Payroll Software for Independent Contractors – Introduction

Specialized software is necessary to meet the unique payroll needs of independent contractors, sometimes referred to as 1099 employees. These workers are not considered traditional employees and must fulfill their tax duties and other financial responsibilities independently. The purpose of independent contractor payroll software is to assist in managing these obligations while complying with state and federal laws. Our article will outline the top seven options for this type of specialized software solution.

How Does A Payroll Service Work?

Most online payroll services function similarly, despite having unique designs and diverse features. They usually consist of a cloud-based portal that caters to both employers and employees. The employer or their designated personnel – such as an accountant, bookkeeper, or HR employee – will arrange benefits and salaries for workers on the platform (including contractors in some cases).

By using the employee portal to facilitate self-onboarding, once you have recruited a new team member, you can conveniently obtain their W-4 or W-9 form as well as contact details and allow them to enroll in appropriate benefits.

Automated payroll is an option provided by certain payroll services that enables setting of worker pay and tracking of employee time (if required). The service ensures timely processing of the company’s payroll. Workers can provide their direct deposit information through these services, while on the employer end a business bank account may be linked to eliminate manual printing and delivery of checks during transactions.

In the absence of payroll automation, one must manually process it by entering worker pay amounts and scheduling paydays a few days before payday.

Online payroll services often come equipped with tools that make administering benefits easier, as well as seamless integration with accounting software. Additionally, these services frequently provide workers the choice to receive a payment card for receiving funds ahead of payday and utilizing it directly in purchases.

9 Best Payroll Software for Independent Contractors

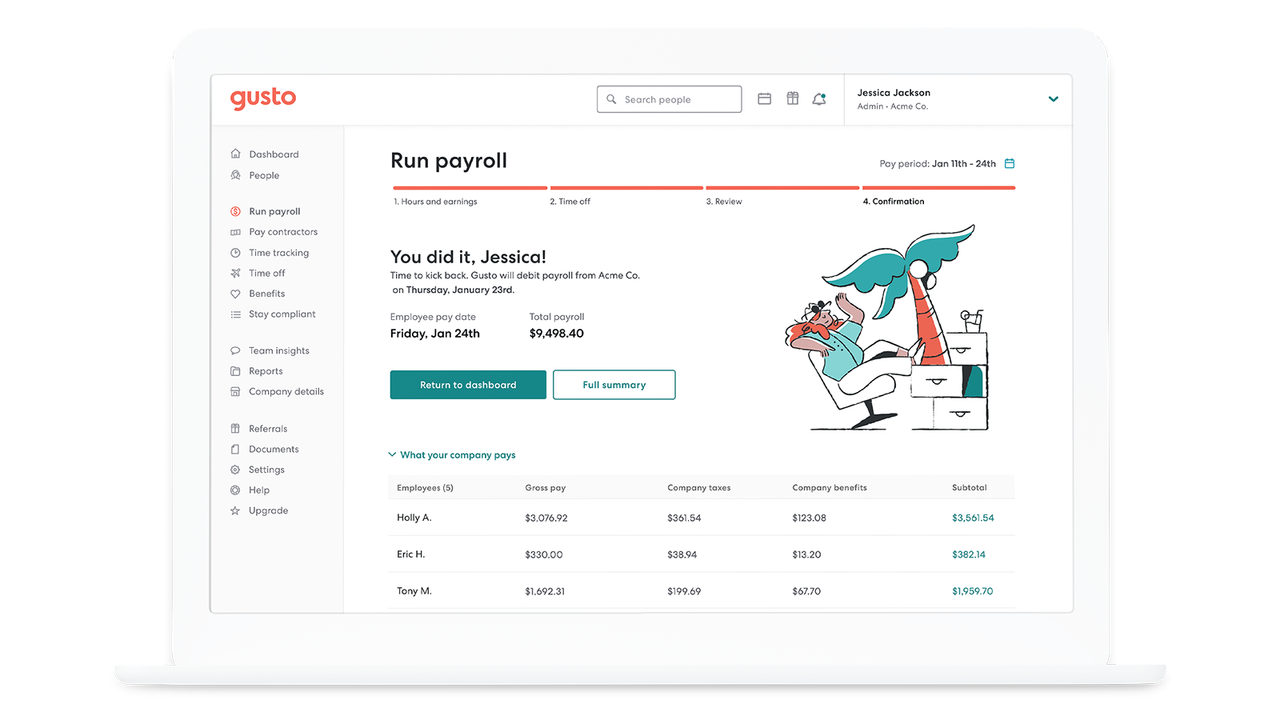

1. Gusto

Gusto is a payroll platform specifically designed to cater for small businesses and freelance workers by providing them with an array of tools meant to simplify managing their payrolls.

Gusto’s Features:

Gusto eliminates the need for independent contractors to perform manual tax computations by automating tax calculations. This guarantees precision and adherence to tax regulations.

Gusto enables independent contractors to streamline payroll processing by offering direct deposit payments for their employees, ensuring efficiency and convenience.

Gusto streamlines the onboarding process through its Employee Self-Onboarding feature, enabling personnel to input personal information directly into the system. This functionality not only saves time but also guarantees accurate data collection.

Gusto offers an easily navigable interface that caters to freelancers with diverse technical backgrounds. Its user-friendly layout simplifies payroll management and promotes usability through its intuitive design.

Gusto’s multi-state and local tax processing feature enables contractors to operate smoothly across various geographic regions, ensuring compliance with diverse tax requirements.

Gusto has a seamless integration with well-known accounting software, which boosts financial management efficiency for independent contractors. The correlation between payroll and accounting systems is made possible by this incredible integration, allowing effortless data transfer and reconciliation.

Gusto presents a full and easy-to-use answer for self-employed individuals who desire to simplify payroll procedures. By automatically computing taxes, offering direct deposit options, providing employee onboarding tools, accommodating multi-state taxation requirements and integrating with accounting software – Gusto optimizes payroll management so that contractors can concentrate further on developing their business.

2. Quickbooks

3. Wave

Designed specifically to cater to the distinctive requirements of small businesses and independent contractors, Wave is a comprehensive payroll solution. Its feature-loaded application boasts an intuitive interface that simplifies payroll management for freelancers and self-employed individuals alike.

Wave’s Features:

Streamlining tax calculations is made easy with Wave’s Automatic Tax Calculations. With this feature, accuracy and compliance with tax regulations are guaranteed while reducing the risk of manual errors. It also saves time by easing the burden brought about by computing taxes manually.

Wave’s direct deposit feature makes it easy and secure for independent contractors to receive payments straight into their bank accounts, removing the requirement of physical checks and providing a hassle-free payment process.

Through Wave’s Employee Self-Onboarding, contractors can independently input their personal and tax details into the system. This allows for efficient and precise data entry, thereby keeping employee information current while promoting empowerment in the process.

Wave’s cost-effectiveness is its most noteworthy advantage. With no subscription fees or hidden costs, this free payroll software provides comprehensive payroll management capabilities which makes it an ideal option for independent contractors who are particular about operating within budget constraints.

Wave offers freelance workers a dependable and streamlined payroll system tailored to their unique requirements. By offering automated tax computation, direct deposit capabilities, and self-enrollment for employees, Wave eases the management of payrolls while being affordable and easily accessible.

4. Justworks

Justworks offers a unique blend of product and service, integrating HR software tools with the support of professional employer organization (PEO). Enterprises can benefit from access to an uncomplicated yet dynamic human resources information system (HRIS) as well as guidance from expert HR professionals. This partnership helps minimize compliance risk and eliminates repetitive administrative tasks.

Justworks provides companies with fast access to essential HR functions, such as payroll, benefits and workforce management straight from the homepage. On top of this, businesses can use Justworks’ payment center for processing expense reimbursements and organizing off-cycle payroll runs for contractors or vendors. Integration options include integrating QuickBooks or Xero data migrations allowing simplified labor cost tracking and smooth audit processes when it comes to managing payments.

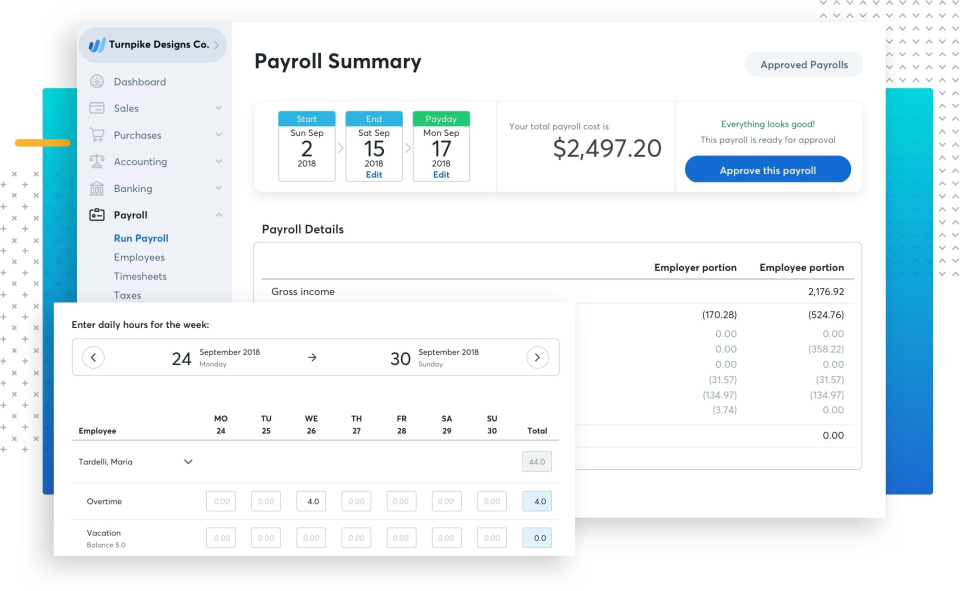

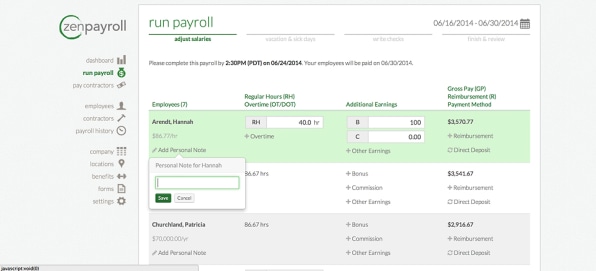

5. Zenpayroll

Designed for small enterprises, including self-employed professionals, ZenPayroll simplifies payroll administration with its user-friendly platform and extensive functions. The software operates on the cloud to provide optimal convenience.

Top Features offered by ZenPayroll

ZenPayroll streamlines tax calculations by automating the process, promoting accuracy and compliance with relevant regulations. This function eliminates reliance on manual calculation methods, saving users time while minimizing risks of errors.

ZenPayroll enables independent contractors to receive their payments directly into their bank accounts through the efficient and convenient option of direct deposit, thereby enhancing convenience while also increasing efficiency.

With ZenPayroll’s employee self-onboarding capabilities, independent contractors can enter their personal and tax information into the system without assistance. This feature helps to enhance data management precision and streamline processes for increased efficiency.

ZenPayroll’s exceptional ability to manage multiple state and local taxes is noteworthy. It proves especially advantageous for enterprises that operate in various states or regions, as it guarantees adherence with diverse tax laws.

ZenPayroll integrates smoothly with widely used accounting program QuickBooks, efficiently streamlining financial procedures by synchronizing payroll data alongside accounting records for an improved accuracy and efficiency.

ZenPayroll offers freelancers a dependable payroll system complete with crucial functionalities like automated tax computations, direct deposit and self-enrollment for employees. Its proficiency in managing numerous regional taxes while also integrating effortlessly with bookkeeping software makes it an indispensable asset to small enterprises looking to streamline their payroll management.

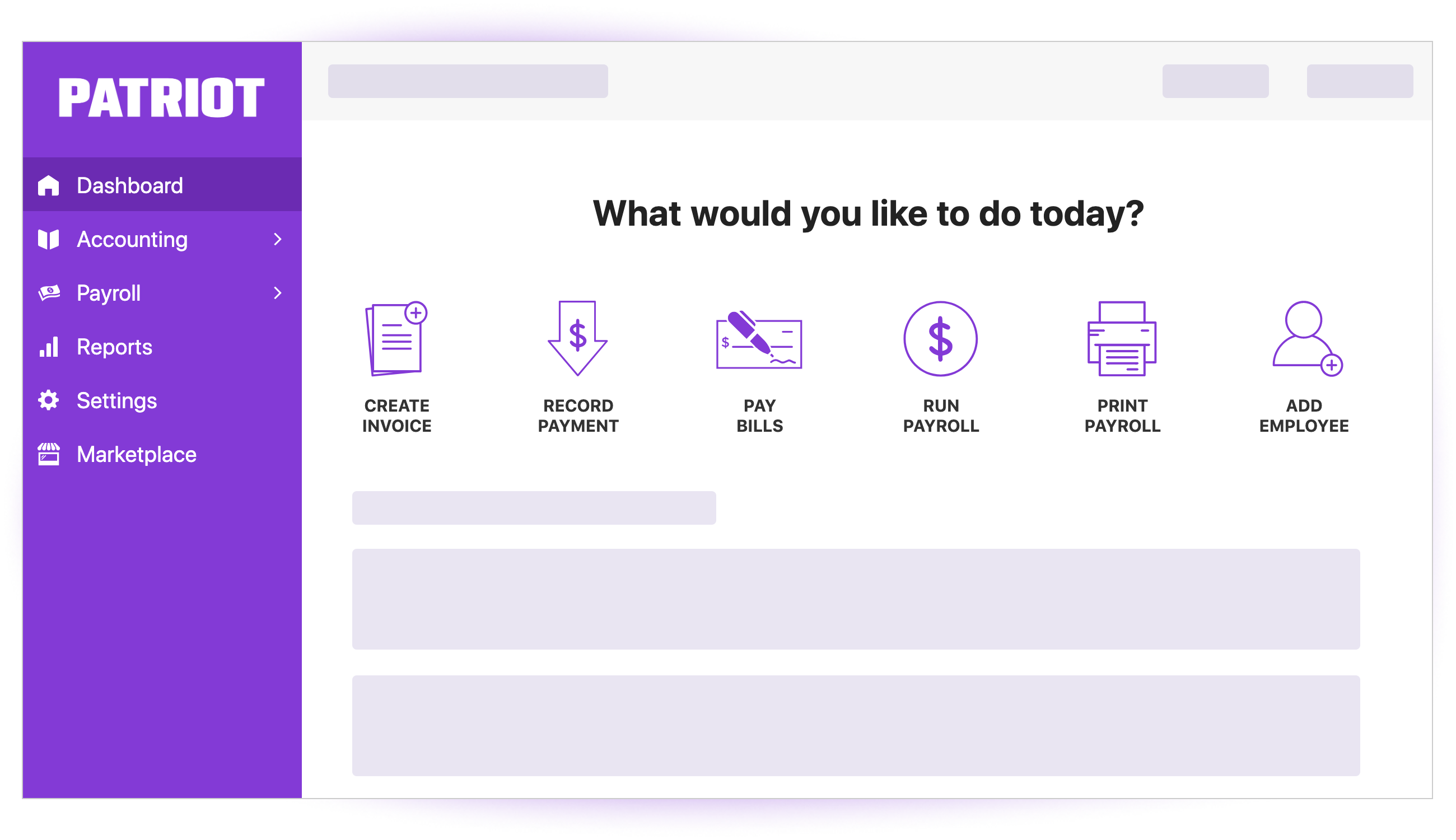

6. Patriot Software

The full-featured payroll solution provided by Patriot Software is designed to simplify the management of payroll for small businesses and self-employed professionals. It offers several helpful features aimed at streamlining this process.

Patriot Software Features:

Patriot Software facilitates direct deposit, which provides independent contractors with an easy and secure way to receive their payments directly in their bank accounts.

Patriot Software streamlines tax filings through automation, making it easier to comply with tax regulations. This feature saves time and minimizes the chance of mistakes that come with manual filing processes.

Patriot Software has a feature wherein employees can self-onboard, enabling them to input their personal and tax details into the system unaided. Such functionality fosters data management efficiency and precision.

Patriot Software has the ability to manage various state and local taxes, guaranteeing adherence with different tax laws. This feature proves highly beneficial for enterprises operating across multiple states or areas.

Patriot Software offers a seamless integration with well-known accounting software like QuickBooks, which enhances the efficiency and accuracy of financial processes by syncing payroll data with accounting records.

Patriot Software offers a comprehensive payroll solution that caters to independent contractors by providing crucial features like automated tax filings, direct deposit and employee self-onboarding. It effectively manages various state and local taxes in addition to integrating with accounting software thereby becoming an indispensable tool for small businesses seeking smooth payroll management.

7. Adp

Renowned for its payroll services, ADP offers tailored solutions to satisfy various payroll needs of independent contractors. Below are some notable advantages and characteristics of ADP’s services specifically designed for these professionals:

ADP enables direct deposit services for contractors, which streamlines payroll processing by providing an efficient system to distribute payments to their employees. This enhances convenience and expediency in the payment process.

ADP streamlines the tax compliance process for independent contractors through its automated tax filings feature, which facilitates accuracy and timeliness in fulfilling various tax-related obligations.

ADP facilitates employee self-onboarding, allowing contractors to simplify the onboarding process by enabling employees to input their data directly into the system. By doing so, this feature minimizes time and enhances data precision.

ADP has the ability to manage a variety of state and local taxes, allowing for efficient compliance with diverse tax regulations. This feature is particularly beneficial to contractors working across multiple geographical locations.

ADP offers a complete suite of services that go beyond just payroll solutions, encompassing human resources and benefits administration. For self-employed contractors looking for holistic support to manage their workforce requirements, these supplementary offerings can prove beneficial.

ADP provides a formidable range of payroll solutions tailored for freelancers that include direct deposit, automated tax filing systems, employee self-enrollment and multi-state tax management. Furthermore, its extensive list of services like HR and benefits administration make it an important tool for independent contractors in streamlining their payroll processes as well as managing workforce operations with ease.

8. Paychex

Paychex is a distinguished payroll services provider that offers an extensive array of solutions customized to suit the specific requirements of both independent contractors and small-scale entrepreneurs.

Paychex Features:

Paychex offers direct deposit as a payment option which allows independent contractors to receive their earnings conveniently and securely in their personal bank accounts.

Automated Tax Filing: By using Paychex, tax filings can be automated which streamlines the burdensome task of adhering to tax regulations. This component not only saves time but also mitigates any errors that could potentially occur during a manual taxing process.

Through its self-onboarding functionality, Paychex enables employees to independently enter their personal and tax information into the system. This feature enhances data management by streamlining processes and ensuring accuracy.

Paychex can manage multiple state and local taxes to guarantee adherence with diverse tax laws, providing a valuable advantage for enterprises that function across various states or areas.

Paychex provides a range of supplementary services such as human resources and benefits administration. These supplements enhance the payroll solutions to provide an all-inclusive set of instruments for managing diverse aspects related to workforce management.

Paychex offers comprehensive payroll solutions to support small business owners and independent contractors. Its feature-rich software includes direct deposit, automated tax filing, and employee self-onboarding options for efficient management of the workforce. The platform facilitates multi-state taxation compliance alongside critical services such as HR administration which enhances overall efficiency in organizations operations. Specifically created to cater towards 1099 employees’ needs; these tools make managing payments accessible while enjoying streamlined processes that ensure smooth day-to-day workflow without any hitches or delays experienced by businesses during their operation cycles with manual processing systems.. Overall Paychex continues to be an essential tool that consolidates all aspects of a company’s financial accounting suite into one intuitive program offering reliable results when it matters most – making work easier!

9. Deel

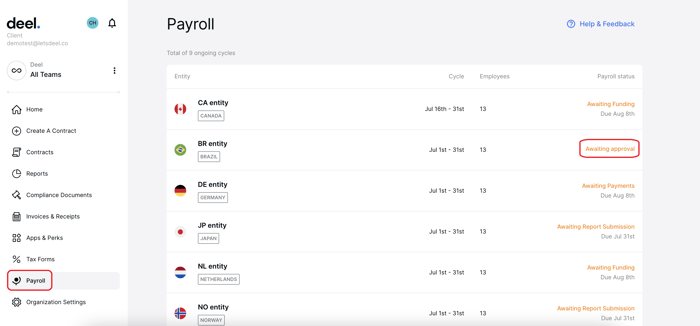

Deel started as a fix for international payment management concerning contractors, providing an efficient system that caters to global employers and contractors.

Deel’s global presence allows for seamless contractor hiring and payment operations across more than 150 countries. What sets the platform apart is its commitment to providing each company with a personalized customer service manager who can aid in essential areas such as onboarding, recruitment, and payroll compliance specific to every country. This unique feature provides significant assistance that benefits small businesses without dedicated HR teams by helping them navigate potential pitfalls effectively.

Deel streamlines the payment process for contractors by allowing them to access funds directly through its platform. With Deel, contractors can conveniently submit invoices and adjust time entries whenever it suits them. Additionally, this platform offers various payment methods such as ACH transfer, cryptocurrency, and pay cards that give contractors the freedom to select their preferred mode of receiving payments. By reducing administrative tasks significantly , these user-friendly options let contractor concentrate more on delivering exceptional services without any hassles or inconvenience in handling finances related matters efficiently with clients’ satisfaction at top priority.

How To Choose A Payroll Service

Top-tier payroll services offer essential features that streamline payroll processes and enhance efficiency, catering to various company sizes and payroll requirements. These crucial features distinguish payroll software from manual spreadsheet-based methods:

- Variety of Payment Methods: A robust payroll solution should offer diverse payment options, including paper checks, direct deposit, and prepaid debit cards, accommodating the preferences of employees.

- Payroll Tax Filing and Payment: Automation of tax preparation, filing, and payment based on employees’ locations is essential. This feature becomes even more critical for companies with employees in multiple U.S. states and international locations.

- Unlimited Payroll Runs: Flexibility is key, particularly for businesses with employees and contractors on different pay schedules. Unlimited payroll runs allow for seamless adjustments and timely payments.

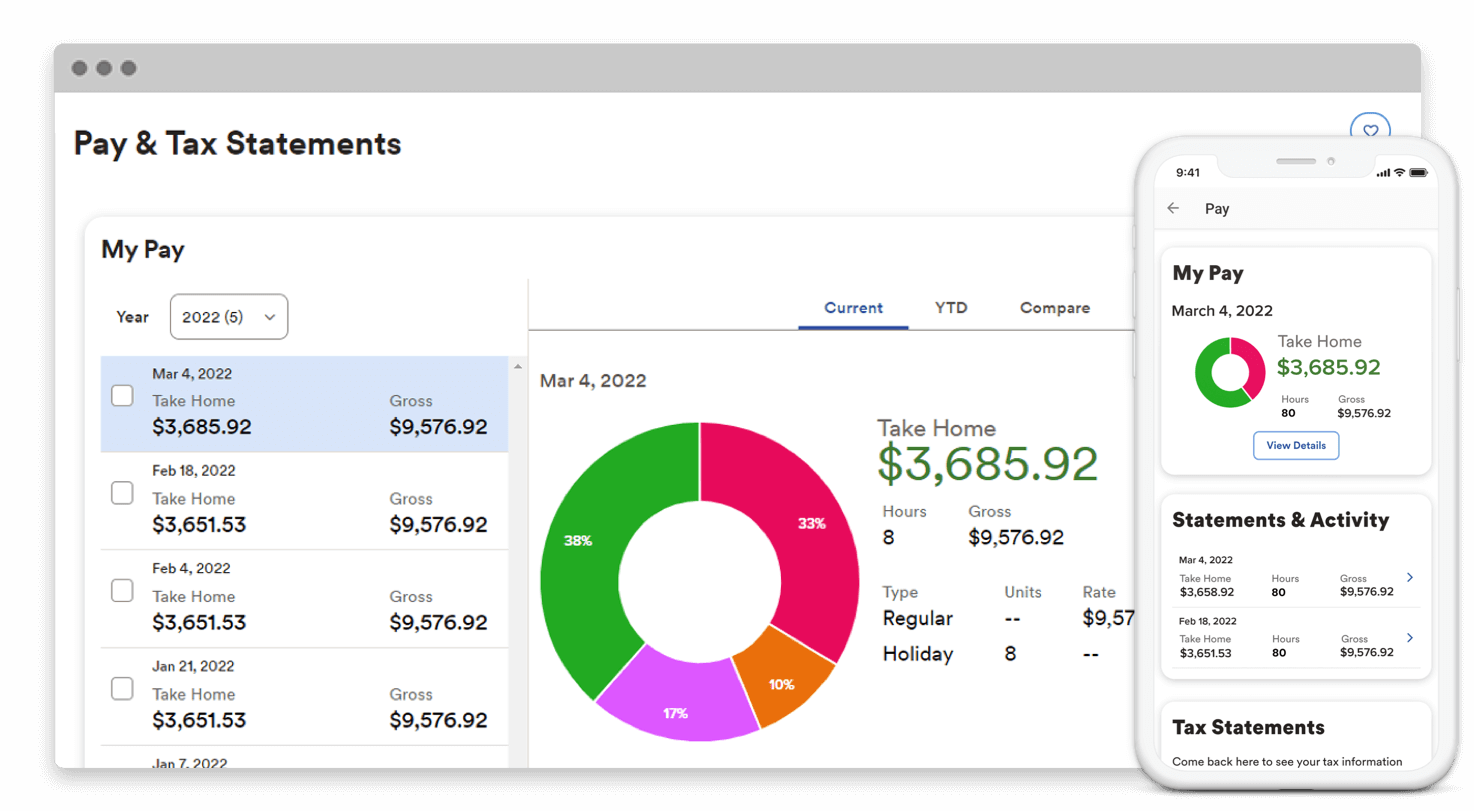

- Self-Service Portal: Accessible online portals empower HR staff, payroll administrators, and employees to view and sometimes modify payroll-related data, enhancing transparency and convenience.

- Basic Reporting: Payroll software generates essential reports on company-wide or individual levels, offering insights into metrics such as total compensation, deductions, and taxes paid within specific periods.

- Automatic Compliance Updates: Staying abreast of the latest payroll and tax regulations is crucial. Leading payroll software and services automatically update to ensure compliance, sparing users the need for manual tracking.

- Mobile Accessibility: Mobile access enables HR staff, payroll administrators, and employees to manage payroll tasks on the go. Employees should easily access pay history and pay stubs through the mobile app for enhanced convenience and transparency.

Benefits Of Using Payroll Software

Automated Tax Calculations: Payroll software for independent contractors can automatically calculate and withhold the appropriate taxes for each employee, reducing the risk of errors and saving time for the business owner.

- Direct Deposit

Most payroll software for independent contractors offers the option of direct deposit, which allows employees to receive their paychecks directly into their bank accounts. This can save time and money for both the business owner and the employees.

- Employee Self-Onboarding

Some 1099 payroll software includes employee self-onboarding features, which allow employees to enter their own personal and tax information into the system. This can save time for the business owner and also ensure that the employee’s information is accurate and up-to-date.

- Multiple State And Local Taxes

Many payroll software for independent contractors can handle multiple state and local taxes, which can be a major benefit for businesses that operate in multiple states or have employees who live in different states.

- Integration With Accounting Software

Some payroll software for 1099 employees can integrate with popular accounting software, such as QuickBooks, which can make it easier to manage both payroll and finances in one place.

- Record Keeping

Payroll independent contractor software can help keep accurate records of all the payments and taxes that the government requires, this can save a lot of time and effort while preparing tax returns.

- Time-Saving

By using the software for independent contractors, business owners can save a lot of time as the software automates many of the tasks involved in payroll processing, such as calculating taxes and making direct deposits.

- Cost-Effective

Payroll software for independent contractors can be cost-effective, especially when compared to the cost of hiring a dedicated payroll professional. Additionally, using it can reduce the risk of errors and penalties, which can save money in the long run.

- Handling 1099 Employees

As mentioned earlier, the software can handle and track 1099 employees, which is a big advantage for independent contractors and small business owners who have 1099 employees.

- Reports And Analysis

Many payroll software for independent contractors offer reports and analysis features, which can help business owners better understand the payroll and make informed decisions. Overall, using the software for independent contractors can save time and money for business owners, while also reducing the risk of errors and penalties. It can also offer additional benefits such as employee self-onboarding and integration with accounting software, making it a valuable tool for independent contractors and small business owners.

Conclusion

Payroll software for an independent contractor is essential for managing the unique financial needs of 1099 employees. The software can automate tax calculations and filing. It also provides detailed reports and analytics to help independent contractors manage their finances effectively.