Cryptocurrency Exchange Hacks: How to Protect Your Assets

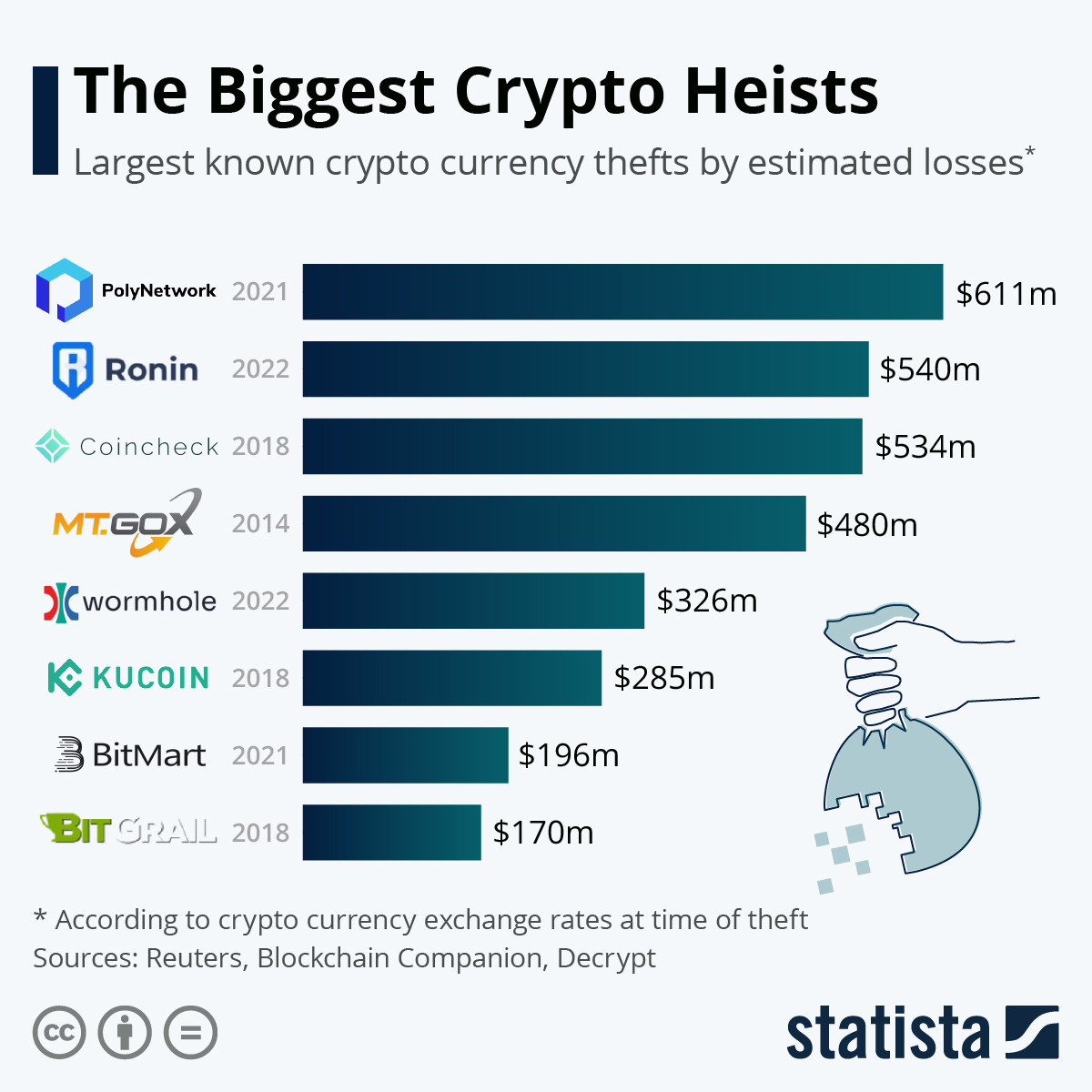

The rise of cryptocurrencies has brought numerous benefits to the financial world but has also given rise to new risks. As a result of this, Cryptocurrency exchange hacks have become a recurring concern, with several high-profile incidents in recent years. These hacks can result in significant losses for individuals who store their digital assets on centralised exchanges. However, by taking proactive steps, investors can enhance the security of their cryptocurrency holdings. This article will examine the dangers of exchange hacks and provide valuable tips on protecting your assets.

Understanding the Risks

Cryptocurrency exchange hacks occur when hackers gain unauthorised access to an exchange’s platform and siphon off users’ funds. These hacks can happen for various reasons, including vulnerabilities in the exchange’s security infrastructure, insider attacks, or phishing attempts targeting users. When a hack takes place, it often leads to substantial financial losses and erodes trust in the affected exchange.

Choosing a Secure Exchange

Selecting a reputable and secure exchange is one of the most crucial steps in safeguarding your cryptocurrency assets. When selecting an exchange, it’s important to keep the following factors in mind:

- Security Measures: Look for exchanges implementing robust security measures such as two-factor authentication (2FA), withdrawal whitelisting, cold storage for funds, and regular security audits.

- Reputation and Track Record: Research the exchange’s reputation and track record by reading user reviews, checking their history of security incidents, and verifying their compliance with regulations.

- Insurance: Some exchanges offer insurance coverage for user funds in the event of a hack. Choosing an exchange that provides this added protection can provide peace of mind.

Practising Good Security Habits

Besides choosing a secure exchange, users must also adopt good security habits to protect their assets. Here are some recommended practices:

- Secure Passwords: Use strong, unique passwords for your exchange accounts and enable 2FA wherever possible. Avoid reusing passwords across platforms.

- Beware of Phishing Attempts: Be cautious of phishing attempts, often disguised as legitimate emails or websites. Always double-check the URL and avoid clicking on suspicious links.

- Regularly Update Software: Keep your computer, mobile devices, and wallets up to date with the latest security patches and software updates. Outdated software can leave you vulnerable to hacking attempts.

- Secure Communication: When communicating about your cryptocurrency holdings, use encrypted channels, such as secure messaging apps or encrypted email services, to prevent unauthorised access.

Utilising Hardware Wallets

Hardware wallets bring another level of protection to the cryptocurrency storage process. Your private keys are safely stored offline by these physical devices, making it very impossible for hackers to access your money. A hardware wallet should be used when:

- Purchase from Authorised Sources: Only purchase hardware wallets directly from the manufacturer or authorised resellers to ensure the authenticity of the device.

- Set Up Properly: Follow the manufacturer’s instructions carefully to set up your hardware wallet correctly. This includes backing up your recovery seed in a safe and secure location.

- Verify Transactions: Hardware wallets bring another level of protection to the cryptocurrency storage process. Your private keys are safely stored offline by these physical devices, making it very impossible for hackers to access your money. A hardware wallet should be used when:

Diversifying Your Storage

Rather than relying solely on a single exchange or wallet, consider diversifying your storage across multiple platforms. This strategy mitigates the risk of losing all your assets if a particular exchange or wallet is compromised. However, it is essential to ensure that each platform you use maintains the same level of security and trustworthiness.

Conclusion

While cryptocurrency exchange hacks pose a real threat to investors, taking proactive measures can significantly enhance the security of your digital assets. By choosing a reputable exchange, practising good security habits, utilising hardware wallets, and diversifying your storage, you can protect yourself from potential losses. It is crucial to stay informed about the latest security practices and remain vigilant in the ever-evolving landscape of cryptocurrency security. Remember, the safety of your assets ultimately lies in your hands.