Freelancer Insurance: Protecting Your Independent Career

In today’s gig economy, freelancers play a crucial role, offering diverse skills and services to clients worldwide. As a freelancer, you enjoy the freedom of working on your own terms and schedule, but with great independence comes significant responsibility. One vital aspect that often goes overlooked is insurance coverage tailored to the unique needs of freelancers. In this comprehensive article, we will delve into the world of “Freelancer Insurance” to help you understand its importance, the various coverage options available, and how it can provide you with peace of mind while navigating the challenges of freelancing.

Freelancer Insurance: Understanding the Basics

Freelancer insurance is a specialized form of coverage designed to protect self-employed professionals from potential risks and liabilities associated with their work. Unlike traditional employee insurance plans, which are typically offered by employers, freelancer insurance offers customized solutions that cater to the specific requirements of independent contractors.

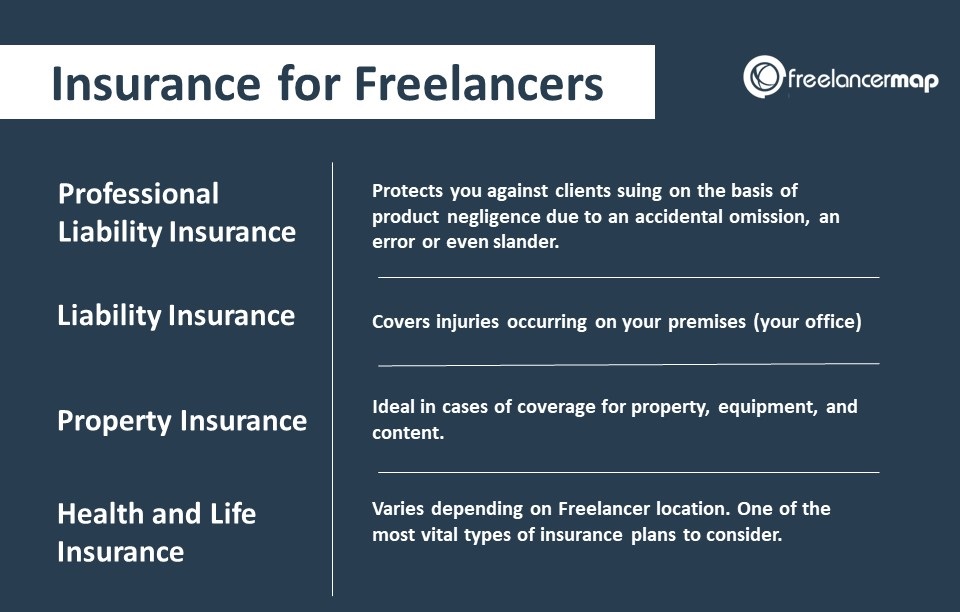

Identifying Key Freelance Insurance Policies

The insurance you need as a freelancer will vary based on your profession and the type of freelance work you do. However, there are several policies that are essential for protecting yourself from potential lawsuits and risks that freelancers commonly face.

Professional Liability Insurance: Also known as errors & omissions coverage, this is crucial for most freelancers. If you provide professional services like programming, design, writing, or accounting, this insurance covers you in case you make mistakes that impact your clients financially. For instance, if you promised to deliver a functioning website by a specific date and fail, this insurance can cover legal costs and payouts related to such claims.

General Liability Insurance: Essential for most business owners, this policy protects you from injuries to customers or damage to third parties. If you rent office space, it’s often required before signing a lease.

Commercial Property Insurance: Even if you work from home, standard homeowner’s or renter’s insurance might not cover your business equipment. If your business-related property gets damaged or stolen, a commercial property policy ensures you’re protected.

Fidelity Bonds: Freelancers in fields like IT and finance might need fidelity bonds. These agreements involve you, your client, and the insurer. They provide protection against fraud, theft, and data breaches, ensuring your client is compensated if you don’t fulfill your contract.

Cyber Liability Insurance: IT freelancers handling customer data are at risk of cyber attacks. If personal information is stolen, you could be financially liable. Cyber liability insurance covers expenses related to breach notifications, forensic investigations, legal fees, and damages.

Health and Disability Insurance: Many freelancers lack employer-provided health insurance or benefits. Affordable healthcare is a concern. Freelancers should consider health insurance and disability insurance to protect against potential medical issues and loss of income due to injury or illness.

If you’re unsure about your insurance needs, you can consult with a business insurance expert to ensure you’re getting the right coverage for your freelancing business. Feel free to reach out to experts for guidance on your freelance insurance options.

Why Do You Need Freelancer Insurance?

When you’re a freelancer, whether you work as a management consultant, tutor, architect, or in any other field, there are risks that come with the benefits of working for yourself. For instance, an important file could get lost, or you might make a mistake in your project calculations. Accidents can happen, and as a freelancer, if something goes wrong on your watch, you might face a claim for compensation from a client.

In today’s litigious society, accidents, errors, or even misunderstandings can lead to legal actions and financial losses. As a freelancer, you are exposed to various risks, such as professional liabilities, data breaches, or personal injuries, depending on your line of work. Having the right insurance coverage can safeguard your hard-earned reputation, assets, and financial stability.

Professional indemnity (PI) insurance is a way to safeguard yourself from the financial impact of a client claiming that there are problems with your work. This insurance covers both the compensation you might need to pay and the legal expenses that can arise. Additionally, you might want to consider getting public liability insurance. This kind of coverage can help you handle claims if you’re accused of damaging someone else’s property or causing an injury to a third party.

In the digital realm, cyber and data security insurance is available to protect you in case there’s a breach in the security of your data or your client’s data. And if there are costs related to interruptions due to personal injury or equipment damage, freelance insurance can offer assistance.

In essence, having freelancer insurance provides you with peace of mind, knowing that you’re financially protected in case things don’t go as planned in your freelance work.

What Type of Freelancer Insurance Do You Need?

As a freelancer, it’s crucial to take responsibility for your work, and insurance is a must, even if freelancing is just a side gig. Various types of freelance insurance can help secure your journey toward independence.

Professional Indemnity Insurance: Professional indemnity insurance is a lifeline for freelancers when clients claim something went wrong. Let’s say you’re a freelance beauty therapist and a client isn’t satisfied with your service. Similarly, a graphic designer might face disagreements with clients about their work. Even as a freelance advertising professional, a client could raise concerns about sensitive information you used. If you’re a management consultant providing advice, a client might believe your suggestions negatively impacted their business. This insurance covers the cost of addressing claims, ensuring minimal disruption to your work.

Public Liability Insurance: Public and products liability insurance is important if your freelance work involves interactions with people. It protects you if someone claims injury or property damage due to your work or products. For instance, a freelance photographer’s cables might cause harm at an event. Similarly, a yoga teacher could face claims of causing injury during a session. Public liability insurance covers legal fees and compensation, making it vital if you couldn’t handle these costs otherwise.

Contents Insurance: Contents insurance safeguards your belongings when you work from home. Freelancers, especially those using equipment like computers, should consider this, as regular home insurance might not cover business-related assets. This insurance benefits sole traders relying on tools, valuable equipment, or protective gear, as well as freelancers with instruments, books, or software. Contents insurance provides protection against fire, theft, and accidental damage.

These insurance options ensure you’re covered for various situations, safeguarding both your work and your peace of mind.

Other Types of Cover You Might Need as a Freelancer

- Business Interruption Insurance: Unforeseen events like property damage can disrupt your freelancing business. Business interruption insurance provides income support during such incidents.

- Personal Accident Insurance: Freelancers lack sick pay. Personal accident insurance offers weekly payments if you’re unable to work due to injury.

- Portable Equipment Insurance: Many freelancers rely on equipment. Portable equipment insurance covers the cost of replacing essential tools or devices.

- Cyber and Data Risk Insurance: In the digital age, cyber insurance is vital for freelancers. It covers lost data, lost income, and GDPR claims arising from cybercrime.

- Product Liability Insurance: If your work involves creating or supplying products, even digitally, product liability insurance protects you if your product causes harm or damage.

- Legal Protection Insurance: Freelancers often face unique legal challenges. Legal protection insurance helps with costs related to disputes or legal matters.

The landscape of work is changing, with more people embracing freelance careers for flexibility. While freelancing offers many benefits, it’s important to remember that it’s a serious business endeavor. Freelancers are essentially small business owners, responsible for their own finances and any potential issues that arise from their work.

If you’re a full-time freelancer, you need to consider aspects like paying taxes and providing insurance coverage for potential liabilities. Just like any business owner, protecting yourself with the right freelance insurance program is crucial. Whether you’re considering freelancing or have already made the switch, understanding and investing in the proper insurance coverage is vital for your business’s security and success.

The Benefits of Freelancer Insurance

- Financial Protection: Freelancer insurance offers a safety net against unexpected legal claims, accidents, or health issues, preventing significant financial losses.

- Client Confidence: Demonstrating that you have appropriate insurance coverage can boost client confidence in your professionalism and reliability.

- Peace of Mind: With insurance in place, freelancers can focus on their work without constantly worrying about potential risks and liabilities.

- Continuity in Business: Insurance ensures that unforeseen circumstances do not disrupt your business operations.

FAQs about Freelancer Insurance

What factors should I consider while choosing freelancer insurance?

To select the right insurance coverage, consider your specific line of work, potential risks involved, budget constraints, and the level of coverage you need. Some freelancers may require comprehensive policies, while others may find specific insurances more suitable.

Is freelancer insurance mandatory?

Unlike employee insurance, freelancer insurance is not mandatory in most cases. However, having appropriate insurance coverage is highly recommended to protect yourself and your business from unforeseen events.

Can I modify my freelancer insurance as my business grows?

Yes, as your business expands or changes, you can adjust your insurance coverage accordingly. It is essential to review your policies periodically to ensure they align with your current needs.

How much does freelancer insurance typically cost?

The cost of freelancer insurance varies depending on the type of coverage, your industry, location, and coverage limits. It is best to request quotes from different insurance providers to compare costs.

Can I have multiple insurance policies for added protection?

Yes, many freelancers opt for multiple policies to create a robust safety net. However, it’s essential to avoid overlapping coverage to optimize your insurance expenses.

Does freelancer insurance cover international work?

The extent of coverage for international work depends on your insurance policy. Some policies may include global coverage, while others may have limitations. It’s crucial to clarify this with your insurance provider.

Conclusion

Freelancer insurance is a vital investment for independent professionals looking to safeguard their careers and financial stability. With various coverage options available, freelancers can tailor their insurance plans to meet their specific needs and mitigate potential risks. From professional liability and general liability to health and disability insurance, each policy plays a crucial role in ensuring peace of mind and continuity in your freelance journey.

As you embark on your freelancing adventure or continue your established career, make sure to prioritize your well-being and protect your hard work with the right freelancer insurance coverage.

As a freelancer myself, I know how tricky it can be to navigate the world of insurance without the support that comes with a traditional employer. Health and disability insurance are often overlooked, but they’re essential for protecting myself in case of unexpected medical issues or an injury. I agree that consulting with a business insurance expert is a smart move. Thanks for this helpful information.

Thanks keep reading and sharing