or enterprise loans. You may as well routinely re-invest your curiosity and make penalty-free withdrawals at any time.

For the reason that loans use stock as collateral, they’re thought-about safer than different private or enterprise loans. You may as well routinely re-invest your curiosity and make penalty-free withdrawals at any time.

Credit score Card Rewards

Sure, I take into account bank card rewards passive earnings as a result of I earn them simply from spending cash like I usually do. In our home, this stream is value tons of of {dollars} a 12 months within the type of money again, free gift cards, and journey. The magic actually occurs if you benefit from sure sign-up bonuses for brand new playing cards — incomes the equal of 20%, 30%, 40% money again or extra in journey worth or assertion credit score. Right here’s only a actually easy instance:

Money Again Apps

Except for bank card rewards, I exploit a number of money again apps to earn “reverse passive earnings” each time I store. Amongst these are:

- Capital One Shopping – A free browser extension that helps you discover higher offers and coupon codes if you store on-line, whether or not or not you financial institution with Capital One. Plus, you’ll earn loyalty credit you’ll be able to redeem for reward playing cards. Disclosure: Capital One pays me if you get the Capital One Purchasing extension by means of my hyperlink.

- Fetch Rewards – Scan your grocery receipts with the free Fetch app to earn money again on 250+ manufacturers. Not 100% passive however very painless.

- Pei – When you hyperlink your bank card, Pei is a seamless approach to earn an additional 1-10% money again at many native shops and eating places. That is my favourite new computerized money again app.

Mint Cellular

I lately switched to Mint Mobile, which runs on the T-Cellular community, for my cellular phone service. While you pre-pay, it prices simply $15 a month:  In comparison with my previous supplier, Ting, and my even older supplier, Verizon, this represents financial savings of $180-500 a 12 months.

In comparison with my previous supplier, Ting, and my even older supplier, Verizon, this represents financial savings of $180-500 a 12 months.

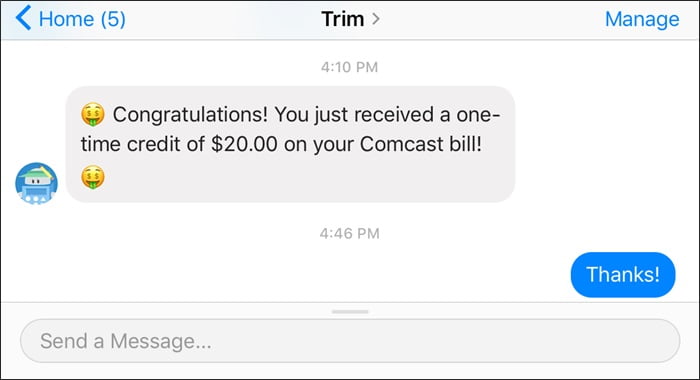

Trim

Trim is a novel program that may assist you to get monetary savings. Join, obtain the app, and join your accounts to Trim.  The app analyzes your spending and finds methods to save lots of you cash. This consists of negotiating to decrease your payments, like cable and web. Trim additionally will help you cancel forgotten subscriptions and recurring prices costing you cash each month. I used to be somewhat skeptical however Trim negotiated more than $300 in annual savings off my Comcast invoice! The company prices 33% of the financial savings as their “success price,” which is decrease than competing companies like Billshark or Billcutterz.

The app analyzes your spending and finds methods to save lots of you cash. This consists of negotiating to decrease your payments, like cable and web. Trim additionally will help you cancel forgotten subscriptions and recurring prices costing you cash each month. I used to be somewhat skeptical however Trim negotiated more than $300 in annual savings off my Comcast invoice! The company prices 33% of the financial savings as their “success price,” which is decrease than competing companies like Billshark or Billcutterz.

A Debt-Free Life

One other reverse passive earnings stream I can’t take as a right is the cash we save each month by carrying no debt. In accordance with Nerd Wallet, the typical family with debt is dealing with:

- $6500 in bank card debt

- $27,000 in car debt

- $46,000 in pupil mortgage debt

In the event you’re paying curiosity proper now, I might prioritize eliminating that month-to-month expense earlier than exploring a few of these different methods.

A Commute-Free Life

The prices of even an average commute can add up quick, within the type of:

- Gasoline and car upkeep

- Depreciation in your car

- Insurance coverage prices

- Alternative prices in your time

Working from house for the final 10+ years has undoubtedly saved me 1000’s. After all, it’s not sensible for all job roles, however remote work has actually develop into extra mainstream these days. In the event you can work from home even one or two days per week, I might chalk that up as a win within the reverse passive earnings class.

Renting As an alternative of Shopping for

That is very unpopular in private finance circles, however we’ve been consciously “throwing cash away” on hire for years. The maths will differ by location, however in our space, it’s far cheaper to rent than to own. Writing that hire test each month saves 1000’s of {dollars} over a mortgage on a similar-sized house. To make sure, we’re not building any fairness or capturing any appreciation, however our would-be down fee, mortgage, and property tax cash is working for us in different methods. On top of that, we’ve seen our home-owning associates spend severe cash changing roofs, transforming, and even fixing settling foundations. I’m positive some day we’ll soar again into house possession, however for proper now renting saves no less than $20,000 a 12 months.

Financial savings Account Curiosity

Our financial savings account, by means of Capital One, earns 0.5% curiosity on our stability. It’s not so much, however provides up. Even for those who don’t have substantial financial savings (but!), it could be time to make a switch.

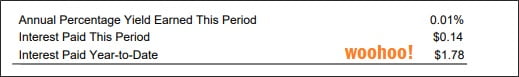

Checking Account Curiosity

This passive earnings stream is laughably small, however hey, each penny counts proper? I earned a whopping $1.78 in checking account curiosity final 12 months!

DiversyFund

DiversyFund is a more moderen “eREIT” that targets “value-add” residence complexes. These are cash-flowing complexes in want of upgrades – however as soon as the enhancements are made, the worth of the complicated and rental incomes enhance.  The technique appears to be working. Diversyfund has seen 15%+ returns in its first couple years! It’s essential to notice that you simply should only make investments cash you don’t anticipate to want for some time; the company suggests a goal 5-year holding interval throughout regular market conditions. DiversyFund is open to non-accredited traders with a minimal funding of simply $500.

The technique appears to be working. Diversyfund has seen 15%+ returns in its first couple years! It’s essential to notice that you simply should only make investments cash you don’t anticipate to want for some time; the company suggests a goal 5-year holding interval throughout regular market conditions. DiversyFund is open to non-accredited traders with a minimal funding of simply $500.

Roofstock

Persevering with the true property theme is Roofstock. The platform makes a speciality of matching traders with “turnkey” rental properties throughout the nation. A pair associates of mine have bought a number of homes by means of this easy-to-use website. I like the variety of REITs, but when building a real estate empire is your long-term plan, these guys will assist you to do it–one home at a time.

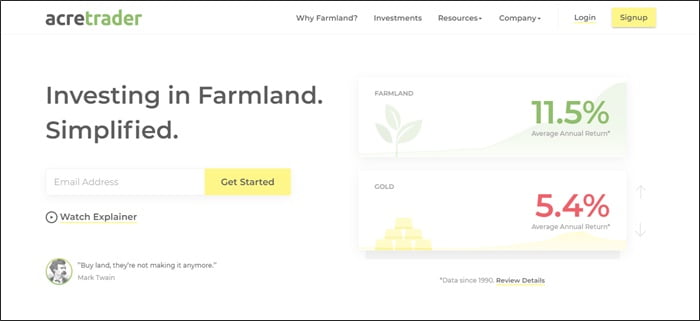

AcreTrader

Put money into America’s farmland with AcreTrader, beginning with $5000 minimums. Since 1990, farmland investments have seen an 11.5% annualized return  AcreTrader crowdfunds the acquisition of lively farmland, after which rents it again to the farmers who function it. Traders earn money in two methods: from appreciation of the land within the occasion of a future sale, and from annual money hire funds from farmers. The company goals for annualized money distributions within the 3-5% range.

AcreTrader crowdfunds the acquisition of lively farmland, after which rents it again to the farmers who function it. Traders earn money in two methods: from appreciation of the land within the occasion of a future sale, and from annual money hire funds from farmers. The company goals for annualized money distributions within the 3-5% range.

RealtyMogul

RealtyMogul was one of many first actual property crowdfunding websites I got here throughout, and so they have two “MogulREIT” choices which are open to non-accredited traders with comparatively low minimal investments (beginning at $5000). Each MogulREITs put money into industrial properties in debt and fairness positions, and pay out a 4-7% annualized dividend every month. The platform additionally provides private lending deals for accredited of us that concentrate on returns of 12-14%.

YieldStreet (accredited traders only)

YieldStreet is an attention-grabbing platform that unlocks investments beforehand only obtainable to hedge funds or institutional traders. The company builds “mini mutual funds” (my time period, not theirs) of various asset courses, together with actual property, authorized case settlements, industrial tools, and accounts receivable. The platform targets 8-15% annualized returns and has traditionally earned traders over 11% unrealized inside rate of return.

Web site Investing

As I can attest, blogs and web sites can earn nice passive earnings without your direct involvement. However you additionally often can’t stand nonetheless for long earlier than that earnings begins to fade. Issues break, content material wants updating, and Google rankings are all the time altering. There are a number of companies that may assist you to make investments on this asset class hands-off although. Onfolio is one which got here throughout my desk lately. When you have internet expertise, you would possibly like this interview with Stacy Caprio, who purchased sufficient money circulate within the type of present web sites to give up her job.

StreetShares is a novel platform that means that you can put money into / help veteran-run companies and earn a set 5% return.  The product known as the Veteran Enterprise Bond and is open to all traders with only a $25 minimal contribution. You’ll be able to entry your cash anytime for a 1% price; or withdraw fee-free after 3 years. (It is a related set-up to Worthy, besides that Worthy permits fee-free withdrawals at any level.)

The product known as the Veteran Enterprise Bond and is open to all traders with only a $25 minimal contribution. You’ll be able to entry your cash anytime for a 1% price; or withdraw fee-free after 3 years. (It is a related set-up to Worthy, besides that Worthy permits fee-free withdrawals at any level.)

Kickfurther

On Kickfurther.com, you put money into stock for rising e-commerce firms. This appealed to me far more than backing random firms on Kickstarter. As an alternative of early entry to a product which may not ever attain manufacturing, you’ll be able to curiosity on short-term stock loans. A typical Kickfurther “consignment” would possibly pay 5-9% “revenue”, with a 4-10 month payback interval. A few of my early offers on the positioning didn’t pan out, which sort of soured my opinion of the platform, however I’ve been seeing higher outcomes these days. Nonetheless, I choose Worthy proper now as a result of the curiosity funds are way more constant, you’ll be able to routinely reinvest in simply $10 increments, and you may withdraw anytime without charges.

Funding Circle

On Funding Circle, accredited traders can lend cash to established and rising American small companies. The rates of interest differ from 5% to over 20%, however historic returns are within the 5-7% range. There’s a $500 minimal per mortgage, however $25,000 minimal required deposit to open an account.

P2BInvestor

Assist small companies develop with short-term, asset-backed funding alternatives on P2B Investor (peer-to-business).

Passive Earnings Concepts from Building Property

In the event you don’t occur to be sitting on mountains of idle money, the good information is there are nonetheless a number of methods you’ll be able to start building passive earnings. In reality, I consider allocating a few of your time to only this pursuit is extremely precious. When the belongings you build begin paying off, you’ll be able to slowly taper off buying and selling time for cash. I touched on a few of my strategies above, which primarily revolved round building income-producing web sites and books. However these aren’t the only sorts of belongings you’ll be able to build in your spare time. Listed below are another concepts to think about.

Create an Electronic mail Course

Do you have got a ability you’ll be able to educate over e mail? You would possibly even have already got some materials in your “despatched mail” folder! Highbrow is a novel studying e-newsletter platform–that pays creators each time somebody indicators up on your class. My buddy Paul Minors has one on creating a productivity system, and stated it pays him passive earnings each month. (On top of that, the platform helps him attain a brand new viewers of potential weblog readers, purchasers, and clients.)

App Improvement / Software program

Might you clear up an issue with software program? It’s the last word scalable enterprise in that the identical code might be bought to a vast variety of clients. Whereas smartphone apps are likely to have a brief shelf-life, a premium software program tool might be bought both as a one-off buy or a recurring month-to-month subscription. As a buyer, I’ve purchased each. In the event you don’t have the technical chops to build one thing like this your self, you possibly can all the time associate or rent somebody who does. The largest consideration is to do your homework upfront and ensure there’s a hungry market demand for what you’re building.

Music Licensing

Evan Oxhorn described himself as “a reasonably gifted musician,” however defined that he’s incomes 1000’s of dollars a 12 months in passive earnings by means of stock music licensing. His songs have been on NPR, the Outside Channel, Verizon’s On Demand channel, and extra. In reality, as digital media channels proliferate (apps, Youtube, your favourite podcast), the demand for inexpensive, licensable music retains rising to maintain tempo.

Picture Licensing

Like music licensing, licensing your pictures is a numbers game. It seems on each passive earnings checklist however my understanding is that it’s extremely aggressive and also you’ll want 1000’s and 1000’s of photographs to make any significant earnings from it. For instance, Dave Bredeson is knowledgeable industrial photographer who dietary supplements his commissioned work by promoting inventory pictures on Dreamstime.com. Regardless that every picture sells for comparatively little, that very same picture might be bought to dozens of various consumers. In reality, Dave has round 3,200 photographs in his portfolio, however he’s remodeled 100,000 gross sales on Dreamstime. “I’ve been averaging round $1,600 a month in Dreamstime earnings,” he defined. “I select matters which are easy to supply on the lowest possible price. My portfolio is dominated by backgrounds, know-how, enterprise, and Christmas photographs.”

Alexa Talent Improvement

There are a pair methods side hustlers could make passive earnings with Amazon’s in style Echo gadgets. The primary is like Apple’s app retailer. You’ll be able to build special Alexa voice apps, called “skills.” As a ability developer, you’ll be able to set your individual worth and earn 70% of the income when customers purchase it. For instance, Nick Schwab created a free ambient noise ability, and now has 10,000 paying customers for a premium subscription version, priced between $0.99 and $1.99 a month. Amazon additionally has a rewards program to encourage builders to build out the ecosystem of expertise. Your rewards are primarily based on the recognition and engagement of your ability, however some builders report incomes thousands of dollars a month.

Voice Over Royalties

As you might need guessed from the audiobook part above, there’s one other approach to earn money from audiobooks on Amazon without writing something your self. That technique is as an audiobook narrator and producer. In the event you love the concept of getting paid to talk, know your method round audio engineering tools and software program, and don’t thoughts studying different individuals’s work, it might be a enjoyable side hustle. Because the producer, you’ll be capable to make mounted worth bids on tasks that authors post on ACX. You’ll additionally see royalty-share tasks, the place you’d be narrating the e book without cost upfront, in change for a share of the audiobook royalties and bounties when it sells. In each instances, you’ll submit your audition and get to work if chosen.

Subcontract a Service Enterprise

Chris Schwab began a residential house cleaning business again when he was still in college, however he grew it to $60,000 a month in lower than two years—all whereas by no means mopping a ground or dusting a shelf himself. What Chris found was that, though there have been already dozens of competing cleansing companies, there was alternative within the house. He figured that out whereas perusing Yelp reviews of present cleansing firms. “Nobody complained concerning the cleansing itself,” he stated. “What individuals complained about was the customer support. They didn’t know when the crew was going to indicate up; they couldn’t get a quote; nobody was answering the cellphone. I knew I may try this, and discover cleaners to do the precise work.” Since then, he’s delegated a lot of the shopper help as well. Once we caught up, the enterprise took simply a couple of minutes a day for him to handle.

Promote a Digital File or Information

Jodi Carlson brings greater than twenty years of expertise in Lady Scouts to the desk–first as a scout, then as a troop chief. She began a weblog documenting the activities she was doing with her scouts, largely simply as a reference for herself and different native leaders. Earlier than long, troop leaders from the opposite side of the nation had found her website by means of Google or Pinterest. They emailed asking what different concepts she had. That’s when Jodi started compiling her exercise guides into PDF paperwork. She uploaded them to Teachers Pay Teachers, a website to purchase and promote lesson plans, and made a number of gross sales within the first week. Since then, the enterprise has grown to greater than $5k a month by means of sales of these digital guides, promoting income, and affiliate partnerships — all on the side from her day job.

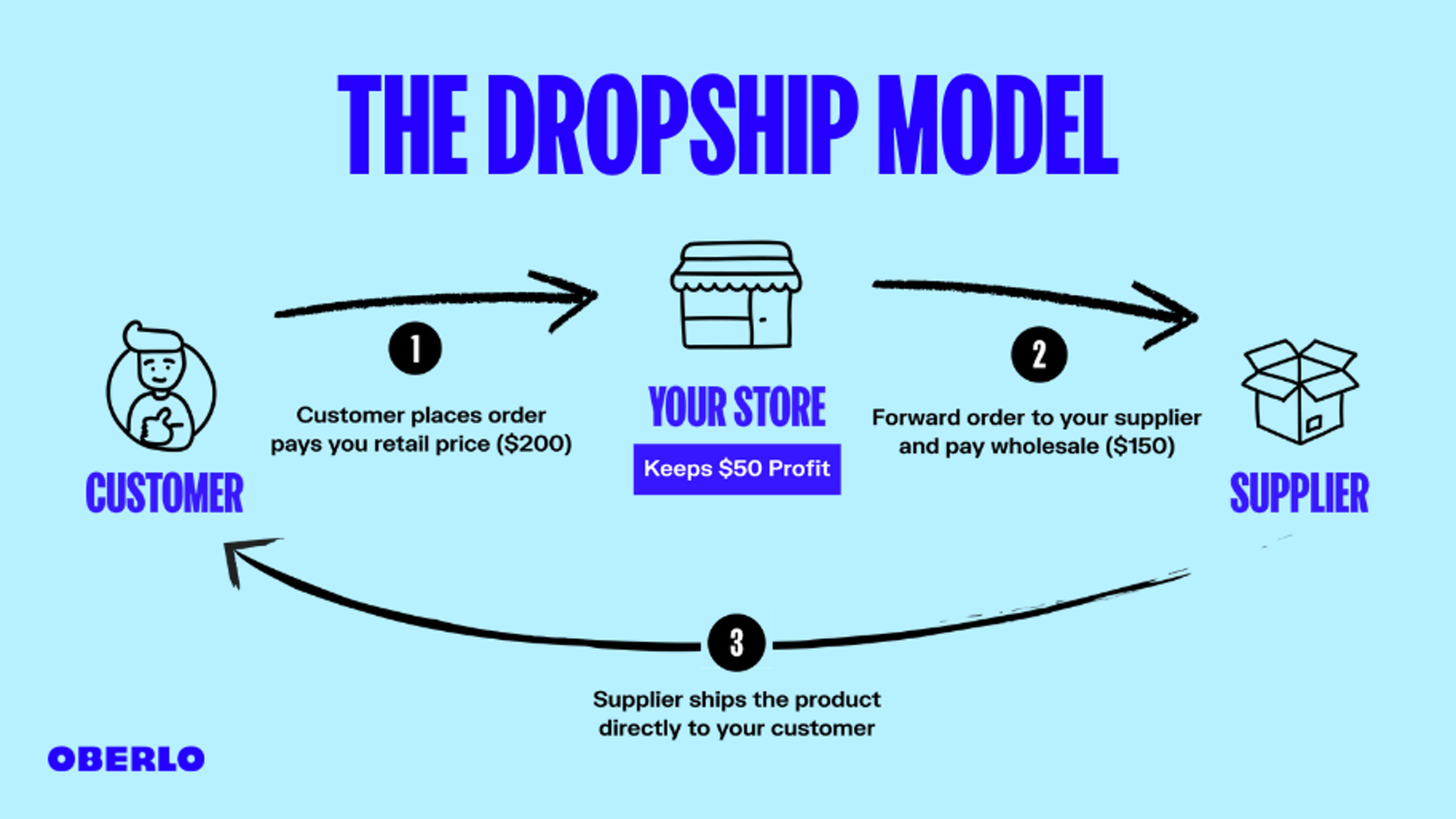

Drop Delivery

Drop transport is a novel type of e-commerce the place your provider really ships the products to clients in your behalf. As the vendor, you don’t must buy any stock upfront, and revenue on the unfold between the retail worth you charge and the wholesale worth you’ve agreed upon along with your provider. In probably the most in style Aspect Hustle Present episodes of all time, Rene Delgado broke down how he sold $300,000 worth of bounce houses in his first year as a drop ship store owner. Though there’s a number of upfront work in building the positioning and securing provider relationships, drop transport might be comparatively passive after that.

Merchandising Machines

Merchandising machines are one of many oldest passive earnings concepts — a silent gross sales pressure that collects money and routinely dispenses products if you’re not round. The problem is managing stock and conserving the machines stocked, particularly when you’ve got a number of places. Nonetheless, the considered returning to a machine and discovering it stuffed with cash is fairly motivating. For extra on how the merchandising machine enterprise can work, take a look at my interview with Matt Miller, whose passive earnings empire started with just $36 and a bag of gumballs.

Passive Earnings Concepts Sharing or Promoting Property

The subsequent class of passive earnings concepts we’ll discover entails promoting are sharing some asset you control. It might be a bodily product, it might be further house, or it may even be one thing extra summary, like an concept or your consideration. Many of those require having one thing of worth to share or promote, which naturally will take both time or cash to amass. Nonetheless, listed below are some choices to think about.

Amazon FBA

The Achievement by Amazon program lets particular person sellers such as you and me faucet into Amazon’s logistics community and big viewers of consumers. The way it works is you ship products into the warehouse(s), and Amazon ships the objects to clients in your behalf. I’m counting this as passive as a result of like different choices on this part, you can also make gross sales and revenue long after you’ve built up your preliminary stock. The best approach to get began is definitely by sourcing discounted products domestically, as explained by long-time Amazon seller Jessica Larrew. After I examined this myself, I made over $650. The draw back is for those who cease sourcing, you’ll ultimately run out of products to promote.

License a Product Thought

Product licensing is a novel method earn residual earnings out of your concepts–whereas letting another person do the work. Nate Dallas and his brother break up $300,000 in royalties from a Pictionary-inspired card game they licensed to Mattel. The duo (a dentist and a preacher) didn’t must design it, produce it, or promote it–however they discovered somebody who may–and so they cashed the checks.

Hire Out that Spare Room

With Airbnb and related websites, you’ll be able to flip the additional house in your house into further money. Examine the calculator on their website to see how much you could earn. The place this could develop into extra passive is when you’ve got a second property and rent a third occasion service to handle your bookings, guest communication, and cleansing.

Hire Out Your Automobile

The common car sits idle about 22 hours a day. What for those who may flip the time you didn’t want your car into money circulate? That’s the promise of peer-to-peer car rental platforms like Turo and Getaround. These marketplaces present a method for to checklist your car for hire, set your costs, and receives a commission–and so they deal with all of the insurance coverage. Some associates of ours in San Diego do that with their private “fleet”, and have earned enough to offset the cost of their dream car, a Tesla Model S. After all, they’ve found out some course of efficiencies to guard their investments and decrease their time.

Hire Out Your RV

The “idle time” stats for RVs are even worse than for vehicles. In the event you’ve obtained a RV parked in your side yard, it’d make sense to let one other household take it for a spin. Websites like RVShare facilitate peer-to-peer leases and canopy insurance coverage. The costs range from $150-300 an evening!

Hire Out Your Boat

With websites like Boatsetter and GetMyBoat, you’ll be able to hire your boat to you landlocked friends. A fast search of boats close by yielded loads of outcomes with charges starting from $230 to $950 per day! How usually do you actually get out on the water?

Hire Out Your Yard

In the event you don’t like the concept of strangers all up in your house, perhaps letting vacationers keep in your yard is extra interesting. Platforms like HomeCamper assist join individuals with “unofficial” tenting spots.

Develop Marijuana in Your Storage?

Citizen Grown is “hashish by the individuals, for the individuals.” The company guarantees to pay you $1000 a month to host a completely automated pot-growing “Node.” Every unit requires a 5ft x 5ft house of your private home, residence, or storage.

Hire Out Your Mud Collectors

Numerous marketplaces have popped up that can assist you earn money from objects you not often use, and to assist debtors from shopping for tools they don’t really want. One in style platform is Babyquip, which rents high quality used child gear to touring households. Members common over $600 a month in rental earnings. In the meantime, FatLlama has gone broader, utilizing the slogan “Airbnb on your stuff.”

Hire Out Your Storage or Attic?

The Neighbor platform goals to disrupt the normal self storage business by letting you home your neighbor’s further stuff the place you have got house for it.  That is more likely to be very passive month-to-month earnings after the preliminary drop off. In accordance with the positioning, hosts are incomes as much as $15,000 a 12 months operating their very own mini self-storage operations.

That is more likely to be very passive month-to-month earnings after the preliminary drop off. In accordance with the positioning, hosts are incomes as much as $15,000 a 12 months operating their very own mini self-storage operations.

Hire Our Your Parking House

Perhaps you don’t have an RV to hire out, however do have house to park one. In that case, Stow It could be value a glance. The positioning helps join parking house homeowners with individuals who have to retailer their seldom-used automobiles. In Europe, JustPark appears to have extra traction.

Just a few completely different market analysis firms pays you passive earnings for those who consent to share nameless utilization knowledge with them. As an illustration, Mobilexpression pays you in change for knowledge out of your cell phone. Download their app and permit it to work within the background recording your looking habits whereas in your cellphone. By taking part with Mobilexpression, you’ll earn weekly credit redeemable for gift cards to popular retailers. Realistically, that is an un-intrusive background app that may most likely earn you round $20 a 12 months in passive earnings. And also you’ll earn a free $5 reward card after your first week. Equally, the well-known Nielsen company rewards you for sharing web utilization behaviors. Merely obtain their app to your whole gadgets.

Hire Your Bandwidth

A brand new app known as Honeygain has been building so much “buzz” these days. In accordance with the positioning, you’ll be able to earn as much as $30 a month if you share “your unused web site visitors with knowledge scientists.” (Figures primarily based on sharing 10 GB a day, which is a crap-ton of information!)  After you put in the app (obtainable on Home windows, MacOS, and Android), join it to the Web, and earn rewards passively. On common, it takes customers 48 days to succeed in $20. Get a $5 bonus to start. Earlier than you get began although, be sure you’re really on a vast plan because it seems like this might chew by means of a number of bandwidth in hurry!

After you put in the app (obtainable on Home windows, MacOS, and Android), join it to the Web, and earn rewards passively. On common, it takes customers 48 days to succeed in $20. Get a $5 bonus to start. Earlier than you get began although, be sure you’re really on a vast plan because it seems like this might chew by means of a number of bandwidth in hurry!

Flip Your Automobile Right into a Cellular Billboard

In the event you don’t care what your car appears to be like like, signal as much as have your car lined with a wrapped commercial with a service like Wrapify. The cash you earn with Wrapify relies on how far you drive. Commuters in in style areas can earn up over $100 per week. Obtain the app and as you drive, Wrapify passively tracks your mileage.

Reverse Passive Earnings Concepts

My remaining technique for producing passive earnings is to truly avoid wasting cash as an alternative. Your private profitability is the unfold between what you make and what you spend, so you’ll be able to find yourself with more money on the finish of the month by slicing bills. Itemize out your bills and see what alternatives you might need, particularly to trim recurring month-to-month charges. However, there’s a motive I are likely to give attention to the earnings producing side of issues. There’s a restrict to how a lot it can save you, however your incomes potential is limitless. I shared a number of of my favourite “reverse passive earnings” concepts above, together with Credit Card Rewards and Pei, however when you’ve already tackled these, listed below are a number of extra to think about.

Minimize Your Automobile Insurance coverage Prices

Can I let you know the soiled secret of the car insurance coverage business? Your car is value much less yearly due to depreciation, however you retain paying the identical quantity to insure it. If it’s been greater than 2 years because you final shopped for car insurance coverage, you’re paying an excessive amount of. Take a look at Gabi for a fast and painless comparability on car and residential insurance coverage. It’ll take only a few minutes and customers report saving a mean of $961 per 12 months!

Skip the Fitness center

Regardless that my health club membership was lower than $20 a month, it’s cash I now take into account reverse passive earnings since I began out simply understanding at house. I additionally save the drive time and fuel too.

Dosh

Dosh is a cool app that means that you can earn further money again for purchases you make at many retailers and eating places. For instance, listed below are the provides I discovered close by:  How this one works is you simply download the app and connect your card. Then, store as you usually would after which earn cash by buying at shops it’s possible you’ll already frequent. You’ll discover that many native eating places are connected to Dosh, not simply giant chain eating places. Switch your earnings to a checking account, PayPal or donate it to a charity. The common cashback rate with Dosh is 2.5%, however some are as high as 10%. In the event you’re going to be consuming or buying there already, it is a tremendous passive method to save cash.

How this one works is you simply download the app and connect your card. Then, store as you usually would after which earn cash by buying at shops it’s possible you’ll already frequent. You’ll discover that many native eating places are connected to Dosh, not simply giant chain eating places. Switch your earnings to a checking account, PayPal or donate it to a charity. The common cashback rate with Dosh is 2.5%, however some are as high as 10%. In the event you’re going to be consuming or buying there already, it is a tremendous passive method to save cash.

Begin a Dropshipping Retailer

Dropshipping is among the most worthwhile passive earnings sources you’ll discover on-line. And since we right here at Oberlo focus on dropshipping, it’s a good place to begin. With dropshipping, you’ll be able to find trending products on the Oberlo market you could then promote on-line to clients around the globe. You’ll be able to promote products in numerous dropshipping niches from vogue to house decor to magnificence. The magic in dropshipping is that you simply build your own business and control how a lot you charge for the products. In reality, out of all of the passive earnings concepts on the checklist, dropshipping is the one the place you have got probably the most control over your earnings. To begin dropshipping at the moment, you’ll be able to sign up for Shopify. When you create a web based retailer, you’ll be able to sign up to Oberlo to find high-quality products to sell.

Run a Blog

The most well-liked passive earnings stream tends to come back from running a blog. Running a blog has helped numerous entrepreneurs earn passively by means of affiliate hyperlinks, programs, sponsored posts, products, e book offers, and extra. It’s true that it may possibly take fairly a little bit of upfront work to build a successful blog. However, it’s probably the most sustainable methods to generate an viewers by means of natural and social site visitors or by building an email list. The largest perk of making a weblog is you could flip that one asset into a number of different streams of income. So for those who’re on the lookout for an easy passive earnings concept, running a blog could be the right choice for you . Desirae Odjick,

Founding father of Half Banked, explains: “I began my weblog to make speaking about private finance extra approachable, and as a part of that, I are likely to share a number of private tales. They usually included shout-outs to the tools that I used to be utilizing and located useful, so it was a pure transition so as to add affiliate hyperlinks as I joined these firms’ programs. Now that I’ve been overlaying private finance for nearly 4 years on my weblog, these hyperlinks reliably usher in 4 figures each month as individuals uncover my articles and begin to get their funds so as – and I really feel incredible recommending them, as a result of I do personally use all of my affiliate products. It’s a good way so as to add passive earnings to your online business, particularly for those who don’t have passive products of your individual to promote (…but!)”

Create a Course

Promoting on-line programs is among the best passive earnings concepts of 2021. That’s as a result of we’re nonetheless seeing huge gross sales development for course creators. Whether or not you determine to promote a course by yourself web site or on a platform like Udemy, you’ll discover clients who need to be taught your insider suggestions and methods. In the event you’ve adopted tip quantity two and built your individual viewers, promoting your course in your web site will help you control how a lot passive earnings you earn. Discovering your clients is as much as you. That might be a bit simpler for those who promote on target platforms like Udemy, however your course could also be closely discounted throughout sure durations. It will have an effect on how a lot passive earnings you earn. Sumit Bansal, Founding father of Trump Excel: “I began a weblog about Excel Spreadsheets in 2013.

I did it as I used to be studying so much about spreadsheets and thought it will be a good approach to share my information with others. It slowly began getting traction in two years, it was getting 100K+ pageviews a month. I made a decision to create a web based course and see if it will fly, and it did. I made good side earnings for a number of months after which determined to do that full-time and launch extra programs. Since then, the weblog has grown so much and I’ve been featured on many distinguished websites and publications reminiscent of Problogger, YourStory, GlassDoor, CEO Journal, and so on.”

Instagram Sponsored Posts

In the event you love Instagram as a lot as I do, you would possibly need to flip your scrolling time into posting time that can assist you skyrocket your passive earnings. The best factor about Instagram is you could actually create fan pages for completely something. Whether or not you’re keen on journey, vogue, magnificence, house decor, or one thing actually peculiar like outrageous canine grooming… … you’ll discover a dedicated viewers. The key to getting a ton of Instagram followers is to be tremendous in line with the type of content material you post. So you’ll want to stick to 1 area of interest in order that individuals who observe you’ll be able to rely on you to deliver extra content material identical to that.

In your Instagram bio, you’ll want to add your e mail tackle. As your account begins to develop, so will sponsored posts requests, permitting you to make money on Instagram. The extra Instagram engagement your posts get, the extra individuals will attain out to you so you’ll want to create participating content material.

Create a Print on Demand On-line Retailer

With ecommerce being probably the most in style methods to make passive earnings on-line, it only is sensible to provide a shout-out to print on demand. Print on demand means that you can promote your customized graphics on products like t-shirts, clothes, mugs, canvases, cellphone instances, luggage, and extra. The best factor about that is you could build your own branded products. Need to begin your individual Print On Demand enterprise? Join a free trial of Shopify and build your dream retailer. At present’s the day.

CREATE YOUR POD BUSINESS The only draw back is that it’s essential be savvy at graphic design as a result of the margins are sometimes too skinny to outsource the designs affordably. However, for those who create that distinctive successful design, your gross sales will take off. Plus, it won’t damage gross sales because you won’t be competing with anybody however your self. Do not hesitate to begin immediately with Shopify! How worthwhile is print on demand?

Discover out the reply in our collaboration with Wholesale Ted, the place we evaluate dropshipping with print on demand. Veronica Wong, founding father of Boba Love, shares how her love of bubble tea helped her earn passive earnings: “I’ve been ingesting bubble tea for as long as I can bear in mind, so combining my love for boba with my love for design appeared like an ideal match. I began designing and promoting bubble tea attire and equipment final 12 months and the journey has been unbelievable. With Printful dealing with the manufacturing, achievement and transport, I can give attention to advertising and marketing and building my model. I’ve connected with boba lovers all around the world and lately reached 10k followers on Instagram. I’m simply beginning my journey to incomes extra passive earnings, however Shopify and Printful make it very easy and I’m very optimistic!”

Create an App

We would only be on the sixth passive earnings concept on this checklist, however you most likely seen a pattern: Creating stuff tends to result in passive earnings. In the event you’re a developer or programmer, you would possibly need to attempt creating apps as a passive earnings stream. You’ll be able to go about it in two methods. First, you’ll be able to charge a price for individuals who need to purchase your app.

Second, you’ll be able to make your app free and monetize with advertisements. My fiance did this a number of years in the past and nonetheless makes a side earnings from his app to today. He purchased code from CodeCanyon. Then, he used a tool known as Eclipse and put in the Android Development SDK to make modifications to the code to create his personal distinctive app. You’ll be able to monetize your app in a variety of methods, together with operating in-app promoting, providing paywalled content material, and charging for premium features.

While you have a look at the world’s richest individuals, it’s fairly secure to say that shares have performed a giant position of their deep, countless financial institution accounts. Whereas the act of investing in shares is fairly passive, the analysis that goes into it’s lively. Warren Buffett reads 500 pages a day, however he’s not studying your common thriller e book. Nope. He reads enterprise’ annual reports. By studying annual experiences every day, he higher understands whether or not or not a enterprise is performing well, which helps him enhance his potential to put money into shares. \Inventory investments will help you earn passive earnings that stretches far past what your worth at your 9 to five job is value. So, take into account this passive earnings concept for those who like studying concerning the efficiency of varied companies.

Purchase Property

Relying on the place you purchase and when, actual property could be a good approach to make passive earnings. In in style cities like Toronto, there was a gentle enhance in property worth – 9.36% throughout 2020, the best development in Canada since 2016. By shopping for pre-construction condos, it’s possible you’ll discover some decrease price properties that’ll enhance in worth by the point it’s lastly built, permitting you to promote the property as soon as it’s full for a revenue.

As with all investments, it may be dangerous, so it’s best to talk with an actual property agent for those who’re new to the game that can assist you purchase the correct funding property. Shawn Breyer, Proprietor of Breyer Home Buyers, shares: “My girlfriend, now spouse, graduated regulation faculty with $173,000 of college debt and we set the length of the mortgage to be paid over 15 years, which made our month-to-month funds come out to be $1,459 per thirty days in funds.

We needed to make use of rental property money circulate to cowl our month-to-month regulation faculty debt. Our first choice was to purchase a duplex and live on one side whereas we rented out the opposite side. This alone saved us the $1,350 in housing bills that we had prior to purchasing the duplex. As an alternative of allocating that cash in the direction of further principal funds on the college debt, we saved that cash and acquired one other duplex two years later.

This acquisition added $650 in month-to-month money circulate, which we snowballed into a 3rd property. The three properties supplied us with an additional $2,500 per thirty days in financial savings and earnings that we had been in a position to then put in the direction of further principal funds. The great thing about this method is that our tenants are paying down our regulation faculty debt and if we had been to lose our jobs or have a medical emergency, then we will rely solely on the rental earnings to pay for the college debt for us.”

Host Airbnb

In the event you adopted step quantity eight, you’ll be able to select to checklist your rental or house to rent on Airbnb. What’s attention-grabbing is that you simply don’t really want to purchase a brand new property to make Airbnb passive earnings. You may as well hire a room in your present house or residence when you’ve got a spare room. Additionally, Airbnb has lately expanded into “Airbnb Experiences,” which let you host occasions, meetups, and excursions in your metropolis. You’ll be able to select to deal with it as a side hustle as well, although it won’t be passive earnings. Martin Dasko, Founding father of Studenomics, makes passive earnings renting his rental on Airbnb.

He explains, “I made a decision to provide Airbnb a shot after I stayed in a single on a go to to NYC. I cherished the idea and needed to get in on it. I put my rental up for hire and was shocked by the demand. I used to be in a position to charge $169/night time (in downtown Toronto). My greatest win got here when a company contacted me as a result of they had been sending a number of workers to Toronto. They booked the unit for your complete month. I didn’t have to fret about discovering new friends. The great thing about Airbnb is you could flip it on and off as you please. While you’re seeking to make some further money, you’ll be able to put your home up for hire. You may as well hire out that spare bed room.”

Build your Personal Web site

Building your own website could be a dependable supply of passive earnings. Some of us create advertising and marketing companies and outsource the work to freelancers. Others, like a pair entrepreneurs on this checklist, create on-line programs to share their information and educate others. You may as well promote products – digital or bodily – on-line. New to on-line promoting? Listed below are some concepts for what to sell on the internet. However, by building your individual web site, you acquire extra control over what you promote and the way a lot cash you make. It’s one of many best newbie passive earnings concepts as there are a selection of tools that can assist you create an internet site (no coding required).

You’ll be able to then spruce it up by including a theme, brand, and different UI components. In the end, your success lies in your arms, enabling you to take your model wherever you need it to go. Software program engineer and Flipped Coding Proprietor Milecia McGregor earns passive earnings by serving to individuals develop into internet builders. She shares, “I’ve a web based class that folks pay for each month and so they be taught all of the front-end improvement languages and I add new materials each month. My greatest win with this class to this point was when one in all my college students obtained their first internet developer job. They got here again and thanked me a lot that it gave me a happiness I hadn’t skilled earlier than. I’m planning to get 200 college students in my class this 12 months and assist all of them get that first paying gig.”

Affiliate Advertising

Affiliate marketing is among the best passive earnings alternatives obtainable at the moment. The upside to it’s that nearly each massive model has an affiliate program so you’ll be able to promote some fairly in style products and rake within the dough. The only actual draw back is that you simply only make a fee of the sale. Some programs like Shopify’s affiliate program will let you earn as much as $58 per referral, which is a good earnings. Different on-line firms only give a measly $5-$10 in referral bonus. So, you’ll need to be sure you perform some research into the best affiliate advertising and marketing programs earlier than you get began.

Running a blog tends to be probably the most cost-effective approach to make recurring affiliate commissions without having to spend cash on advertisements. Sireesha Narumanchi, Founding father of Crowdworknews.com, shares, “I began my side hustle as a blogger somewhat over two years in the past and this has been probably the most unbelievable journey to this point. As a content material creator, most of my earnings is from associates and it’s completely passive. It wasn’t easy to juggle my job and enterprise but it surely was completely value it. I do put in a number of hours researching, crafting, and dealing on enterprise methods, however as soon as my content material is finished, it generates earnings passively repeatedly. The immense pleasure of serving to individuals and exhibiting them that there’s a choice of working from house and incomes a good earnings is my trophy on the finish of the day.”

Promote your Movies

In the event you all the time end up within the midst of drama and pleasure, you would possibly need to pull out your cellphone and hit document. Doing that may assist you to make some passive earnings. The newest video marketing stats point out that individuals are obsessed with video content material, so that you should be capable to discover an viewers on your movies. Why? As a result of you’ll be able to sell that video to a information website.

And if the video takes off, you can also make some recurring cash for weeks, months, and generally even years. After all, the simplest approach to get in on the motion is to be at public occasions reminiscent of protests, demonstrations, and festivals. Wherever there’s controversy, you’ll discover alternatives on your content material to be bought. And for those who’re good at producing entertaining content material, firms pays you to create viral movies together with providing a share on overall earnings.

Peter Kock, Proprietor of Seller at Heart, shares how he made passive earnings importing movies to in style web sites: “I uploaded a number of movies to Newsflare and Rumble. When my content material will get purchased, 50% of all income generated will get wired to my private account. My movies had been featured on MSN, AOL, Yahoo, Each day Mail, The Guardian, and so on. With Newsflare, I remodeled $4,000 to this point and nonetheless I’m getting royalties for movies uploaded a number of years in the past.”

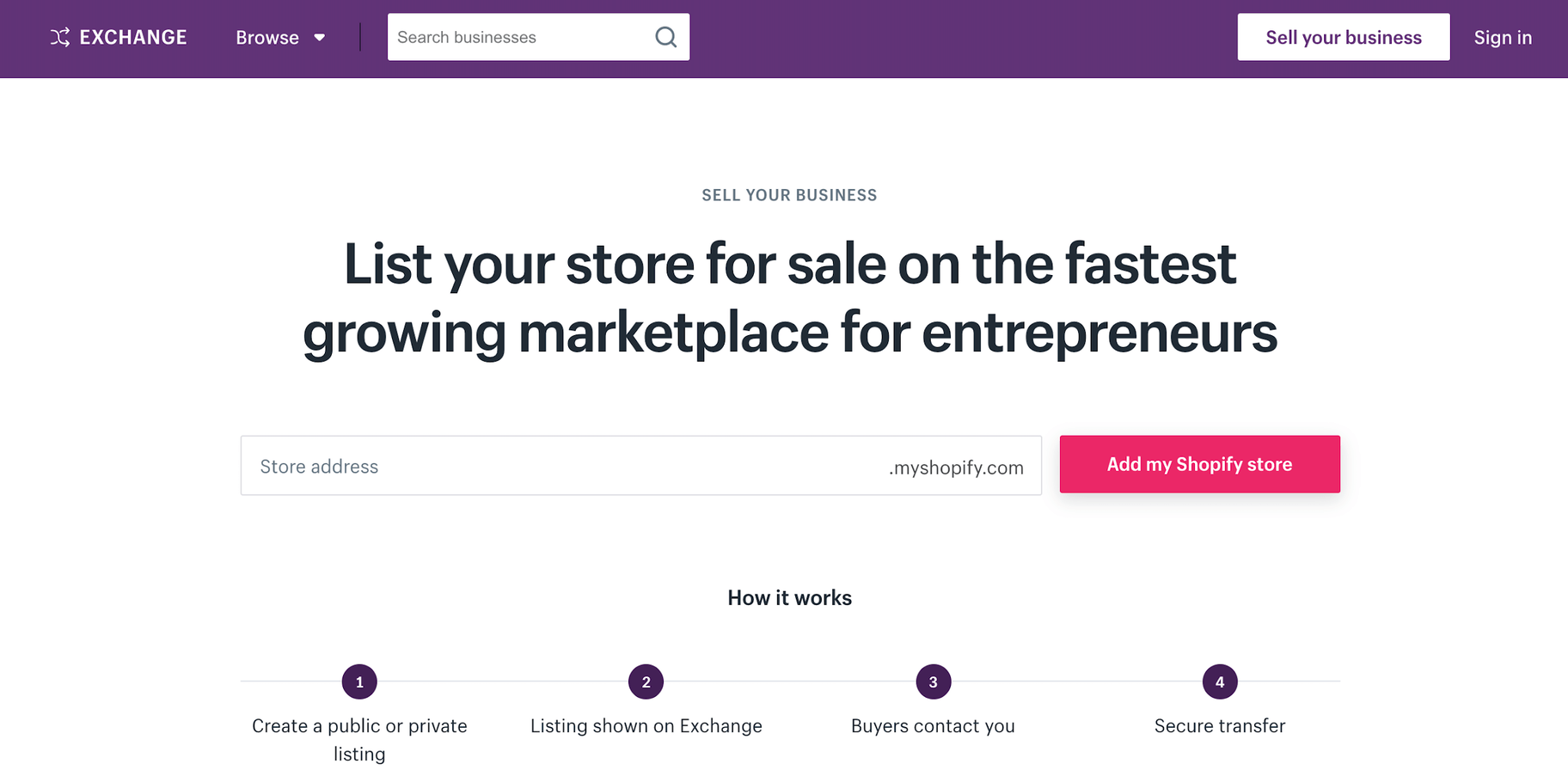

Flip Web sites

Do you’re keen on building web sites and on-line shops? If that’s the case, you possibly can make passive earnings promoting them. You’ll possible have to get your first few sales (to show that your retailer is superior). However for those who’ve obtained nice design expertise and build out a few of the content material in your web site, you possibly can discover somebody who’d be keen to purchase your retailer. In the event you’re on the lookout for a spot to promote your web site, you possibly can check out Shopify’s Exchange Marketplace. On the platform, you’ll be able to promote your newly built on-line retailer or your superior six- or seven-figure retailer. It’s the right platform for website flipping.

Yup, your 9 to 5 job can even develop into a passive earnings stream. No, it’s not the hours you’re employed. However, your company shares or any company-matching retirement plans will help you rating some fairly first rate passive earnings. I really used this passive earnings technique to pay for the downpayment on my rental. And it only took two years. After all, you’ll possible want to take a position a few of your individual cash too, however the further bit that the company provides in is a pleasant perk for those who’re keen to attempt it. (And belief me, few individuals ever do.) In the event you’re beginning a brand new 9 to five job, you’ll want to ask for company stocks as a part of your hiring bundle. You’ll thank me later.

Create YouTube Movies

YouTube is the passive earnings stream that simply retains on giving. From sponsored movies to advert income, you’ll discover you could make recurring earnings out of your YouTube channel. The key to making a profitable YouTube channel is creating content material on a constant schedule for a long time. That’s it. In the event you keep it up for the long haul, you’ll ultimately begin reaping the passive earnings rewards. Have already got a YouTube channel? Take a look at our article, How to Make Money From YouTube, for concepts on how you can monetize your video content material.

Matthew Ross, the Co-Proprietor and COO of RIZKNOWS and The Slumber Yard, began his passive earnings journey on YouTube: “Again in 2013, my enterprise associate and I had been extraordinarily enthusiastic about wearable know-how (Garmin watches, Fitbit exercise trackers, and so on.) and determined to begin a YouTube channel that will review some of these products. We actually simply loved testing out the watches and thought we may earn somewhat promoting cash on the side. In whole, we invested about $5,000 creating the channel and buying the products to review. However, round that point, the wearable know-how class exploded and we began making extra money than we ever imagined.

Evidently, I managed to show my hobby into a business. We’ve been in a position to develop top line income to over $2.5 million {dollars}, we’ve employed ten full-time workers, and we lately moved the company’s headquarters to a brand new state-of-the-art 7,000 sq. ft workplace in Reno, Nevada. At present, our web sites and YouTube channels entice over 4 million guests per thirty days mixed.”

Promote your Pictures

Whereas being a photographer could look like an lively earnings enterprise, it’s really not. Photographers don’t only earn money from taking pictures. They promote them too. Stock image sites, magazines, and canvas printing on your purchasers are a few of the methods you can also make the massive bucks within the pictures biz. All you want is a good camera to get began. However today, you’ll be able to even use your phone to take photos and promote them to make passive earnings You possibly can even take high-quality product pictures and market them to ecommerce companies.

All you want is a good product photography course, a smartphone, and a few inspiration to get going. Jacob Hakobyan makes passive earnings together with his pictures enterprise Shotlife Studio. He shares, “Having profound enterprise training and what some could take into account as very secure workplace jobs, we felt that we had the potential to do extra. Not financially, however spiritually. As a brother-sister-husband trio, we began Shotlife Studio just because all of us had a standard love for pictures, and there was an added thrill of main a enterprise of our personal. With our CPA information coming to assist, we ready a transparent technique on the expansion of the enterprise and managed to double our earnings from 12 months to 12 months, reaching a five-figure side earnings.“

Assist Companies Usher in Shoppers

Are you a savvy marketer or salesperson? If that’s the case, there are tons of companies who will pay you referral fees for bringing them extra enterprise. Actual property brokers are all the time seeking to assist extra individuals discover a house they love. Freelancers, DJs, photographers, and different solopreneurs will usually be keen to pay a referral bonus for locating them a shopper that indicators a contract. So for those who love serving to individuals earn money, you can begin building passive earnings by means of your connections. All it takes is a few emails or messages and you possibly can earn passive earnings for little or no effort.

Write an eBook

Ebooks exploded onto the scene in 2009 and 2010 and are nonetheless a massively in style content material medium. Regardless that they first turned in style a number of years in the past, there’s nonetheless a fairly good chunk of people that make passive earnings from writing ebooks to today. Certain, it’s an insanely aggressive market. But when your writing chops are stellar, you possibly can end up with a good slice of the earnings. By creating how-to ebooks on in style niches and marketing them, you possibly can build a fanbase of loyal readers.

Allie McCormick makes passive earnings by creating ebooks. She explains, “In 2016, after I was pregnant with my son, I began an Amazon Kindle Publishing side hustle to hopefully earn simply $500/month by the point he was born so I may keep away from going again to the workplace. Whereas I didn’t give up working instantly, 18 months later I had a six-figure passive earnings enterprise that enabled me to take action. Greatest win? This enterprise nonetheless runs totally on auto-pilot to today. I work on it 1-2 hours weekly and take 3-4 weeks off at a time whereas nonetheless raking within the dough!”

Promote your Stuff

Seeking to observe Marie Kondo’s recommendation and begin decluttering your private home? Properly, you would possibly need to flip that litter into chilly, onerous money. All of us have these piles of packing containers stuffed with stuff we haven’t thought of in years. You’ll be able to both maintain onto the stuff for an opportunity to finish up on an episode of Hoarders or you’ll be able to sell it online that can assist you make passive earnings. You might need to dig deep, however you will see that you’ve got some objects which are value some severe money. So for those who don’t know the place to begin with regards to passive earnings, your closet could be your best wager.

Nicholas Christensen, Founding father of Lottery Critic, shares how he makes passive earnings promoting members of the family’ stuff: “I’m the ‘eBay whisperer.’ It began off with me volunteering to declutter my aged aunt’s home. Over 60 years of stuff needed to be sorted, dumped, donated or bought. I discovered a field with an enormous doll inside. She turned out to be an vintage Shirley Temple doll in pristine condition (needed to Google it). I did my analysis, bought it on Ebay and break up the proceeds with my cousin. Phrase obtained out to different members of the family and I had a pleasant side gig. It’s nonetheless ‘work’ and the additional money is sweet.”

Promote Digital Merchandise

In the event you’re seeking to create your individual products as an alternative of promoting another person’s, you’ll be able to create digital products. You’ll be able to create a Shopify store to promote your digital products on-line. Digital products can embrace ebooks, on-line programs, PDFs, customized graphic designs, inventory pictures, or different digital items. Promoting these products is the epitome of passive earnings, as your complete course of might be automated on Shopify with prompt downloads. Kelan and Brittany Kline, the duo behind The Saavy Couple, tells us, “Final month we launched a Shopify retailer with a number of digital products to promote to our readers.