No-Fault Insurance: Coverage Options in the Event of an Accident

Accidents can happen anytime, and no one likes to think about them until they do. In the event of a car accident, having the right insurance coverage can be invaluable. When it comes to auto insurance in Columbia Sc, no-fault insurance is an important option that many drivers don’t know much about. No-fault insurance is not required in Columbia Sc; however, it can protect you and your family in the event of a car accident.

It can help pay for medical expenses incurred and offer other valuable benefits. But what is really “no-fault” insurance, and how does it work? In this article, we’ll provide an overview of no-fault insurance in Columbia Sc and some of the coverage options you should consider in the event of an accident. This article will also discuss when you should consult a personal injury lawyer in Columbia Sc.

Understanding No-Fault Insurance Coverage

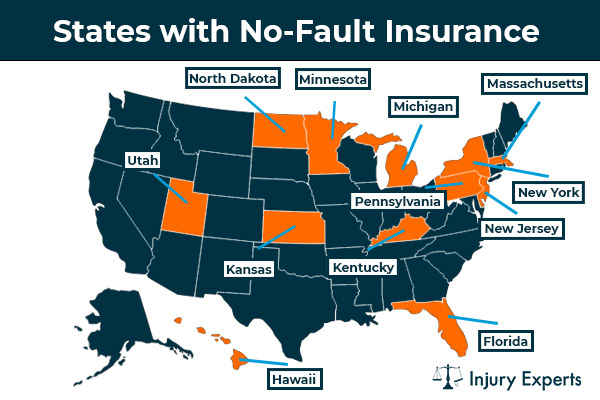

If you are looking for insurance coverage options in the event of a car accident in Columbia Sc, you may be disappointed to learn that the state does not have a no-fault law in effect. Columbia Sc uses an “at-fault” model with comparative negligence. This means that when two drivers are involved in a car accident, the driver who is found to be at least partially responsible for the accident must pay for any medical bills or property damage resulting from it. Therefore, if you are looking for a no-fault insurance car accident attorney in Columbia Sc to help determine the coverage options in case of a car accident, this type of insurance may not provide you with all of your needed coverage.

When to consult a personal injury lawyer in no fault insurance case?

When it comes to no-fault insurance coverage in Columbia Sc, there are specific scenarios when it’s wise to consult car accident lawyers. You may require the help of an experienced accident attorney if:

- The parties involved in the car accident cannot agree on who was at fault, or there is a dispute over who caused the accidentYou’re looking for compensation beyond what Columbia Sc’s no-fault insurance laws allow you to receive

- The other driver is uninsured and you have suffered property damages or medical expenses due to the accident.

- The insurance company denies your claim or offers a far lower settlement than you expected.

If any of these situations arise, it’s essential to consult a qualified personal injury lawyer in Columbia Sc to help guide you through the process. An experienced auto accident attorney can review your case and provide you with advice on how to best pursue your claim. They will ensure that you receive fair compensation for your losses.

Overview of Columbia Sc’s No-Fault Insurance Laws

Columbia Sc’s no-fault regulation dictates that all drivers must have liability insurance and medical payment coverage. Liability insurance covers personal injury or property damage when the other driver is at fault. Medical payments coverage, on the other hand, helps pay for medical bills in case of an accident, regardless of who is at fault. Under Columbia Sc law, car owners must be able to provide proof of financial responsibility if they are involved in a car accident or charged with a traffic violation. This proof can be in the form of an auto insurance policy or other financial documents.

For car accidents in which you are at fault, it is important to make sure that you have the appropriate coverage for your vehicle. Contacting a no-fault insurance car accident lawyer will help you understand the different coverage options available and make sure that your policy covers you in the event of an accident.

What No-Fault Insurance Coverage Options

No-fault insurance is an insurance system designed to provide compensation for medical and property damage costs in the event of a car accident. It is important to understand the different coverage options available in Columbia Sc if you are involved in a car accident. There are three basic coverage options available in Columbia Sc:

- Personal Injury Protection (PIP): PIP covers you, your passengers, and family members for medical bills. It also covers lost wages up to the policy limits regardless of who is at fault for the accident.

- Uninsured/Underinsured Motorist Coverage (UM): UM covers you, your passengers, and family members in case of an accident. Provided that the said accident is caused by an uninsured or underinsured driver. This coverage also pays for medical bills and other expenses up to the policy limits regardless of who is at fault.

- Property Damage Liability (PD) Coverage: PD covers damage done to another person’s property (car, home, etc.) as a result of an accident that was deemed your fault. This coverage includes costs like repair or replacement as well as legal costs related to the accident up to the policy limits.

No-fault insurance gives you peace of mind knowing you are covered in case of an accident, no matter who is at fault for the damages that occur. If you need help determining which types of coverage are right for you, no-fault insurance car accident lawyers can assist you with understanding your options and making sure they fit your specific needs.

Factors That Determine the Amount of Coverage after an Accident

When it comes to determining the amount of coverage after an accident in Columbia Sc, several factors come into play.

- The first factor is the state’s “at fault” model with comparative negligence. This means that when an accident occurs, the party who is found to be at fault is held responsible for the damages. The other party’s insurance company will then cover their policyholder’s damages, up to their limit.

- Another factor is the minimum limit for all property damage in one accident according to Columbia Sc state law. The minimum limit for this type of coverage is $25,000 for all property damage in one accident.

- Finally, although not required by law, many drivers opt for full coverage car insurance which includes comprehensive and collision coverage. Comprehensive coverage provides financial protection from theft or physical damage and collision insurance covers damages from a covered auto collision with another vehicle or object such as a traffic sign or tree. These two forms of insurance typically provide more robust protection than the state-mandated minimum policy.

Exceptions to No-Fault Law

In Columbia Sc, no-fault coverage options are the standard when it comes to car accident claims. However, there are some exceptions to this insurance coverage rule. When the accident is caused by someone else’s negligence or recklessness, a personal injury lawsuit may be filed against the other party. This can be done by an insurance company or an attorney on behalf of the injured person.

In this case, the injured party must prove that the at-fault driver is responsible for their injuries to receive compensation from them. An experienced no-fault insurance car accident lawyer in Columbia Sc can help you determine if your case falls under any no-fault insurance coverage exemptions. Below are some examples of circumstances that may exempt a person from no-fault insurance coverage:

- The accident involved a hit-and-run driver.

- The accident occurred while committing a crime.

- The driver was operating an uninsured vehicle.

- The damages were intentional

Conclusion

So, if you’re a Columbia Sc resident who has been involved in a car accident, it’s important to understand your rights and the potential coverage options available to you. No-fault insurance can be confusing, and the aftermath of an accident can be stressful and daunting.

An experienced personal injury lawyer in Columbia Sc can help you determine what insurance coverage is needed to protect you and your family. They will make sure that your interests are safeguarded. With their knowledge and expertise, you can be sure that you’re getting the best possible advice and guidance to navigate the complex no-fault insurance system.

Interesting blog.It would be great if you can provide more details about it.