Social media content is a great tool for insurance agents to connect with past customers and engage with prospective ones. In today’s digital age, social media platforms provide a unique opportunity to promote sales, provide policy details, offer advice, and establish oneself as a reliable authority in the insurance sector. Additionally, social media serves as an effective channel for sharing news about closures, community events, and sponsorships. In this article, we will explore the various ways insurance agents can optimize their use of social media to reach their company’s goals effectively.

Define Your Target Audience

Before diving into social media marketing, it is essential to define your target audience. Understanding who you are speaking to will enable you to tailor your content accordingly. It is also crucial to periodically reevaluate your social media strategy to ensure alignment with your overall market objectives. The audience you target on social media may differ from your broader market, and it is vital to adjust your strategy as needed. Since social media platforms are constantly evolving, regular strategy revisions will prevent you from wasting time on outdated approaches.

What is Your Goal? – Create and Implement a Strategy

Determining your goals for using social media is a crucial first step. Whether you aim to generate more leads and sales or create a community and showcase your company’s culture, your goals will shape how you use social media and the resources you allocate to it. Once you have established your goals, you can proceed to select the platforms that align with your objectives. While social media marketing traditionally focused on “the big four” platforms, the landscape has evolved with the emergence of new platforms and changing audience preferences.

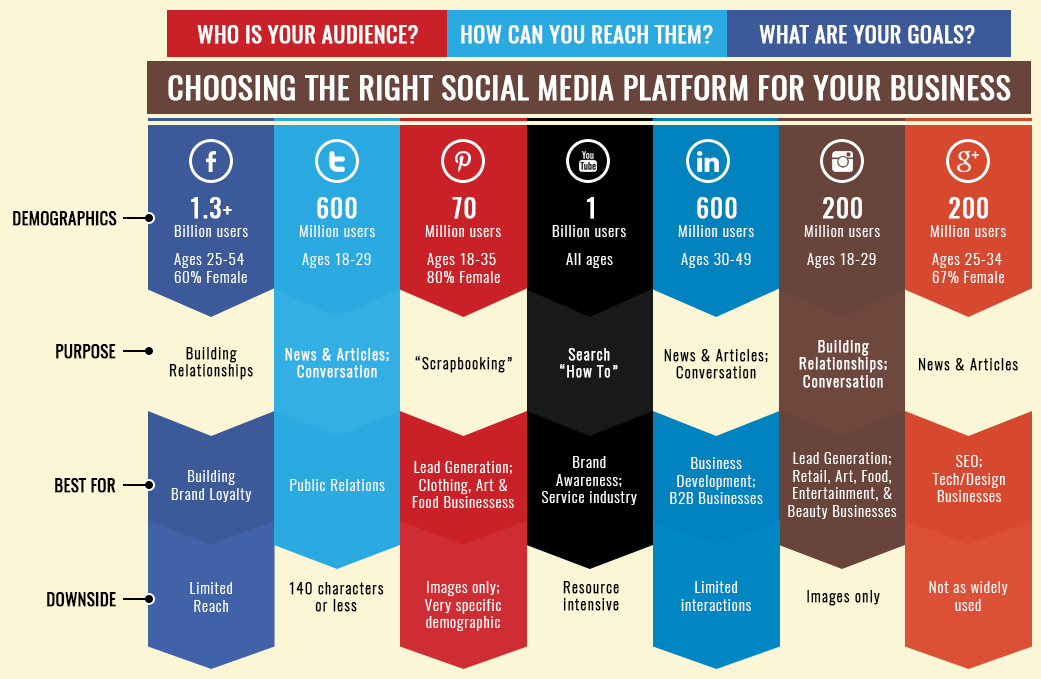

To effectively utilize social media for insurance marketing, it is essential to understand the characteristics and demographics of different platforms. Let’s take a look at some of the most prevalent social media platforms:

With 2.91 billion active users as of 2022, Facebook remains the largest social media platform. The majority of users fall within the age range of 25 to 34, spending an average of 33 minutes per day on the app. Contrary to popular belief, Facebook’s growth rate has slowed in recent years, and users spend slightly less time on the platform. Engaging Facebook content typically combines text and images, with videos driving higher engagement compared to static images alone.

LinkedIn boasts 810 million active users and has traditionally been associated with older generations. However, it is increasingly gaining popularity among millennials as they enter the job market. LinkedIn is particularly beneficial for business-to-business (B2B) interactions and offers highly targeted audience options for paid ads.

Instagram has gained traction among Gen Z and millennials, with 2 billion active users as of 2022. The largest age group on the platform is between 25 and 34, closely followed by the 18-24 age group. Instagram’s visual nature makes it an ideal platform for insurance brokers looking to engage with clients through images and videos.

While Twitter has experienced recent growth, studies indicate a potential decline in the coming years. Despite this, Twitter remains a valuable platform for discussions and customer service. It has 211 million active users, with the largest age group being between 18 and 29. Being up-to-date and responsive is crucial on Twitter due to its fast-paced nature.

YouTube

YouTube is a video-based platform with over 2 billion active users. The platform attracts a younger audience, particularly within the age range of 15 to 35. Longer videos and streaming content have gained popularity, making YouTube an excellent choice for insurance companies looking to invest in video advertising.

TikTok

TikTok, a rapidly expanding social media network, has reached 1 billion active users in 2022. It primarily appeals to users between the ages of 10 and 19, with a higher percentage of female users. TikTok’s short video format and integrated video editing tools make it an accessible platform for creating engaging content.

To create engaging and high-quality content on social media, insurance companies must have a solid understanding of their target demographic. Tailoring your social media posts to resonate with your audience is essential for effectively promoting your insurance products. By identifying the specific demographics, interests, and preferences of your target customers, you can create highly targeted social media posts that capture their attention. Being creative and unique in your strategy will help your insurance firm stand out from the competition.

Creating Creative Digital Content

When it comes to social media content, creativity is key. Insurance companies should think outside the box and create content that resonates with their target audience. While it is important to promote your services, a hard sell approach is typically ineffective on social media. Instead, focus on providing valuable, entertaining, and useful content that strikes the right balance between self-promotion and friendly engagement. Examples of innovative social media content for insurance companies include sharing blog entries, engaging social media advertisements, and team-focused Instagram posts.

Consistency and Quality

Consistency and quality are crucial aspects of successful social media marketing. It is important to choose the right platforms that align with your resources and capabilities. Setting up multiple platforms and neglecting them can create a negative impression. It is better to be consistent on a few platforms than to spread yourself too thin across many. Additionally, each platform has its own characteristics and requirements. For example, Twitter is often used for customer service and requires shorter response times. Monitoring your platforms and using the data obtained can help you make informed decisions and refine your social media strategy.

Creating Advertisements for Clients

Precisely targeting your audience through social media ads is a valuable strategy for insurance firms. Social media platforms provide powerful tools for reaching specific demographics based on region, age, gender, interests, and behaviors. By using precise ad targeting, you can optimize your ad budget and ensure your ads are shown to the most relevant audience. Tailoring your ads to different target audiences can effectively promote various insurance products and services. Offering incentives or discounts can help capture attention and drive conversions. Remember to consider your goals and desired actions when creating social media ads.

Conclusion

Social media offers tremendous opportunities for insurance agents to connect with customers and achieve their business goals. By defining your target audience, setting clear goals, and implementing a well-planned strategy, you can optimize your use of social media platforms. Each platform has its unique characteristics and audience demographics, so it’s essential to choose the ones that align with your objectives. Social media can increase brand awareness, facilitate creative digital content, and enable precise audience targeting through advertisements. Consistency, quality, and creativity are key to making your insurance firm stand out in the competitive social media landscape.

Frequently Asked Questions (FAQs)

1. How can social media benefit insurance agents? Social media allows insurance agents to connect with past customers and engage with prospective ones, promoting sales, providing policy details, and offering valuable advice. It is also an effective platform for sharing news about closures, community events, and sponsorships.

2. How can insurance agents define their target audience on social media? Insurance agents can define their target audience by considering factors such as gender, age range, geography, lifestyle, and preferred social media platforms. This helps in creating highly targeted social media posts that resonate with the intended audience.

3. What are the key considerations when choosing social media platforms for insurance marketing? When choosing social media platforms, insurance agents should consider factors such as the platform’s active user base, age demographics, engagement levels, and the suitability of content formats (e.g., images, videos) for promoting insurance products effectively.

4. How can insurance companies create engaging social media content? Insurance companies can create engaging social media content by being creative, personable, and informative. It’s important to strike a balance between promotional content and posts that provide value to the audience. Examples include sharing blog entries, using captivating images and videos, and team-focused posts.

5. Why is consistency and quality crucial in social media marketing for insurance? Consistency and quality are vital because they help maintain a strong brand presence and ensure that followers and potential customers receive a positive impression. Monitoring platforms and providing timely responses can also enhance customer service and overall satisfaction.