The Best Investment Apps for Every Investor

Investment apps allow both new and experienced investors to manage their investments in the stock market and other financial markets. With a variety of convenient services at low fees, these investment apps—the best we’ve seen out today—may help investors save money and improve their portfolios, especially when coupled with an updated investment calculator. While you used to have to pick up a phone and call a stockbroker to make a trade (and then pay a steep commission), you can now pick up your smartphone, tap your screen a few times, and trade almost instantly—often for free or at a relatively low cost.

After reviewing several apps for cost, ease of use, investment options, and other key factors, we rounded up the best investment apps available today. Time constraints are one of the biggest obstacles for aspiring investors — and even experienced investors trying to grow their portfolios. A packed schedule gets in the way of the research and management required to grow a successful financial portfolio.

Best investment apps for Every Investor and everyday investors aim to solve that problem by making your finances accessible straight from your smartphone. There are apps dedicated to almost every investment strategy, and at every skill level. From beginners ready to make their first investment to advanced entrepreneurs looking to trade stocks on the go, the right app can make many financial actions more accessible. Keep reading to find the best investing apps and start building your portfolio straight from your phone.

When it comes to taking control of your financial future, investing is one way to diversify your income and grow your wealth. However, if you’re new to investing, figuring out the best way to get started can be daunting. Now thanks to technology, investing is becoming more accessible to the masses, and just about anyone can get started on a mobile app. We compiled the best investing apps for every investor that help you diversify your portfolio and learn as you go. As you get into investing, remember that all investments come with their own risk and return expectations.

What Are The Best Investment Apps For Every Investor?

The best investment apps for beginners focus on a few main features: user experience, risk management, and available information. Beginners should find apps that show them the ropes while making investments that fit their personal financial goals. Based on this, here are some of the best investment apps for beginners:

Acorns

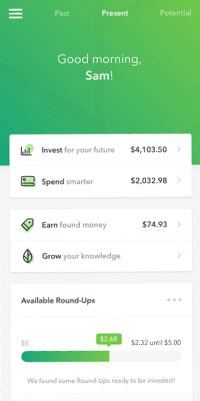

Acorns is a great investment app for beginners. This app is especially useful if you want to bolster your savings and invest without even thinking about it. The app integrates with your credit or debit card and rounds up purchases to automatically add funds to an investment account. Acorns allows you to invest in EFTs and a few fractional shares in stocks. There are three tiers (lite, personal, and family) allowing users to add additional accounts for a premium rate. Other key features of the app include:

- No investment minimums

- Five portfolio types

- Automatic rebalancing

- Option for family spending account

- 24 hour customer support by phone or live chat

- Costs $1 to $5 a month depending on account type

Stash

Stash is one of the best apps for beginners hoping to learn the ropes of investing fast. The app mixes educational content and games to make financial topics easier to learn. Users can customize goals based on what they want to focus on, and can actively track their progress. Stash lets you work with value-based investment offerings and provides suggestions for building your portfolio. Stash is also known for:

- $5 Investment minimum

- Fees ranging from $1 to $9 a month

- Educational support

- Option to invest in stocks and EFTs

- No inactivity fees

- Visualization tools for investment decisions

Ally

Ally invest is a great option for beginners interested in stocks and bonds. This app integrates real time data to allow users to trade anytime, anywhere. Ally invest also gives users access to bonds, mutual funds, and EFTs. There is no minimum investment, and the app doesn’t require additional downloads to access the trading platform (making it very user friendly). Additional features include:

- Nonexistent fees on eligible stock and options trades

- Options pricing calculator

- Some transaction fees depending on investment type

- Chat, email, and phone support

- Additional web browser based access

nvstr

Invstr is one of the best investment apps for beginners. This investing app is best known for its fantasy game-play that allows users to play with $1 million in fake cash to learn more about stocks. Invstr is a great option for anyone who wants experience managing a portfolio, before actually getting started. The app has an active community of investors and an updated news feed to help users learn more about managing a portfolio. Invstr also offers:

- Real cash prizes for successful game play

- Fractional shares in stocks

- Portfolio management simulation

- Access to specialized education material

- Interactive game play

Robinhood

Robinhood gained popularity as one of the first apps to offer stock trading without fees or commissions, which made starting a stock portfolio a lot more attractive for first-time investors. Today, there are several apps with this same offering, but Robinhood still stands out for a few reasons. First, the app allows users to trade cryptocurrency without fees. Robinhood also has no minimum account balance and no inactivity fees. Its user-friendly interface also makes it stand out among other web-based trading platforms. There are a few drawbacks to keep in mind, for example, Robinhood doesn’t sync with retirement accounts and has limited customer support. But given its user-friendly interface and nonexistent fee structure, Robinhood remains one of the best stock market apps.

SoFi Invest

As one of the top ranking investing apps in the Apple Store, SoFi Invest is made for all experience levels. Beginners can easily opt for automated investing and let SoFi’s investors build your wealth for you. For the more hands-on beginner, you also have the freedom to diversify your own portfolio by choosing from crypto, stocks, or exchange-traded funds (ETFs). With SoFi’s affordably priced offerings, all you need is $1 to get trading with no commissions.

Features:

- Fees: None

- Commissions: None

- Minimum balance: None

Pros:

- User-friendly platform

- Affordable trading

- Fractional share options

- No-cost financial planning

Cons:

- Limited investment options

Betterment

If you want an investing app designed to help you reach your goals, start out with Betterment. This app is great for beginners because it takes care of everything from managing your money, investing it, trading, and rebalancing your portfolio. The only caveat is that Betterment does it all for you if you’re willing to spend a little extra on it. You can choose from two investing plans: Digital (0.25 percent of your balance) and Premium (0.4 percent of your balance).

Features:

- Fees: Annual fees of 0.25 percent or 0.4 percent of your balance, various fund fees

- Commissions: None

- Minimum balance: None for Digital, $100,000 for Premium

Pros:

- Hands-off investing

- Goal-oriented platform

Cons:

- Annual fees for advising (high with large balances)

- High minimum balance for Premium plan

Charles Schwab

Investing with Schwab Mobile is a great option for beginners who want to learn and put their knowledge to use. Schwab’s free and expansive research offerings include real-time news, a quarterly magazine, researched reports, and expert quotations. The platform also offers a variety of affordable funds to invest in. As you level up your skills, you can use the mobile app to trade and monitor your positions at all hours, as well as customize your investing experience with alerts, summaries, and notifications. The app earns bonus points with beginners for zero minimum balance and no annual or inactivity fees.

Features:

- Fees: None

- Commissions: None

- Minimum balance: None

Pros:

- Large investment selection

- Ample research offerings

- No fees or minimums

- Biometric security

Cons:

- Small cash sweep rate for uninvested funds

Acorns

Founder of DebtHammer, Jake Hill, says, “Even if you don’t have a lot to invest, make sure you’re putting it in different places. Whatever you can afford without straining your finances.” Acorns makes investing with whatever you have easy by automatically investing your spare change. Users can set up an account in less than five minutes and begin automating micro-investments at price plans of $1 (Lite), $3 (Personal), or $5 (Family) per month. Depending on your plan, you can invest your spare change, start saving for retirement, or even start investment accounts for your kids. Beginners can start investing without having to think about it or manage it, and a team of advisors is there for support if you ever need them. Features:

- Fees: $1 to $5 per month

- Commissions: None

- Minimum balance: None to open, $5 to invest

Pros:

- Invests spare change from purchases automatically

- Built-in robo-advisor

- Educational and investing support

- Cash back at select retailers

Cons:

- High monthly fees compared to small account balances

- Small portfolio

- Can’t build your own portfolio

Stash

Stash is focused on simplifying investing for regular people, and it represents another option for beginners to grow their wealth. The Stash Beginner plan allows you to start investing long term in fractional shares for $1 per month, and you can always level up to Stash Growth ($3 per month) or Stash+ ($9 per month) if you want to do more than that. They offer a great learning center with built out posts to teach you about investing and keep you up-to-date on money news.

Features:

- Fees: $1 to $9 per month

- Commissions: None

- Minimum balance: None

Pros:

- Educational resources

- Personalized advice

- Automated investing

Cons:

- High monthly fees compared to account balance

- Only four trading windows

Stockpile

With Stockpile, beginners can start investing with as little as $5. This trading platform lets you purchase fractional shares in any dollar amount or gift stock ownership for any amount with a gift card. You can choose from a variety of stocks and ETFs, and with no account fees, you just pay the small commission of 99 cents per trade. Stockpile allows you to start investing what you have and lets you learn as you go with mini-lessons to guide you.

Features:

- Fees: None

- Commissions: 99 cents per trade

- Minimum balance: None

Pros:

- Redeemable stock gift cards

- Fractional shares

- Educational resources

Cons:

- No real-time trading

- Commission on every trade

Public

If you love social media and are looking to get into investing, Public may be the app for you. Public allows beginners to buy fractional shares of their favorite companies for any amount of money you choose, commission-free. Beginners benefit from Public’s social nature by using it to learn and find community. By following other investors on the app, you can see what everyone else is investing in, learn from them, participate in group messages, and share your own experiences.

Features:

- Fees: None

- Commissions: None

- Minimum balance: None

Pros:

- Social component

- Referral program

- Fractional shares

- No fees or commissions

Cons:

- Small investment selection

Invstr

Beginners can practice investing before doing it with real money using the Invstr app. The app is free to download and after registering, get learning with lessons from Invstr Academy. Put your newfound knowledge to the test by practicing with other community members in the Fantasy Finance League and win prizes. After gaining experience and some confidence, you can start investing in fractional shares with as little as $1.

Features:

- Fees: Up to $3.99 per month, withdrawal and deposit fees

- Commissions: $2.99 per full trade, 99 cents per fractional trade

- Minimum balance: None, but $25,000 to day trade

Pros:

- Practice investing without risking your money

- Educational resources

- Large investing community

- Portfolio and performance insights

Cons:

- Limited amount of trades per day (unlimited with subscription)

- Can only invest in U.S. stocks

- Lots of fees

M1 Finance

M1 Finance is an investing platform that offers a lot of flexibility for beginners. You can choose from premade expert portfolios or cultivate your own investment strategy by building a customized portfolio for free. You also benefit from automated contributions and rebalancing of your account. Enjoy the flexibility of this app for free, but beware of other miscellaneous fees and a $100 minimum account balance before you get started.

Features:

- Fees: No annual or monthly fees, but a $20 inactivity fee and others

- Commissions: None

- Minimum balance: $100 to $500

Pros:

- Customizability

- Automated investing

- Fractional shares

Cons:

- $100 minimum account balance

- Inactivity fee

- Morning trading window only for free accounts

TD Ameritrade

This award-winning trading platform is a good mobile investing option for beginners and active traders alike. With no account minimums and no commissions, beginners can easily get started and quickly level up their learning with how-to videos. The TD Ameritrade app also offers free research in the form of market trend reports, charts, and updates. This app also allows you to set up price alerts and get quotes in real time. As an added bonus, it’s easy to monitor your portfolio from a phone, tablet, or even Apple Watch.

Features:

- Fees: None

- Commissions: None for online U.S. stock, ETFs, and options trade (65 cents per options contract fee)

- Minimum balance: None

Pros:

- Ample research and educational offerings

- Large investment selection

- Quality customer support

- Apple Watch compatibility

Cons:

- No fractional shares

- Advisor program fee (a percentage of managed assets)

E*TRADE

As another popular, award-winning investing app, E*TRADE offers commission-free investing to beginners with an easy-to-use app interface. The app has a wide investment selection and is compatible with mobiles, tablets, and Apple Watches. Users can access real-time news, Bloomberg TV, and third-party research to stay updated on the market at all times. Beginners can watch a platform demo to get started and work toward becoming a more active trader.

Features:

- Fees: None

- Commissions: None for online U.S. stock, ETFs, and options trade

- 65 cents per options contract

- $1.50 per futures contract

- $1 per bond

- Minimum balance: None

Pros:

- Large investment selection

- Ample research offerings

- User-friendly interface

- Quality customer support

- Apple Watch compatibility

Cons:

- High minimum balances and fees for managed portfolios

Robinhood

Beginners can easily get started on Robinhood and invest commission-free with no minimum balance and no fees. Users are able to customize their portfolios, trade in real time, and invest any amount they choose thanks to fractional shares. For beginners that just wish to trade stocks and ETFs, Robinhood is a solid option and new users can get their first stock free.

Features:

- Fees: None or $5 per month for Robinhood Gold

- Commissions: None

- Minimum balance: None

Pros:

- Fractional shares

- Cryptocurrency options

Cons:

- No free research offerings

- No retirement options

- No bonds or mutual funds

Mint App

Whether you prefer to be a hands-off investing beginner or a hands-on learner, there’s a mobile investing app to help you get started. Try out one of these best-investing apps for beginners to start growing your money today. Don’t forget to link your investment accounts with the Mint app to ensure that you maintain your personal budget when making investment contributions and make the right money moves toward a brighter financial future.

Merrill Edge

Investors looking for other apps without trading fees will find Merrill Edge to be a great option. This app allows users to trade stocks and options without hidden fees. Merrill Edge is owned by Bank of America, and offers integrations for account holders. This feature allows users to utilize the same online login across both platforms and transfer funds instantly. A few other features of Merrill Edge include:

- Preferred rewards program for eligible users

- Educational resources including courses, webinars and articles

- Customizable dashboard for trading

- No annual or inactivity fees

- Tradable stocks, bonds, mutual funds, options, and EFTS

Wealthfront

Wealthfront is a hands-off investing app that allows you to grow your funds with the help of a robo-advisor. The app starts with a questionnaire about your financial goals and risk tolerance, before guiding you towards specific investment options. The app will then balance your portfolio as needed, charging a .25 percent account management fee. The minimum investment is $500, which can be steep compared to other apps on this list. However, this minimum is relatively low when compared to investment opportunities outside of the app store.

Betterment

Investors looking for an app to help create a tax-friendly portfolio will enjoy learning more about Betterment. It’s known for being the first app to offer a robo-advisor, though this feature has since expanded to other apps. Betterment stands out by managing user accounts with taxes in mind, so that it can minimize losses. A few other features that make Betterment stand out today are:

- Taxable and retirement account management

- No minimum investment required

- Phone support from certified financial planners

- User survey to create tailored portfolios

- A .25 percent management fee

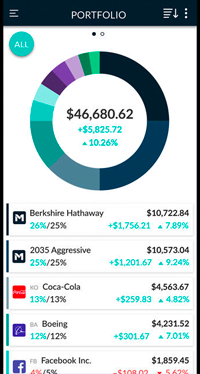

M1 Finance

M1 Finance strikes a balance between hands-on investing and automated portfolio management. The app allows users to build a portfolio of stocks and EFTs. M1 Finance works best for investors who want the flexibility to build their own portfolios, with a little guidance along the way. It offers a taxable investment account and IRA for users. M1 Finance also includes:

- Hybrid investment setup with stocks and EFTs

- Taxable account minimum at $100

- Retirement account minimums at $500

- No fees after account minimum is met

- Premium version with more stock options

E-Trade

Another one of the best stock investment apps is E-Trade. This app is known for the number of options it provides users. With thousands of stocks, options, mutual funds, and EFTs investors get the freedom they want to choose how their portfolio is set up. This is a great fit for investors who already have a little knowledge on the stock market and where they want to invest. Other features to keep in mind are as follows:

- No commission for trading stocks

- Live news and market analysis

- Personalized notifications on stocks

- Robo-advisor offerings available

- Minimum balance of $300

TD Ameritrade

If you like diving into all the details of a subject before getting started, TD Ameritrade is about to become your best friend. This app allows users to access information on stocks, companies, and markets to make informed decisions when investing. There are even educational videos available to break down more complex topics. TD Ameritrade also offers users:

- Multiple trading platforms

- No investment minimums

- Wide variety of investments

- Customer support and advice

- Free educational resources

Wealthbase

Wealthbase is another simulation-based app for those who want to gain a little experience before investing their funds. The app connects to your social media accounts to show you updates of friends who play as well. This provides users the opportunity to discuss potential investments with friends who are interested in stocks as well. Wealthbase is primarily known for its in-app game, but can also be accessed from the web as well. This social-oriented investment app can be a great entry into the world of investing, especially if you want to learn from those around you.

Stockpile

The aptly named Stockpile app allows users to purchase fractional shares of stocks to grow their financial portfolios. This app is commonly known for its gifting feature, that allows users to send gift cards for stock to friends and family. This can be a great way to ease someone new into investing. Other popular features of the app include:

- No monthly fees

- The gifting feature makes it easier for younger investors to get started

- Charges only .99 cents for a trade

- You don’t need an account on the app to send a gift

Fidelity

Fidelity hosts over 3,500 mutual funds for investors to choose from and trade, commission-free. The trading platform also offers a number of educational resources for users to learn more about their investment choices. The educational content makes this app stand out for beginners, while the numerous options make the app attractive to more advanced investors. Fidelity also offers user:

- No fees or commissions on trading

- No account minimum

- Comprehensive customer service

- A variety of research tools for users

Charles Schwab

Charles Schwab is another well-known investment app for users of all experience levels. This app allows users to choose from a large investment selection, without worrying about transaction fees. Charles Scwab is popular among investors for its user-friendly mobile app and education resources. Other features of the app include:

- Low to no account minimums

- Stocks, bonds, EFTs, Futures, and Options available

- No annual or inactivity fees

- Two mobile apps and a desktop version to choose from

- Fractional shares available

TD Ameritrade

We chose TD Ameritrade as the best overall because it offers something for investors of all expertise and has excellent pricing. For beginners, the standard TD Ameritrade mobile app has excellent ease of use, and for more advanced traders, their thinkorswim mobile app gives a professional-style experience. TD Ameritrade users can access both apps with a brokerage account, and there is no minimum balance requirement or commission fees for trades. Users of the thinkorswim app can also enjoy a live CNBC feed inside the app. Charles Schwab has acquired TD Ameritrade and will merge TD Ameritrade accounts into its existing ones; Schwab will keep the thinkorswim platform.

Key Features

- App names: TD Ameritrade Mobile and thinkorswim

- Account minimum: No minimum deposit required

- Fees: $0 commission for online stock, ETF, and options trades but there is a 65-cent flat-fee per each options contract; $25 for broker-assisted trades; $49.99 for no-load mutual funds; additional fees may apply

- Investment types: Wide range, including stocks, options, ETFs, mutual funds, bonds, fixed-income, futures, and several other choices

- Account types: Supports standard, retirement, education, and other types of accounts

- Other important details: Recently acquired by Charles Schwab

What We Like

- Beginner and expert mobile apps

- No additional fee for advanced trading platform

What We Don’t Like

- Some users may not like the switch to Schwab

Runner-Up Fidelity

Open Account Fidelity is a well-known brokerage with extensive resources for various types of investors. The firm is a standout for its focus on retirement education, including retirement calculators and other tools. Through the Fidelity Investments mobile app, you can do just about anything you need in your investment account. It integrates with both Apple Watch and Google Assistant for even more features. You can also link your investment account to Fidelity Spire, which helps you set and track savings and investment goals. The brokerage offers a few of its own mutual funds with no transaction fees or recurring fees. It’s also one of a small list of major brokerage firms to offer fractional share investments.

Key Features

- App name: Fidelity

- Account minimum: No minimum deposit required

- Fees: $0 commission fees on stock, ETF, and options trades, but there is a 65-cent flat fee per options contract; $32.95 for broker-assisted trades; $49.95 for no-transaction-fee mutual funds; no recurring fees for most accounts; additional fees may apply

- Investment types: Stocks, ETFs, mutual funds, fractional share investing, and more

- Account types: Supports brokerage, retirement, education accounts, and more

What We Like

- Fractional share investing

- Robust mobile app features

- Fidelity Spire app for savings goals

What We Don’t Like

- $12.95 fee for phone trades

Best for Beginners Acorns

Open Account Acorns is a mobile-first brokerage and banking app offering creative funding options, including recurring transfers and round-ups for purchases made with connected cards. The brokerage offers ETFs and it generates specific recommendations for you based on a survey you fill out when signing up for an account. The biggest downside of Acorns is the fee structure. You pay $1 per month for an investment account only (“Lite”); $3 per month for investing, retirement, and checking (“Personal”); and $5 per month for all the features of Personal plus investment accounts for kids. A couple of dollars a month may not sound like much, but it could be a big percentage of your balance on smaller accounts. For example, a $1 monthly fee equals a 12% yearly interest rate for a $100 account balance.

Key Features

- App name: Acorns

- Account minimum: No minimum deposit required

- Fees: $1, $3, or $5 for a monthly subscription; additional fees may apply

- Investment types: Fractional share investments in ETFs made up of stocks and bonds

- Account types: Robo-advisor brokerage, retirement, and checking accounts

- Other important details: Earn money by shopping with a linked card at partner retailers

What We Like

- Automated micro-investing

- Gamified app experience

What We Don’t Like

- Monthly fee on all accounts

Best for Free Investing Webull

Open Account Webull has an impressive mobile app for active and expert traders. It’s great for trading stocks, ETFs, cryptocurrency, and options; and it supports IRAs. However, there are no bonds or mutual funds. While Webull is focused on free investing and trading, it’s best for investors with trading experience. The app’s focus on active stock and options traders may be overwhelming for beginners. But, if you’re willing to take the time to learn, Webull is an excellent low-cost option.

Key Features

- App name: Webull

- Account minimum: No minimum deposit required

- Fees: $0 commission or contract fees for online stock, ETF, or options trades; $8 to $45 for wire transfers; additional fees may apply

- Investment types: Stocks, ETFs, options, and cryptocurrencies

- Account types: Supports brokerage and IRA accounts

- Other important details: Generous free stock promotions for new users and for customers who refer others

What We Like

- Community area to interact with other users

- Paper trading available (trade with virtual money)

- Advanced charting features

What We Don’t Like

- Real-time data streams require an additional subscription

- Limited investment types

Best for Automated Investing Betterment

Open Account Some investors just want to hand their money over to someone else to pick stocks, bonds, and funds on their behalf. In the old days, you needed an expensive financial advisor to give you personalized advice. These days, Robo-advisors like Betterment will assign you to a professionally designed portfolio of low-cost ETFs based on your investment goals. You can choose between a personalized portfolio for your goal or a socially responsible portfolio when investing with Betterment. Betterment charges an annual 0.25% management fee with no minimum balance requirement. Those with a balance of $100,000 or more can upgrade to the pricier Premium plan, at 0.40% per year, including access to a human financial advisor. While it’s not free, the cost could be worth it for investors who want a hands-off experience.

Key Features

- App name: Betterment

- Account minimum: $0

- Fees: 0.25% for Digital account or 0.40% for Premium account

- Investment types: Managed portfolios of ETFs

- Account types: Robo-advisor brokerage, IRA

- Other important details: Offers a checking-style cash management account

What We Like

- Easy, automated micro-investing

- Gamified app experience

What We Don’t Like

- Monthly fee on all accounts

Best Easy-to-Use App SoFi

Open Account SoFi is a full-service finance company with lending, banking, and investing managed in one convenient mobile app. SoFi’s app, SoFi Invest, is great for beginners because it includes investment education and allows you to start small with fractional shares called Stock Bits. SoFi Invest users can trade stocks, ETFs, and cryptocurrencies. Stock and ETF trades are free. SoFi Invest also offers a managed portfolio product with no added investment management fees. Overall, SoFi offers some impressive accounts that are well-priced and easy to use—that’s a winning combination.

Key Features

- App name: SoFi Invest

- Account minimum: $1 minimum deposit required

- Fees: No fees for online stock or ETF trades; 1.25% markup on crypto transactions; expense ratios vary on SoFi-branded ETFs; additional fees may apply

- Investment types: Stocks, ETFs, and cryptocurrencies

- Account types: Supports self-directed and managed portfolios, plus retirement and cryptocurrency accounts

- Other important details: SoFi also offers loan products and cash management accounts

What We Like

- Fractional share investing

- No-fee automated investing

- Education resources alongside investment tools

What We Don’t Like

- No advanced research tools

- Limited investment assets

Wealthfront: Best App for Low-Maintenance Investors  Wealthfront, founded in 2008, is a robo-advisor that invests your money in a portfolio of low-cost exchange-traded funds (ETFs) and (in some cases) individual stocks. Portfolios typically contain six to eight ETFs from a larger catalog spanning 11 different asset classes. Once you’ve opened an account and answered a few questions about your goals and risk tolerance, Wealthfront will take it from there. Proprietary software will automatically rebalance your portfolio as needed, allowing you to focus on other things.

Wealthfront, founded in 2008, is a robo-advisor that invests your money in a portfolio of low-cost exchange-traded funds (ETFs) and (in some cases) individual stocks. Portfolios typically contain six to eight ETFs from a larger catalog spanning 11 different asset classes. Once you’ve opened an account and answered a few questions about your goals and risk tolerance, Wealthfront will take it from there. Proprietary software will automatically rebalance your portfolio as needed, allowing you to focus on other things.

In terms of fees, you’ll face a 0.25% account management fee. However, if you refer a friend who then funds an account, both of you will have the fee waived for the first $5,000. You’ll need at least $500 to open a brokerage account with Wealthfront. That’s high relative to other investing apps on this list, but it’s still a relatively low figure when it comes to investing. Also keep in mind that, since Wealthfront is a robo-advisor, you won’t be able to have a hand in fund selection or making trades.

Betterment: Best App for Tax-Efficient Investing

Betterment, founded in 2008, has the distinction of being the first publicly available robo-advisor. Betterment’s software creates custom portfolios for each user based on an initial survey. Betterment says that it wants to save its investors more on taxes than any other service. Like many robo-advisors (including Wealthfront and Stash), Betterment automatically conducts tax-loss harvesting on all accounts. But Betterment takes things one step further with its asset location strategy.

Betterment, founded in 2008, has the distinction of being the first publicly available robo-advisor. Betterment’s software creates custom portfolios for each user based on an initial survey. Betterment says that it wants to save its investors more on taxes than any other service. Like many robo-advisors (including Wealthfront and Stash), Betterment automatically conducts tax-loss harvesting on all accounts. But Betterment takes things one step further with its asset location strategy.

This strategy helps clients with both taxable accounts and retirement accounts ensure that different investments are allocated into both accounts in the most tax-efficient way. For the investor focused on the after-tax return above all else, Betterment is an attractive choice. (Note: If you’re really focused on tax-optimizing your portfolio, we’d recommend finding a financial advisor who specializes in tax planning.) Like Wealthfront, its most direct competitor, Betterment charges a 0.25% account management fee. However, Betterment has no account minimum, so you can start with as small an investment as you like. Investors can choose between a digital portfolio or a premium portfolio.

With a premium portfolio, you can receive guidance on outside investment accounts and speak to certified financial planners (CFPs) over the phone 24/7. The premium portfolio comes with an account minimum of $100,000 and a higher 0.40% account management fee.

Acorns: Best App to Help You Save

If you want to start investing but aren’t diligent about saving money, Acorns may be the app for you. Acorns is a robo-advisor that saves your spare change for you. Link your debit and/or credit cards to Acorn and the app will “round up” purchases on these cards to the next dollar. It then invests this “change” in a portfolio of BlackRock and Vanguard exchange-traded funds (ETFs).

If you want to start investing but aren’t diligent about saving money, Acorns may be the app for you. Acorns is a robo-advisor that saves your spare change for you. Link your debit and/or credit cards to Acorn and the app will “round up” purchases on these cards to the next dollar. It then invests this “change” in a portfolio of BlackRock and Vanguard exchange-traded funds (ETFs).

You can gradually save and build your portfolio without even realizing that you’re doing it. There are just a handful of pre-made investment options, which makes Acorns great for investors who don’t want to spend hours scouring research and comparing stocks In addition to the spare change method, you can also set up one-time or recurring deposits in your investment account if you like. You can open a standard investment account — called Acorns Core — or an individual retirement account (IRA), Acorns Later. While you can choose from a range of portfolios from conservative to aggressive, that’s the only customization available to you. The app charges $1 a month for Acorns Core and $2 for Acorns Later. College students with a .edu email address can access Acorns Core for four years, free of charge.

M1 Finance: Best App for Stock Picking and Automated Investing

M1 Finance is an app for long-term investors who want the choice between hand-picking stocks and letting the app invest for them. With M1, investors can choose a model portfolio powered by a robo-advisor; manually select a portfolio of stocks (including fractional shares) and ETFs; or choose a mix of both strategies.

M1 Finance is an app for long-term investors who want the choice between hand-picking stocks and letting the app invest for them. With M1, investors can choose a model portfolio powered by a robo-advisor; manually select a portfolio of stocks (including fractional shares) and ETFs; or choose a mix of both strategies.

The hybrid setup makes the app a great fit for investors who want some flexibility. M1 offers a taxable account and an IRA account. Both are fee-free provided you invest at least $100 or $500, respectively. Investors who want a line of credit with a flexible payback schedule would need to have at least $10,000 in their account. For an annual $125 fee, you can upgrade to an M1 Plus, which offers a lower rate on the line of credit, more stock options, and other benefits. On the downside, this app doesn’t offer minute-to-minute trading functionality or has much in the way of research materials. If you’re looking to read up on potential stocks or ETFs, you’ll need to do it outside the app.

Stash: Best App for Rookie Investors

Stash is designed to help beginners make their first foray into investing. It caters to these beginners with its ample educational content and its Stash Coach feature. Stash Coach is part game, part educational tool, and it’s designed to help you better understand investing. You can participate in customized challenges and track your progress as you amass more investing knowledge. When you first download the app, you’ll answer a few questions to establish how risk-averse you’d like to be and what your goals are.

Stash is designed to help beginners make their first foray into investing. It caters to these beginners with its ample educational content and its Stash Coach feature. Stash Coach is part game, part educational tool, and it’s designed to help you better understand investing. You can participate in customized challenges and track your progress as you amass more investing knowledge. When you first download the app, you’ll answer a few questions to establish how risk-averse you’d like to be and what your goals are.

Then, the app will suggest a collection of ETFs and individual stocks for you and populate the education tab with content tailored to your situation. The actual act of building your portfolio will be up to you, as Stash only provides suggestions. However, the app may nudge you in a different direction if your portfolio isn’t diversified. You’ll need only $5 to start investing with Stash, thanks to the ability to purchase fractional shares of the 110 individual stocks available within the app. With Stash, you can open a taxable account for $1 per month, a taxable account with a retirement account (traditional or Roth IRA) for $3 per month, or a taxable account, retirement account, and two accounts for kids for $9 per month.

E-Trade: Best App for Investment Selection

The E-Trade mobile app is for the trader who likes having a lot of investment options. You’ll have access to thousands of stocks, options, futures, ETFs, mutual funds, bonds and more. There is no commission for online trading of stocks, mutual funds or ETFs. In addition to trading capabilities, the app has news and market analysis from CNBC, MarketWatch, and Morningstar. You can also set up personalized stock alerts and compile watchlists of investments to more easily keep tabs. If you’d rather not do all the work yourself, you can choose E-Trade Core Portfolio, E-Trade’s robo-advisor offering. You’ll need a minimum balance of $500,

The E-Trade mobile app is for the trader who likes having a lot of investment options. You’ll have access to thousands of stocks, options, futures, ETFs, mutual funds, bonds and more. There is no commission for online trading of stocks, mutual funds or ETFs. In addition to trading capabilities, the app has news and market analysis from CNBC, MarketWatch, and Morningstar. You can also set up personalized stock alerts and compile watchlists of investments to more easily keep tabs. If you’d rather not do all the work yourself, you can choose E-Trade Core Portfolio, E-Trade’s robo-advisor offering. You’ll need a minimum balance of $500,

Frequently Asked Questions

How Do I Use an Investment App?

Investment apps are an easy way to buy and sell stocks and other assets from the palm of your hand. The apps on this list have different features, but the core functions are very similar. Here are the basic steps to using an investment app:

- Sign up with your preferred investment app on your mobile device.

- Connect to your bank and fund your account.

- Choose your first investment asset and buy a share.

- Track the performance of your shares over time.

- Trade assets and update your portfolio as you see fit.

Many brokerages charge few or no fees for trading stocks, ETFs, or options, which means you can trade commission-free. As long as you choose a quality brokerage with no recurring fees, you can invest money for almost free. You’ll still pay small fees added by the stock exchanges and regulators. This is consistent across all brokerages, and these fees are embedded into asset prices.

How Much Money Do I Need To Invest?

Some brokerages and investment apps require a high minimum balance to start. However, none on this list have big deposit requirements, so you can open an account with no minimum balance. Several brokerages on this list would let you start with just $5 or less. Fractional share investing is becoming more common, too. And if the brokerage charges no fees to buy and sell, it may even be practical to invest with less than $100.

Pros & Cons of Investment Apps

Pros

- Easy to invest and manage accounts from anywhere with an internet or cellular data connection

- Never lose track of your portfolio balance

Cons

- Not all features are available on mobile apps

- Managing investments on small screens can be challenging for some users

How Should I Choose an App?

Every investor has unique needs, so there is no one perfect app you should use. Instead, it’s best to look at your personal finances, investment goals, and how you want to manage your investments as factors that help you decide. It’s also imperative to review costs and fees, as those can take a bite out of your investment gains over time. Never invest in something you don’t understand, and never sign up for a paid investing service if you don’t believe it’s a good value.

Are Investment Apps Safe?

Investment apps use multiple layers of security to protect your information, including encryption of personal information, two-factor authentication, and frequent checks for hacks. As long as you use a strong, unique password that isn’t shared with any other account or website, your money is typically safe from bad actors. If you’re traveling away from home, it’s wise to avoid using your investment apps on Wi-Fi networks at offices, coffee shops, hotels, and other public locations. When away from home, your secure cellular connection should keep your information safe. As an extra safeguard, consider adding a VPN to your device.

Investing App Tips For Beginner Investors

The best investment apps aim to make investing more accessible for anyone, especially beginners. If you are curious about investing for the first time, apps with low minimums and affordable fee structures can be a great way to get started. For example, through Acorns and Ally, you can start investing your extra money straight from your smartphone. Other beginner apps, like Invstr, allow you to learn about investments before you get started with your own funds. The features offered by beginner-friendly apps can enable you to learn how to invest without going through a financial advisor, risking your savings, or even spending significant time researching ahead of time. The key is to find an app that is compatible with your learning style and go from there.

How We Chose the Best Investment Apps

To compile this list, we considered over 20 different investment apps. The apps that ultimately made our list were picked for their pricing, features, ease of use, assets available, and account types supported. All apps on our list are available on Apple and Android devices. The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Summary

The best investment apps for beginners and everyday investors will be able to meet you exactly where you are, and help grow your skills and finances along the way. Whether you are looking to start saving for retirement, trading stocks, or supplementing your income, the right investment app should be able to help. If you are a beginner, start with an app that offers educational resources and assistance from a financial advisor. If you already have some investment experience, find an app that will help you diversify your assets. The various investment apps available can assist you in reaching your financial goals, no matter what your starting point is.

Thanks for the informative post. The way you narrated the post is good and understandable. After reading the post I learned some new things about investment apps. Keep posting. Please let me know for the upcoming posts.

Thanks keep reading and sharing

Hello,

This is wonderful and helpful post for me. Everything has represented in a pretty good way. Thanks for explaining such a helpful steps, as well as pros and cons of investment apps. I agree and will defenitely follow this points. Keep sharing like this. Good wishes for your upcoming posts.

Thanks

Thanks for sharing this post.

Which app has low brokarage?…The Best Investment Apps For Every Investor good article.