Top 5 Financial Services Marketing Strategies

The following 5 financial services marketing strategies are an excellent place to start for many marketing strategies for banks and other financial institutions:

I. Customer Outreach

One of the oldest and simplest marketing strategies that banks and other financial institutions can adopt is customer outreach. It is also one of the most effective strategies.

Customer outreach simply refers to the concept of reaching out to customers to fill existing needs surrounding awareness, education, and help. It scales to small organizations in the form of free webinars and consultations to larger organizations in the form of financial education such as debt management programs or financial education offered in schools.

Why Is It Effective?

Customer outreach might seem like a mostly philanthropic use of a budget, but it’s actually intended to encourage customer loyalty and build awareness as well as interest in products and services. A properly formulated financial marketing strategy takes the features and services that you’re trying to sell as well as other marketing campaigns into account.

For example, if you know that students are headed back to school, you could focus customer outreach around programs aimed at teaching college students how to properly manage their finances, budgeting to save up for a car, or even saving for college.

Similarly, if you know that your target geographic area has a large number of seniors, you can create free financial education programs to teach seniors about online security as well as how to use digital banking.

The programs in the two examples above would, in turn, promote savings accounts, digital accounts, and perhaps even your bank through increased consumer trust and awareness.

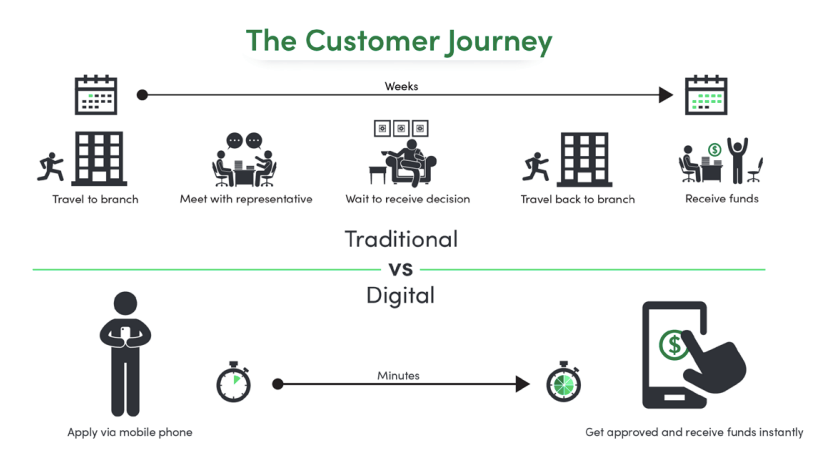

II. Digitalization and Self-Service

Baby boomers and previous generations mostly preferred to receive products via sales representatives that would not only advise them but also help setup accounts for them. In contrast, millennials and Generation Z usually prefer doing everything themselves with the least possible contact with human representatives.

Creating and promoting digitized financial products as well as customer experience or service portals where customers can sign up for various services online, change services and products online, and even view information without physically going to a brand is one highly effective and increasingly essential trend for financial organization. It isn’t, however, a marketing strategy for all organizations since you may be selling services only but no products.

81 percent of the U.S. population is on social media and many people use social media for up to 4 to 5 hours a day. Your smart and consistent use of social media can be a valuable financial marketing strategy that simply cannot be ignored.

Generation Z, Millennials, as well as Baby Boomers use social media to learn from their peers, connect with brands, and follow current news and events. Maintaining a steady social media presence with a strategy in place for offering value to followers can help you build brand trust, grow your customer base, and create marketing opportunities.

Numerous banking and financial institutions regularly use social media for connecting with consumers with the aim to build trust. For example, by showing that real people work at banks and other financial institutions, showcasing success stories and customers, and delivering customer service. Financial institutions are usually able to cut the cost of customer service by over 70 percent by switching to social media rather than phone.

A good social media marketing strategy involves the smart use of content, storytelling, creative humor, and consistency as well as the willingness to offer value for the customer as opposed to the bank. Still, it’s well worth the effort in terms of building awareness, trust, and relationships with customers in their space.

IV. Big Data and Automation

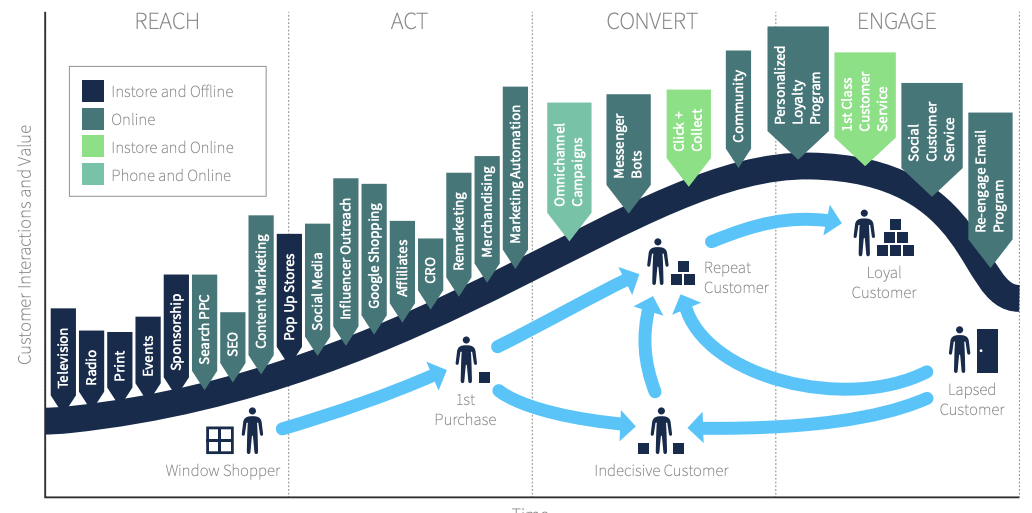

Financial institutions usually have more data than they know what to do with, but this is something that’s changing rapidly. Today, automation tools and customer experience platforms make it incredibly easy to utilize and apply data as part of your marketing strategy for financial services.

For example, with big data you can tell who’s saving up for a big purchase and will most likely require pre-approval for a loan. Big data can also help you identify and provide services before or immediately after they are needed. It can also help you target specific customers to offer digital financial education or additional customer service, and can help you cut down on the customer service that’s needed.

JP Morgan, for example, uses bots when responding to IT access requests originating internally, eliminating the need for 40 full-time employees, and helping speed up the process. Other banks are using automation to offer more personalized or specific solutions, customize services, and even create custom dashboards and data for customers in ways that would have been otherwise very expensive without automation.

V. Digital Storytelling

Storytelling is still a highly effective marketing medium, whether on video, social media, ads, or even cross-channel platforms that extend into the real world.

Your marketing strategy needs to encompass telling a story that not only captures interest but also evokes emotion to move, excite, and interest the viewer. Your goal, here, is creating shareable and relatable content that’s capable of entertaining, educating, or helping the reader in some way – and preferably manage all three at the same time. This content can then gain links and help your seo according to Velseoity.

Summary

For example, the award-winning digital marketing campaign by Allstate focuses on telling the story of 3 to 8 customers that are making a difference. Allstate doesn’t just promote what its customers are doing, building trust by sharing real stories and people, but also drives interest across each and every marketing channels, help build customer relationships, and also helps create a human factor while still promoting the services and products discussed in the videos.

Digital media opens up a wide range of creative marketing strategies, tactics, and ideas that you can adopt, no matter what your financial institution does. However, you should generally avoid focusing exclusively on one or attempting to incorporate everything. A better approach would be to create one broader financial marketing strategy designed in such a way that each element builds on and adds to the rest, adding value to the entire organization.

Thank you for Financial Services Marketing Strategies